Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Japan Shines

Profits at top chemical makers keep on rising

by Jean-François Tremblay

November 20, 2006

| A version of this story appeared in

Volume 84, Issue 47

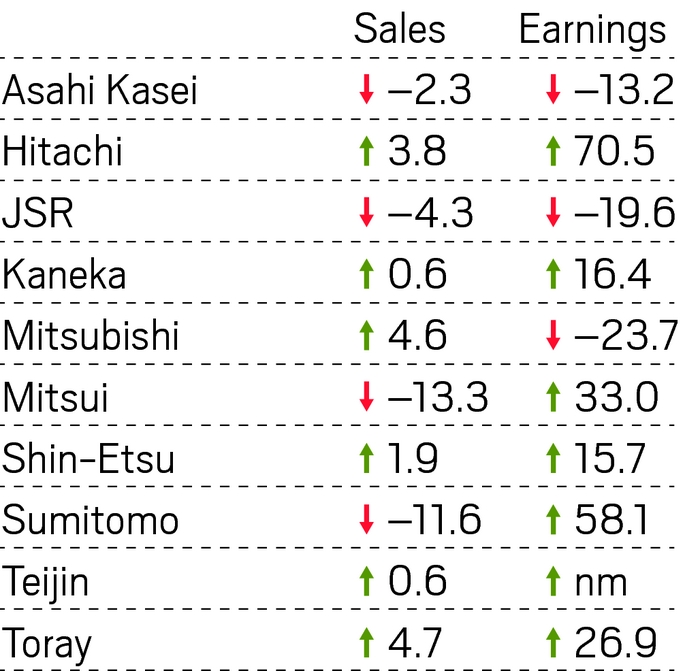

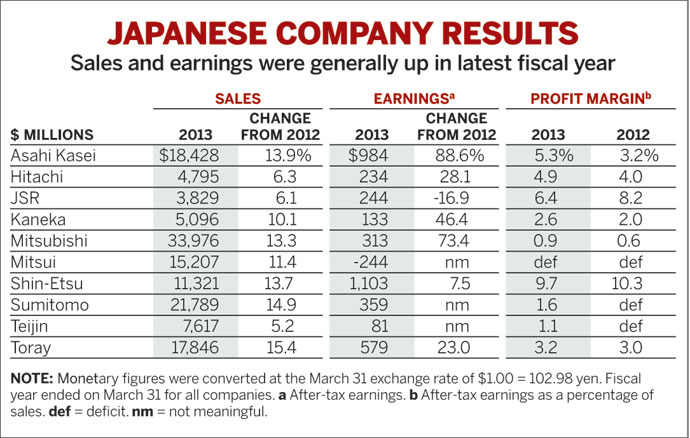

How long will it last? No one knows for sure, but the financial results of top Japanese chemical companies keep improving.

Buoyed by the strength of the economy in Japan and in the rest of the world, Shin-Etsu Chemical, Sumitomo Chemical, and Asahi Kasei reported record profits in the first half of the fiscal year that ends on March 31, 2007. Net earnings rose 35% at both Shin-Etsu and Sumitomo and 14% at Asahi.

Shin-Etsu's recent results make it likely the company will post its 12th straight year of record earnings when it reports in the spring. Profits in its polyvinyl chloride business improved owing to strong demand in Europe and North America. Demand for its silicon wafers was also strong as a result of high semiconductor usage by the mobile phone, computer, and automobile industries.

Toray posted a remarkable 68% improvement in net profit, due largely to an almost 50% jump in operating income in the company's carbon fiber business. Boeing is one of Toray's main customers for this material.

Teijin, another manufacturer of fibers and plastics, saw its net income surge 37%. The company credits its business in high-performance materials, particularly carbon fiber and p-aramid fibers.

With its relatively low profit margin of 2.4%, Mitsui Chemicals looks like it's missing the boat. However, Credit Suisse research analyst Masami Sawato expects Mitsui's profits will rise in the coming months. The company is meeting its cost-control targets. Moreover, as often happens in Japan, Mitsui delivers petrochemical products to its customers before prices are ironed out. Mitsui's recent price increases are therefore not fully reflected in its results, he says.

Exceptional items affected performance significantly at a few companies. At Mitsubishi Chemical, net profit rose 35% even though operating income sagged 21% owing to an inability to pass on high feedstock prices. The company achieved the feat by recording a gain on the sale of securities. Similarly, net income rose 35% at Sumitomo even though operating income climbed just 20%. Sumitomo profitably sold shares in GlaxoSmithKline's Japanese unit.

Unlike in the mid- and late-1990s, when most Japanese chemical companies were just getting by, the languishing ones are the exceptions now. Profit margins have risen to 12% at Shin-Etsu, 10% at electronic materials firm JSR, and 6% at Sumitomo.

Cash reserves are particularly healthy. Shin-Etsu harbors $3.4 billion in its cashbox; Sumitomo, almost $1 billion; and JSR, close to $500 million. At electronic materials producer Tokyo Ohka Kogyo, cash-on-hand is the equivalent of one-third of annual sales. Shin-Etsu has said it hopes to use its cash hoard to acquire companies. As to the others, their intentions are less clear.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter