Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

Pharma Challenged

Market shifts and generic competition create dynamic environment for drug developers

by Joanne Grimley, IMS Management Consulting

December 4, 2006

| A version of this story appeared in

Volume 84, Issue 49

For many of the companies that make up the global pharmaceutical industry, 2005 was a difficult year, marked by expirations of major patents, declines in earnings, and deterioration of the industry's public image.

In 2006, the industry has continued to suffer constant assault from both the press and public, alongside dealing with other significant pressures. These include not only the entrance of the Medicare Part D program, which changed the economics of business in the U.S., but also $23 billion in lost revenues from products losing patent protection, regulatory uncertainties, less-than-exciting pipelines, and a new mood on the part of health care payers.

On the positive side, sales continued to grow by 5.9% to about $580 billion in the 12 months to June 2006, although this pace was slower than in previous years. The emergence of new drugs, especially the anticancer drugs Avastin, Erbitux, Alimta, and Tarceva, has been the top driver of sales growth. In addition, the growth rate includes a one-time event: the uptake of patients covered by the Medicare prescription drug benefit.

The defining event of 2006 was the Jan. 1 launch of the Medicare Part D prescription drug program in the U.S. Its implementation has not proceeded as smoothly as expected. The government appears to have severely underestimated its expenses, and Part D will likely outstrip all original cost projections. The long-term concern remains the cost of the program, especially beyond 2012 when the number of senior citizens becoming eligible for the program will increase dramatically.

Much confusion on the part of beneficiaries surrounded the launch of Part D, and enrollment lagged in two key categories: healthy seniors with little need for medicines and low-income beneficiaries. Nevertheless, recent survey results have suggested that the public's impression of Part D is positive. The group taking most advantage of the program includes those individuals who formerly paid for prescriptions with cash.

Initial analyses of retail prescriptions since the implementation of Medicare Part D have shown an increase in demand for prescription drugs. After the launch of the drug benefit, the volume of retail prescriptions was higher than anticipated in each of the three quarters since the program began. In the third quarter of 2006, for example, volumes rose 1 to 2% higher than anticipated, with categories such as lipid-lowering agents growing 2 to 3% faster. Drug sales for treating many chronic conditions showed increases attributable to Part D.

Overall, brand-name drugs did not suffer, as the Centers for Medicare & Medicaid Services forced plans to cover brands in seven key classes and the share of brands among Part D prescriptions was equal to brand shares overall. But the takeover of Congress by Democrats and a presidential election in 2008 increase the likelihood for further Medicare reform, including possibly more restrictive Medicare formularies beginning in 2008. The market expects to see increased uptake in drug utilization in the short term but more price competition thereafter.

Meanwhile, the industry experienced assorted shifts in regional markets. While the overall global market grew by nearly 6% at constant exchange rates, the geographic balance of the pharmaceutical market continued to shift away from the U.S. toward the world's emerging markets; the dominant U.S. market grew less than 6% in the 12 months to June 2006. The combined growth rate was slightly lower, just over 5%, for the 10 major markets that account for more than 80% of worldwide drug sales. The top five European markets of Germany, the U.K., France, Italy, and Spain were behind the U.S. in their growth rates; collectively these five markets grew just less than 5%.

In emerging markets such as China, Brazil, Korea, India, Russia, and Turkey, growth was double-digit, indicative of an increased focus on underdeveloped markets by companies that are expanding their horizons as their traditional marketplaces become increasingly mature. China, for example, experienced impressive growth of 14% in the 12 months to June 2006 to reach $10.0 billion (hospital only).

These emerging markets are expected to experience double-digit growth again in 2007, largely due to their growing economies and broader access to medication. IMS, a provider of market intelligence and strategic consulting in pharmaceuticals and health care, estimates that by 2010, China will be the world's seventh largest market for pharmaceuticals, and Turkey will rank 10th.

As pharmaceutical markets go, China is a land of opportunity fraught with complex challenges. The government is grappling with building a sustainable and equitable health care system, while hospital tendering, in which potential suppliers bid competitively to provide products, and mandatory price cuts continue to put pressure on margins for pharmaceutical companies. China is the fastest growing market among large countries and potentially the largest market for prescription drugs.

Working with the government can spur much-needed reforms in China's health care environment, but pharmaceutical companies find they must take other actions as well to unlock growth in this market. Investing in China is one road many foreign multinational companies are choosing in an effort to build a localized infrastructure that will ensure new avenues for growth and create a competitive advantage.

Roche, for example, unveiled its fifth global R&D center and first in China, on the outskirts of Shanghai, in late 2004. Since that time, AstraZeneca has made significant investments in its sales force to prepare for expansion into new city markets in China. On the R&D side, it is investing $100 million to open the AstraZeneca Innovation Centre China at a yet-to-be announced location in 2009.

Novartis is collaborating with the Shanghai Institute of Material Medical Research, a leading Chinese R&D institute, and is establishing an alliance with a Chinese biotechnology company on other projects. Pfizer, in an effort to make its products more accessible to local residents, has set up regional headquarters in Shanghai and is considering its own R&D center in China.

Investments like these become even more critical, and the market opportunity more compelling, because rates of chronic diseases are rising in China with the population's increasing affluence. China is the pharmaceutical market of the future, posing the world's biggest strategic challenges but also promising the richest rewards. Companies that succeed in China are expected to achieve higher overall growth rates than they could in mature markets around the world.

Another burgeoning market is Turkey, although it remains a country between two worlds. Not only does it sit between Asia and Europe, but it also boasts a very strong and "Western" industry and infrastructure, along with an economy more typical of an emerging market. This less developed market is estimated to be 40% of the country's gross domestic product.

Today, Turkey is among the top 15 largest pharmaceutical markets in the world and is still growing. In the 12 months to June 2006, the country's total market grew 20.8% to reach $7.1 billion, which makes it a far more promising market than Russia, the other regional "giant" at $3.9 billion in sales, or any European Union newcomer.

With one of the world's highest penetration of generic products—54% of volume and 45% of value—competition in Turkey is fierce. But the very notion of generic drugs is not well-understood by the public in Turkey: Generic brands are so strong and well-established there that the public often sees no difference between a generic and a patented drug. As a result, generics companies develop marketing and sales efforts closer to those required for patented drugs.

Worldwide markets for generic products experienced rapid and well-publicized growth in the 12 months to June 2006. For the top eight countries ranked by sales—the U.S., Japan, France, Germany, Italy, the U.K., Spain, and Canada—combined sales of generic drugs grew 8.9% to $54.8 billion.

Since 2002, growth of the generics market has consistently outpaced that of the overall pharmaceutical market in the top five European markets. Currently growing at more than twice the rate of patent-protected products, generic drugs now represent 38% of volume and 17% of total dollar sales in these markets, significantly more than the 11% of total dollar sales in the U.S. Ongoing and even stronger growth seems guaranteed as cost-containment measures continue to bite more consistently across the region and increasing emphasis is placed on promoting generic prescriptions.

Class cannibalization has also emerged as a key growth factor in the region, led by generic simvastatin's performance in Germany. There, it has taken share not only from the branded version, Merck & Co.'s Zocor, but also from other related compounds within the class of cholesterol-lowering drugs, particularly Pfizer's Lipitor.

A similar effect is anticipated among the antihypertensive drugs when Cozaar loses patent protection in 2009. Class cannibalization—a particular feature of therapy areas with a clear gold-standard product and low brand differentiation—provides tremendous opportunity for manufacturers to tap the market potential of the entire class.

The generics industry was set to have a bumper year in 2006 because six drugs, each with more than $1 billion in sales, lose U.S. patent exclusivity: Zocor, Pfizer's antidepressant Zoloft, Sanofi-Aventis' hypnotic Ambien, Bristol-Myers Squibb's (BMS) cholesterol-lowering drug Pravachol, Novartis' antifungal Lamisil, and GlaxoSmithKline's antinausea drug Zofran.

The biggest generic drug story of the year, however, centered on Plavix, a product that is not set to lose patent protection for another six years. Despite the fact that a U.S. patent on the blood thinner sold by BMS and Sanofi-Aventis does not expire until 2012, the Canadian generic drug firm Apotex took the market by surprise and launched a generic version in August. Apotex previously had been challenging the validity of the patent in court. Aiming to halt litigation, Sanofi-Aventis and BMS entered into an arrangement with Apotex that would allow it to launch a generic copy in late 2011 in exchange for dropping the lawsuit.

But when regulators blocked the settlement, Apotex took advantage of the situation and launched its product (C&EN, Aug. 21, page 12). A court eventually granted Sanofi-Aventis and BMS an injunction to stop Apotex from selling, but the judge did not order a recall of the product already shipped. It is believed Apotex may have shipped enough to satisfy the market for six to eight months.

Plavix has been a crucial part of the profit streams of both Sanofi-Aventis and BMS. In the 12 months to June 2006, it represented 6% of Sanofi-Aventis' revenues and 34% of BMS's. It is the world's biggest selling drug after Lipitor, and total sales in 2006 were expected to reach more than $6 billion before the surprise generic version hit the market. Preliminary data as of August 2006 indicate that the Apotex product has already taken a market share in excess of 53% in the U.S.

In 2007, marketed products with a combined value of over $16 billion will likely lose patent protection, which comes on top of more than $23 billion worth of products that lost protection in 2006. Pfizer is set to suffer another year of substantial patent losses, including protection for its antihypertensive drug Norvasc in the U.S. and top European markets and for its antiallergy drug Zyrtec in the U.S. and Italy. Norvasc is Pfizer's number two product, accounting for 10.5% of the company's global sales, and Zyrtec is its seventh.

As generic drug manufacturers became more aggressive in gaining shares of markets formerly dominated by branded products, companies with significant brand franchises have tried to protect their revenues by going after line extensions, defending patents, and reallocating their product portfolios. Pfizer's divestiture of its $3.9 billion-per-year consumer health division reflects a prioritization of the core pharmaceutical business. In June, Pfizer bowed out of the consumer health market by selling its division to Johnson & Johnson (J&J) for $16.6 billion (C&EN, July 3, page 8).

Analyst response has been positive, based on the view that Pfizer management was focusing more on broad strategic initiatives driven by an underlying concern for shareholder value. With more cash on hand, Pfizer might be expected to engage in deals to acquire compounds that would address the patent expirations of its major drugs, such as Norvasc and Zoloft, without next-generation successors. Despite these changes, Pfizer directors ousted Chief Executive Officer Henry A. McKinnell Jr. in a surprise move and named former general counsel Jeffrey B. Kindler as CEO (C&EN, Aug. 7, page 16).

Advertisement

Pfizer still leads the pharmaceutical industry in sales but has struggled with a decline in the past year and is navigating through one of the most difficult periods in its 150-year history. Since peaking in 2000, Pfizer's stock price has fallen almost 50% and now trades near its lowest level since early 1998. The company has become dependent on mergers to achieve cost savings and artificial growth; its laboratories have failed to produce any important medicines despite an annual research budget that exceeded $8 billion in 2005.

Because recent U.S. product launches have not been meeting expectations, there's been increasing pressure for marketed products to perform. Caduet, a combination of atorvastatin and amlodipine for treating high cholesterol and high blood pressure, had sales of only $187 million in 2005, despite analysts forecasting sales of $305 million. Pfizer hoped to have all patients switched to Caduet before the upcoming Norvasc patent expiration.

Meanwhile, Pfizer's sales of Inspra, used for treating congestive heart failure, were only $49 million in 2005. Doctors have been slow to adopt the drug as a new standard of care, and labeling restrictions and concerns about hyperkalemia (high levels of potassium) have relegated it to a niche status.

The statin drugs remain the cornerstone of revenues for several pharmaceutical companies; sales for the category totaled $32.7 billion in the 12 months through June 2006. IMS data confirm that Pfizer's Lipitor is once again the best selling drug overall, with $13.3 billion in sales. After the recent defeat of Ranbaxy's challenge, Lipitor's patents seem to be secure until 2011. Still, Lipitor is up against competition from new products like Merck and Schering-Plough's heavily advertised Vytorin, a combination drug that reduces the body's production and absorption of cholesterol. Merck's Zocor ranked fifth, with sales of $5.5 billion, despite generic competition.

Statin drugs could find their sales boosted further following dramatic results from a recent clinical study. In the trial, AstraZeneca's Crestor was found not only to reduce cholesterol levels but also to reverse atherosclerosis. Although the 2006 patent losses for simvastatin (Zocor) and pravastatin (Pravachol) will continue to affect growth, increased public awareness of the efficacy of lipid-lowering agents, broader patient screening, and new combination therapies will continue to drive demand.

Other drugs maintained positions in the top 10 global pharmaceutical product ranking compared with the same period last year. These included Plavix, Norvasc, the antiulcerant Nexium, the asthma drug Seretide, and the schizophrenia drugs Zyprexa and Risperdal. There were two departures from the top 10, however, with J&J's anemia drug Erypo and Takeda and Abbott Laboratories' Prevacid and Ogastro antiulcerants being replaced by Amgen's anemia agent Aranesp and its antirheumatic Enbrel.

The oncology market is enjoying spectacular double-digit growth; product sales increased 21.9% in the 12 months to June 2006. An aging population and improved diagnostics have increased demand, and the industry has met the challenge with a strong flow of innovation. Oncology product sales are expected to reach $40 billion to $45 billion in 2007, contributing nearly 20% of the total market growth.

"Through 2007, this class will expand rapidly as more patients gain access to treatment from a growing range of therapies," notes Murray Aitken, senior vice president for corporate strategy at IMS. "But oncology products will eventually be subject to tighter pricing and usage parameters as payers deal with their mounting costs." IMS predicts oncology will become the largest single sector in terms of value by 2010, however, reaching approximately $57.6 billion. Oncology drugs are already the top therapy class in Europe and Japan in terms of sales and are growing fast in the U.S.

Against this promising outlook and an anticipated explosion of approaches and technologies, which include two new vaccines, anticancer therapies already face mounting pressures from growing competition, changing patient demographics in an aging population, and the need for a reconfiguration in cancer care delivery. Affordability is already a key issue, forcing decisions around use based on cost-effectiveness.

"We are gradually seeing cancer become a chronic illness, and managing this over the lifetime of patients will be an increasing challenge," says Graham Lewis, vice president for global strategy at IMS. "The lack of budgetary resources to meet changing demand in this area calls for a much stronger focus on developing health economic strategies that demonstrate real differential value and societal benefit."

One way pharmaceutical companies try to create value for patients and for their businesses is through the development and launch of new chemical entities. This year, launches of NCEs have included Sanofi-Aventis' Acomplia to treat obesity, Pfizer's inhaled-insulin product Exubera, and Pfizer's cancer drug Sutent. Notwithstanding their efforts, pharmaceutical companies have been generating a declining number of NCEs and thus have been making it a key priority to maximize the success of each launch.

In 2005, 22 NCEs introduced into the market were launched into the specialist-driven space. IMS expects this growing emphasis on products prescribed by specialists to continue, with two-thirds of an anticipated 39 new launches in 2006 targeted at these doctors. Dominating these will be 11 new products in oncology, a specialty that is predicted to account for 50 to 55 NCEs over the next five years.

The number of new product launches in 2007 is expected to be in the range of 25 to 35. Nevertheless, with pharmaceutical companies increasingly developing specialty products and treatments to serve niche markets, new products are contributing less to overall market expansion than they have in the past.

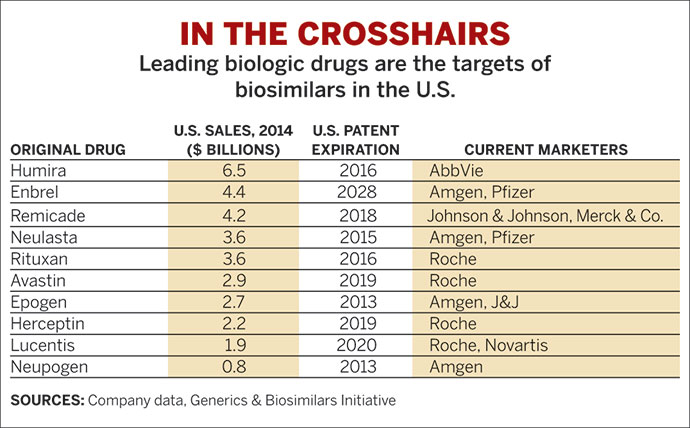

Biotechnology programs, which account for about 27% of the global drug development pipeline, are another source of innovative products. The biotechnology sector is at an exciting stage in its life cycle. It can no longer be considered an emerging industry, but neither is it yet a mature one. Biotechnology is anticipated to continue to have much to offer in the years to come despite the need to address many environmental challenges, including changes in technology and market dynamics; ethical issues, such as stem cell applications; and regulatory challenges, including the introduction of "biosimilars," which are second and subsequent versions of biologics that are independently developed and approved after a pioneer company has developed an original version.

That biological medicines are facing generic competition for the first time is evidence of the sector's maturation. Earlier this year, Sandoz' Omnitrope and Biopartners' Valtropin, both recombinant human growth hormones, became the first biosimilars to receive marketing authorization from European regulators, followed closely by Omnitrope receiving approval in the U.S. Omnitrope had already been launched in Australia in November 2005.

The regulatory approval situation for biosimilars, which is the closest the industry comes to generic versions of biologic drugs, is very different from that of typical generic pharmaceuticals. With small-molecule drugs, it's straightforward to prove that two products are equivalent. The precise composition of a biologic medicine, however, is highly dependent on the process used to make it, so a greater number of studies are needed to prove that a subsequent version is equivalent to the original. Omnitrope and Valtropin are biosimilars of somatropin, the former developed by using Pfizer's Genotropin as the reference medicine and the latter by using Eli Lilly & Co.'s Humatrope.

Omnitrope and Valtropin are likely to be the first of many biosimilars to gain approval in Europe. Regulators there are expecting to receive another seven or eight applications over the next year or so for products such as insulin, erythropoietin (EPO), somatropin, and granulocyte-colony stimulating factor (G-CSF). Price differentials between the biosimilar products and the originals are unlikely to be as high as those for small-molecule drugs, which can approach 60%. The complexity of manufacturing and the fact that fewer companies have the capabilities to do so prevent biosimilars from enjoying a large price drop.

Many companies already have been diving into the biosimilars market in anticipation of its potential being realized. In June, Singapore-based biopharmaceutical company SciGen announced that it had secured the rights to manufacture, distribute, and market G-CSF, which is used to treat the symptoms of chemotherapy, and EPO, which is used to treat anemia from dialysis. Other key players in this area are Teva Pharmaceuticals, Sandoz, Biopartners, Cangene, GeneMedix, LG Chemicals, Pliva (Barr), Rhein Biotech, Roemmers, and Stada. It is possible that some research-based players with biotech expertise may launch biosimilars as a means of sourcing additional growth.

As in previous years, the biotech sector dramatically outperformed the overall pharmaceutical market, growing at 15.5% in the 12 months to June 2006 and achieving total sales of $55.1 billion. Several biotech drugs, including EPO, G-CSF, Aranesp, and Enbrel, have achieved blockbuster status. Humira, a monoclonal antibody product developed by Cambridge Antibody Technology and marketed by Abbott for the treatment of rheumatoid arthritis, became the first European biotechnology blockbuster when it achieved worldwide sales of more than $1 billion in the 12 months to June 2006.

Advertisement

Blockbuster drugs continue to drive the market for pharmaceuticals, accounting for 37% of sales in the 12 months to June 2006. In that period, there were 101 products each with sales of over $1 billion per year; 35 of these had sales exceeding $2 billion, and 16 surpassed the $3 billion mark. An additional 15 products hit the threshold since June 2006, including Humira, Vytorin, and AstraZeneca's Symbicort, an inhaled steroid for asthma and chronic obstructive pulmonary disease.

Although seven of the 101 current blockbusters are likely to face generic competition in 2007, IMS estimates that new launches and growth for products already on the market mean the number of blockbusters will continue to increase.

"The end of blockbusters is not upon us, despite what some analysts are saying," Aitken asserts. "In fact, we expect that blockbusters will continue to be an important part of pharmaceutical market growth over the next five years." New uses for existing therapies, the emergence of niche products, and the ongoing demand for chronic disease treatments will all have an impact. The number of blockbuster products is expected to reach 112 in 2007 and will potentially include paliperidone for schizophrenia, desvenlafaxine for depression, and vildagliptin for diabetes.

And it's become more likely that candidates for blockbuster status will be among products prescribed by specialists, rather than primary-care physicians. "There must be demonstrated therapeutic superiority and cost-effectiveness, especially considering the competition posed by generics," Aitken says. In the past few years, the number of new launches in products targeting primary-care markets has been diminishing, whereas the number of specialist-driven blockbusters has been rapidly growing.

Overall pharmaceutical growth is set to stabilize in the long term, and companies are taking different approaches to position themselves. IMS expects global pharmaceutical growth of 5 to 6% for 2007, as the market continues to rebalance in light of changing dynamics. According to IMS's 2007 Pharmaceutical Market Forecast, global sales will expand to between $665 billion and $685 billion next year. U.S. market growth, meanwhile, is forecast to slow to 4 to 5%, due in part to the loss of patent protection for several key brands.

Growth from new products will not be sufficient to offset the volume of branded products that shift to generic status. In addition, growth is likely to be less in branded products and more in generics, less in primary care and more in specialty markets, and less in traditional pharmaceuticals and more in biotechnology.

Joanne Grimley is a consultant with IMS Management Consulting. IMS is a provider of market intelligence and strategic consulting services for the pharmaceutical and health care industries. All data in the article are sourced from IMS, unless stated otherwise. For further information about IMS, visit imshealth.com.

MORE ON THIS STORY

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter