Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Latin America

The region is enjoying commercial success and hatching big plans for future growth

by Alexander H. Tullo

January 9, 2006

| A version of this story appeared in

Volume 84, Issue 2

The Latin American chemical industry has enjoyed both a global recovery in petrochemical markets and sustained regional economic gains. The good times have fostered a fervor of regional expansion plans, but that hasn't stopped several large projects from being mired in never-ending study phases or getting shelved outright.

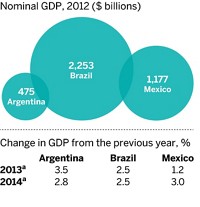

Major economies with large chemical enterprises in Latin America have experienced two successive years of solid economic growth. In a recent report, the International Monetary Fund (IMF) projects this growth to continue for at least another year.

According to IMF, Brazil, Latin America's largest economy, posted 4.9% gross domestic product (GDP) growth in 2004 and is projected to end 2005 with 3.3% growth. It is forecast to grow by another 3.5% this year. Mexico has seen more moderate growth. IMF expects the Mexican economy to expand by 3.0% in 2005 and 3.5% in 2006.

Argentina's rebound from a long recession that ended in 2002 continues. After expanding by 9.0% in 2004, its economy is set to grow by another 7.5% in 2005 and taper off to 4.2% growth this year. Meanwhile, Chile saw 6.1% GDP growth in 2004 and 5.9% last year. It is forecast by IMF to grow by another 5.8% this year.

Oil-rich Venezuela hasn't repeated the 17.9% growth that the country saw in 2004 as it recovered from a general strike in 2002 and 2003 that was meant to oust leftist leader Hugo Chavez. But IMF still expects the economy to grow by 7.8% in 2005 and post another 4.5% increase in 2006.

Chemical companies also posted solid gains in 2005. Pemex, Mexico's national oil company, had a 22% increase in chemical sales in the first nine months of 2005 versus the same period the year before, with revenues reaching $1.9 billion.

For the full year, according to C&EN projections based on Pemex data, its production volumes of petrochemical products are set to increase by 7.6% in 2005. Because of rising prices for petrochemical products, this increase in volumes is forecast to translate into a 24.6% increase in sales, which will reach $2.2 billion by year's end.

Pemex had a major setback in 2005 when its Phoenix Project was sidelined. The $1.9 billion project, planned to start up in 2009, was to have 1.2 million metric tons of ethylene and 600,000 metric tons of propylene capacity annually, plus derivative polyethylene and polypropylene plants.

Pemex had named partners for the project: Canada's Nova Chemicals and local polymer companies Grupo Idesa and Indelpro. Pemex was to take a minority interest in the complex and supply the natural gas condensate feedstocks. The project was derailed when Pemex insisted on feedstock prices similar to those the company could get by exporting the condensate as fuel to the U.S. Gulf Coast.

Rina Quijada, a Latin American chemical consultant with Coral Gables, Fla.-based Intellichem, says Pemex also moved too slowly in advancing the project. Phoenix was a brainchild largely of Mexican President Vicente Fox's administration, which has been keen on free-market reforms. A presidential election looms in July, and a new government isn't as likely to be a proponent of the project. "The year before a presidential election, nothing is going to happen," Quijada says. "Anything that is proposed by the current administration is going to be put on the back burner."

Quijada says that, although there are similar high-ticket petrochemical projects under consideration throughout Latin America, none of these is likely to come onstream before 2012. Instead, she explains, the region will focus on incremental expansions. "If you look from 2005 through 2010, what is going to happen is a lot of expansion of existing units and very few grassroots facilities in the Americas, including the U.S.," she says.

Instead of Phoenix, Pemex is now promoting a modest alternative. The company plans to expand its ethylene crackers in Cangrejera and Morelos by 50% each, to a combined 1.8 million metric tons by 2009.

Pemex is also planning a downstream polyethylene joint venture. Nova says it is interested in participating in this partnership and is in discussions with Pemex.

The ethylene expansion will be based on a natural gasoline feedstock. The pentane stream will feed the cracker and, in addition to the ethylene, will yield about 300,000 metric tons of propylene per year. Indelpro is mulling a polypropylene plant based on this output. The C6 stream from the natural gasoline will be used to feed a 700,000-metric-ton aromatics plant, Pemex says.

In Brazil, company results also improved in 2005. During the first three quarters of last year, Braskem, the country's largest privately held chemical company, reported a 27% increase in revenues, which were $3.5 billion.

Operating rates in polyethylene, polypropylene, and polyvinyl chloride at Braskem were all at or above the strong 95% mark, and volumes in these products grew by a combined 10%. But even with the high operating rates and revenue growth, operating profits, owing to a 30% increase in raw material costs, held flat at about $640 million.

In March, Brazilian state oil company Petrobras will decide on whether it will exercise an option to increase its stake in Braskem from 10% to 30%. In return for the larger stake, Petrobras will give Braskem larger shares of Copesul, an ethylene cracker in the southern Brazilian state of Rio Grande do Sul; Triunfo, a polyethylene business downstream from Copesul; and PetroquÍmica PaulÍnia, a joint venture the companies set up last year to build a 350,000-metric-ton polypropylene plant in PaulÍnia, SÃo Paulo.

Grupo Ultra, which controls ethylene oxide chemicals maker Oxiteno, is studying an enormous petrochemical project with Petrobras in the state of Rio de Janeiro. The $6.5 billion project would include an oil refinery and an ethylene unit based on deep catalytic cracking technology. The complex, slated for start-up in 2011, would have a capacity of 1.3 million metric tons of ethylene, 800,000 metric tons of propylene, and about 1 million tons of aromatics.

Oxiteno, a partner in the complex, would also build a downstream ethylene oxide unit. Suzano, which recently bought out Basell's stake in Brazil's largest polypropylene producer, Polibrasil, would build downstream polyolefins plants.

These two companies have also been active with other expansion projects. Oxiteno will soon begin construction of a new fatty alcohols plant in CamaÇari, Bahia, set for 2007. Suzano is a partner with Petrobras and local group Unipar in Rio PolÍmeros, a 500,000-metric-ton-per-year ethylene and polyethylene complex in Duque de Caxias, Rio de Janeiro, which is currently starting up after more than a year of delays.

The Venezuelan petrochemical industry may step up and become a more significant player internationally. President Chavez has separated state oil company PDVSA from its chemical arm Pequiven and renamed the latter CorporaciÓn PetroquÍmica de Venezuela. The move is meant as a foundation for $10 billion in petrochemical investments in the country and a 10-fold increase in revenues from petrochemical production to about $12 billion by 2012.

But one project, a 1 million-metric-ton ethylene joint venture involving ExxonMobil Chemical in Jose, Venezuela, is still in limbo after more than six years of study. Industry watchers doubt the project will progress in its present form. "Jose is a good investment," Quijada says. "Jose will happen but maybe not with the current structure of partners." She suggests that a company like Petrobras could step in instead.

Regional companies are eyeing Venezuela. Brazil's Braskem is considering a 400,000-metric-ton polypropylene plant in that country based on propylene either from a refinery or from a new propane dehydrogenation plant.

Grupo Ultra is also considering investments in Venezuela. The company says it will take an approach similar to the one it took in Mexico, where it purchased two small ethoxylate makers.

MORE ON THIS STORY

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter