Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Europe

Chemical industry braces for a new regulatory regime while exploiting a pickup in output

by Patricia L. Short

January 9, 2006

| A version of this story appeared in

Volume 84, Issue 2

It doesn't figure high in the calculations of economists making their predictions for this year. But whatever happens to output and demand-and at the beginning of the year the signs are fair to good for 2006-the major factor shaping the European chemical industry this year will be the advent of REACH.

All the various bodies within the European Union have accepted some version of the new chemicals control policy known as REACH, for Registration, Evaluation & Authorization of Chemicals. The differences in versions must be reconciled this year. But it is clear that, by the end of the year, a completed REACH program will be in existence, ready to be implemented during 2007.

What will only become clear as the year progresses and segues into 2007, however, is what the impact on business production, demand, and trade will be.

In fact, companies have already begun making preparations for REACH.

For example, Kemira-Finland's largest independent chemicals producer-as of next month will have established a REACH competence center in Espoo, near Helsinki. The director, recruited from the European Food Safety Authority, and three product safety specialists will be charged with centralizing registration and authorization procedures of all the substances produced or imported by the company within the EU, as required by REACH. Kemira expects the bulk of the needed expert work will be carried out between 2007 and 2010, in the beginning of the first 10-year registration period.

The center will also be responsible for developing Kemira's product safety information technology tools up to the level required by REACH.

Kemira is perhaps more attuned than many others in Europe as to what companies will have to do under REACH: The policy's key coordinator will be the European Chemicals Agency, which is to be based in Helsinki.

But throughout the region, chemical producers are beginning to grapple with how looming restrictions will affect their customers, particularly those in markets close to the consumer. They are also trying to work out the impact on what can be used, what can be marketed, and what can be exported and imported.

For a region that finds considerable success in exports and imports, impact on this aspect of the industry will be of utmost importance. A look at what happened to imports and exports last year, for example, shows how crucial these are.

In Germany, the German Chemical Industry Association (VCI) estimated that for the first three quarters of 2005, exports were up 8.2% over the comparable period in 2004. Imports were even stronger, up 11.9% in the three quarters. Much of the strength came in the second half of the year, following what VCI economists termed a short pause in the second quarter. And they see imports and exports continuing to grow, although at a somewhat slower pace, into this year.

Similarly, economists at the European Chemical Industry Council (CEFIC) argue that the slowdown in production growth in the overall European industry in 2005 reflected less dynamic external demand, because of a deceleration in global economic activity. "Domestic demand in Europe could not compensate for the fallback in foreign demand," CEFIC says in its year-end economic outlook.

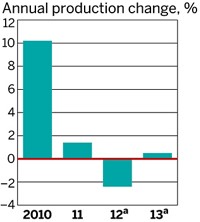

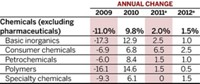

However, CEFIC predicts that 2006 will be a better year for the European chemical industry, with a modest improvement. Growth in 2005 was only 1.6% over 2004, which in turn was up by 2.6% over 2003. This year, CEFIC economists say, should see growth of 2.3% for the industry, excluding the traditionally faster growing pharmaceuticals segment. Including pharmaceuticals, they add, would boost chemical production back to match the level of 2004.

CEFIC's figures aggregate estimates from throughout the region, covering all the chemical industries in European Union countries, as well as others including Switzerland and Norway. Consequently, their forecasts reflect differing levels of activity within the region.

For example, Rein Willems, chairman of the Association of the Dutch Chemical Industry (VNCI), pointed out at a December press conference that 2005 sales in the Dutch chemical industry would wind up 8% higher than in 2004. That growth, though, was solely a result of an increase in selling prices, he said; production output was unchanged from the previous year.

According to Willems, "Although the chemical industry is under pressure because of factors such as the high energy prices, the sector is nevertheless successfully withstanding the adverse conditions and preparing for the coming economic recovery."

On the other hand, German chemical industry executives wound up 2005 in a bullish mood. At VCI's annual end-of-year press conference in Frankfurt last month, Werner Wenning, president of VCI and chairman of Bayer, noted, "For 2005 as a whole, we are expecting a production growth of about 6%." That estimate is more than double the rate that VCI had given at its midyear press conference in June.

"We are, of course, pleased with this highly positive result," Wenning said. "In view of these figures, we think that there will be a further positive economic development in the first-quarter 2006.

"We estimate that total sales of our industry will climb by 3.5%" in value, he added, on a 2.5% increase in production volume. That rate-perhaps more sustainable than a frothy 6%-reflects the fact that Germany's economy finally seems to be improving after a decade of stuttering along, he suggested. "Domestic sales should be able to rise by 3%, and foreign sales [should be] improving by 4% compared with 2005," he added.

Wenning concluded that "the current business situation of German chemical companies is good. The growth of the global economy continues, and domestic sales are brisker, too. Therefore, our industry is looking ahead to the new year with confidence."

For CEFIC economists, performance of the European chemical industry reflected a loss of confidence in the business climate during the first half of 2005. The assessment of the production situation was less favorable, and business expectations worsened, they point out. "But this downturn trend was only temporary," they add in their report, "as the business climate has been improving since September 2005 and this positive trend is likely to continue through the end of 2005."

The various chemical subsectors reacted to differing degrees-and in some surprising ways-to the weaker economic situation in 2005, CEFIC economists say. For example, basic chemicals showed a sharp increase in production, especially petrochemicals and inorganics.

On the other hand, after having performed very well in 2004, specialty and fine chemicals, usually the stars of the industry, showed a slump in growth because of weaker global demand, intensive international competition, and cost increases. And even the pharmaceuticals sector, which in the past has exerted a strong pull on the chemical industry, boosted growth overall by a mere 0.4% in 2005.

For 2006, though, CEFIC sees a return to growth in specialties and fine chemicals. Growth in petrochemicals and basic inorganics will slow to more typical levels. Pharmaceuticals, however, still are forecast to boost production growth only slightly.

In Germany, the region's largest market, production mirrored to some extent the general picture charted by CEFIC. Basic chemicals significantly contributed to the increase in production in 2005, with the highest growth rate, 14.5%, achieved in the production of basic inorganic chemicals. Petrochemicals and polymers rose by 5% each. And agrochemicals logged a production increase of 12.5% in 2005, Wenning said.

More consumer-oriented sectors showed a mixed picture for the country, though. Last year, Wenning said, "was an extraordinarily successful year for pharmaceutical manufacturers, with a production increase of 11%." Output of detergents and personal care products climbed by 3.5% over 2004. Production of fine and specialty chemicals, however, was up by only 0.5%, he said.

At the close of 2005, the picture is not yet clear on just how favorable this year will be, CEFIC economists say in their report. They point out that economic growth in the EU continues to lag behind the rest of the world, while the latest indicators show that EU economic expansion was very modest in 2005.

"Domestic demand is still weak, and the surge of oil prices dampens private consumption as well as investment of firms," the report notes, leading expectations for EU gross domestic product for 2005 to be revised downward, to 1.5%, instead of 1.8% forecasted in June 2005. Only a slight improvement is expected for 2006, with GDP growth of 2%, CEFIC notes.

Consequently, chemical producers can only hope that the surge that developed in the second half of 2005 will continue into 2006. Despite record-setting oil prices during last year, the industry has adapted and gained some urgently needed price increases, although not in all sectors.

Statistics compiled by Italy's Federchimica, for example, chart how price increases were not carried through into downstream chemical sectors over the course of 2005:

◾ The price of petroleum rose by 97%.

◾ Virgin naphtha prices rose 67%.

◾ Increases in basic petrochemical prices varied widely, such as 42% for ethylene, 70% for propylene, 69% for benzene, and 56% for butadiene.

◾ Prices rose 26% for polyethylene, 25% for both polypropylene and polystyrene, 30% for purified terephthalic acid, 55% for ethyl acetate, and 65% for methyl ethyl ketone.

◾ Increases were just 7.6% for adhesives, 3.3% for synthetic fibers, and 2.1% for detergents and cosmetics.

Although these statistics cover only the industry in Italy, the broad picture held throughout the rest of the region.

As Wenning pointed out last month, "With continually rising raw material costs, price increases were most marked in sectors closely connected with raw materials: petrochemistry, polymers, and inorganics. Where fine and specialty chemicals are concerned, the intensive competition on the world market did not allow price adaptations to the necessary degree; trends were similar for detergents and personal care products. Prices for pharmaceuticals even dropped slightly."

Fortunately, he added, VCI predicts the price pressure will ease somewhat, so that producer prices will rise by only 1%, compared with an average increase of 3% in 2005.

In fact, the Organization for Economic Cooperation & Development expects inflationary pressures in Europe to recede during the year. Jean-Philippe Cotis, OECD chief economist, said at a November press conference about his outlook for 2006 that "with price stability being maintained, a powerful impetus arising from the Asian and U.S. economies, and the respending of oil exporters' higher revenues, the case for a prolonged world expansion finally extending to convalescent European economies looks plausible." That is, indeed, the baseline for his economic outlook, he added.

In fact, economists throughout the region are all putting together positive forecasts for 2006, which, if they hold, are encouraging for supplying industries such as chemicals.

At UNICE, the European business federation, economists forecast 2.1% growth over 2005 for the European Union's 25 member countries, up from 1.6% last year over 2004. Inflation is expected to remain low and stable-2.1% over 2005, which in turn saw a 2.1% increase over 2004. And unemployment is slowly coming down; it is expected to be 8.7% in the EU, down fractionally from 8.9% in 2005.

Meanwhile, at the EU, despite economic activity that has been more subdued this year than in 2004, statisticians expect the bloc's member-country economies to return to their potential at the beginning of 2007.

From an estimated 1.5% in the EU in 2005, GDP growth is projected to reach 2.1% in 2006, and to accelerate further to 2.4% in 2007. The main factors behind the outlook include an accommodative macroeconomic policy mix, benign financial conditions, wider profit margins, a weaker nominal effective exchange rate, and a robust global environment.

The recovery is "underpinned by an acceleration in domestic demand, with a slight stimulus in net terms from the external sector. This includes, more specifically, a relatively strong pickup in the pace of investment expenditure and a more gradual recovery of private consumption," the end-of-year EU outlook proclaims.

Exports should also be given at least a small boost by the slight strengthening of the dollar compared with key European currencies.

Economists are also encouraged by the continuing increasing prosperity in the former East bloc countries, spurred by the enlargement of the European Union and its work with the next set of countries waiting to join the EU.

Advertisement

In the acceding countries Romania and Bulgaria, and the candidate countries of Croatia and Turkey, GDP growth is expected to remain relatively high over the next several years: more than 5% per year in Bulgaria, Romania, and Turkey, and accelerating to nearly 4.5% in Croatia by 2007.

Rising labor productivity and an expanding and modernized capital stock are the main sources of this continued expansion, EU statisticians point out. In fact, in these countries, domestic demand should continue to outpace production.

Steven Fries, acting chief economist at the European Bank for Reconstruction & Development, said countries from the EBRD region "continue to perform strongly on the back of a better business climate and greater competitiveness." Speaking in November 2005 at the launch of the annual EBRD transition report, established to assist privatization of government-owned enterprises following collapse of the East bloc communist regimes, he explained that growth of these countries "is being driven by a resilient global economy."

However, the bank is concerned, Fries said. Big challenges remain for each part of the region and individual countries, especially in further tackling corruption and bureaucracy, building their legal and financial sectors, safe-guarding macroeconomic stability, and ensuring that the benefits of growth are widely shared. "Only by addressing these challenges will the countries of this region step up their progress in reaching the living standards of the more mature market economies," he said.

"Substantial progress in transition was achieved by Central Europe and the Baltic States, where the markets have responded favorably to previous reforms," he noted. These countries have benefited, he added, by becoming EU members in 2004.

MORE ON THIS STORY

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter