Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Just Musing

Oil, gas, interest rates, chemicals are intertwined, so what is the worst that could happen?

by William J. Storck

September 4, 2006

| A version of this story appeared in

Volume 84, Issue 36

Warning: what you are about to read is not a forecast, prediction, or projection. It is simply one, probably overly dire, observation about the U.S. chemical industry.

I'm not a pessimist, but it is usually about this time in the economic cycle that I begin to be concerned, especially regarding the U.S. chemical industry. Overall, economic conditions still look fairly good: Gross domestic product (GDP) is rising, employment is increasing in the chemical industry and in the U.S. overall, and inflation doesn't seem to be out of hand. Consumer prices for the three months ending in July were up 4.5% at a compound annual rate, but up just 3.2% when food and energy are taken out.

However, second quarter GDP growth declined to 2.9% from the 5.6% seen in the first quarter, which was the largest increase in two-and-a-half years. And economists are divided on what interest rates are going to be at the end of the year; projections range from 5.5%, the current federal funds rate, to 6.5%.

Oil and natural gas prices are expected to remain high, despite some moderation in natural gas prices in the past few months, and they are subject to political and natural disasters such as hurricanes. These high costs, combined with past and possibly future interest rate increases, could have a profound effect on the economy and the chemical industry.

It does not take a recession to slow the chemical industry. The industry went into a slump in the middle of the past two economic recoveries, only to recover before seeing real recessions in 1990 and in 2001. And although I know that conditions in a prior cycle cannot be used to predict a future cycle, the mid-1980s' slowdown for chemicals came as the federal funds rate increased to 9.0%, while the one in the mid-1990s was preceded by increasing oil and natural gas prices.

What seems to be different for the industry this time around is that chemical companies have been able to offset rising costs by raising prices, improving productivity, and cutting costs in other areas.

Now, however, although natural gas prices have moderated to the point where they may actually be below where they were a year ago (data are available only through May), industry sources say prices for the key feedstock ethane remain high due to capacity constraints. July crude oil prices, on a three-month moving-average basis to remove seasonality, were still 32% higher than they were in the same month in 2005. Basic organic chemical prices, in contrast, were up just 19% during the same period.

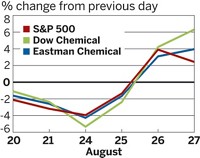

Industry leader Dow Chemical illustrates the impact of this cost-price squeeze in the first half of the year. Chief Financial Officer Geoffery E. Merszei recently told securities analysts that, through June, the prices Dow charged were 3% above those of the first half of 2005.

"But that was not enough," he said, "to keep pace with rising feedstock and energy costs, which were $1.6 billion higher than in the first half of 2005." Merszei also noted: "The bottom line is many of our businesses were not able to achieve the price increases necessary to cover higher costs." The real bottom line for Dow is that the company expects earnings for all of 2006 to be below those of 2005.

If high costs were not enough, there is the increase in interest rates and its effect on chemical markets. The federal funds rate has risen from just 1.0% as recently as May 2004 to 5.5% currently.

This increase has, of course, driven up the national average for a 30-year conventional fixed-rate mortgage to 6.76% in July from 5.70% in July of 2005, with predictable effects on the interest-rate-sensitive housing market. Sales of new homes in July fell 4.3% from June to a seasonally adjusted rate of 1.07 million units, according to the Commerce Department. At the same time, sales of existing homes, according to the National Association of Realtors, dropped 4.1% to an annual rate of 6.33 million units. The industry group also reported that total housing inventory rose 3.2% to 3.86 million units, a 7.3-month supply at the current sales rate.

Now consider how much the chemical industry depends on housing as an outlet for vinyl siding, fibers, insulation, roofing, paint, flooring, and the like.

Rising oil and natural gas prices can also have an effect on the industry apart from its own energy and feedstock costs. Chief among these may be what has been called the "Wal-Mart effect," in which higher gasoline and heating costs cut into discretionary spending by consumers. Usually, this phenomenon is first noticed among lower income sectors of the population and works its way upward. Eventually, other industries that use chemicals are affected as lower consumer demand works its way through the economy.

Put rising costs and interest rates together, and there is the potential for falling demand for chemicals. Falling demand means lower capacity utilization, which, if it gets low enough, hampers producers' ability to raise prices. And in the face of rising costs, producers' inability to raise prices, of course, means lower financial results.

Remember: What you have just read is not a forecast, prediction, or projection. It is simply one, probably overly dire, observation.

Views expressed on this page are those of the author and not necessarily those of ACS.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter