Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Earnings Mixed

First reports from chemical firms show widely varying results for fourth quarter

by William Storck

January 30, 2006

| A version of this story appeared in

Volume 84, Issue 5

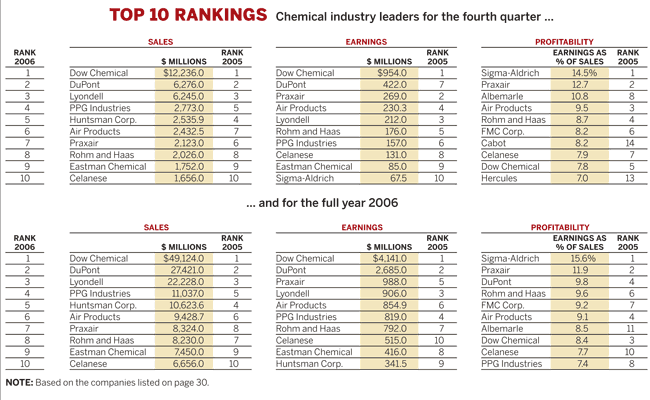

Seven U.S. chemical companies have reported fourth-quarter 2005 financial results that can only be called mixed. Results at the companies range from double-digit increases or better to double-digit declines, with nothing in between.

Two of the companies, DuPont and PPG Industries, saw earnings from continuing operations, excluding unusual items, fall in the quarter. DuPont was the bigger loser with a 66.3% earnings drop to $125.0 million and a 2.9% sales decline to $5.83 billion.

DuPont says the lower earnings were largely attributable to disruptions from hurricanes and other plant outages, higher energy and ingredient costs, and lower crop protection product sales. Big declines came in two of the company's segments: agriculture and nutrition and color and coatings. Agriculture had a pretax loss of $272 million, compared with a loss of $125 million in the 2004 fourth quarter. And pretax operating income from coatings fell 31.4% to $162.0 million.

The effects of the hurricanes will continue to plague the company's coatings and performance materials segments, DuPont says. Its DeLisle, Miss., titanium dioxide plant, damaged by Hurricane Katrina, although now open, is not expected to be fully operational until April (see page 23).

PPG, which had a 24.3% decline in earnings to $143.0 million, says it lost about $17.0 million in earnings because of lower sales volumes resulting from the hurricanes. CEO Charles E. Bunch also notes adverse effects from "historical peaks in energy costs and demanding conditions in some of the markets we serve."

On the plus side, industry leader Dow Chemical had a 20.7% increase in earnings to $993.0 million on a 9.0% sales increase to $11.9 billion. The company notes that pretax income, excluding unusual items, was up in all of its segments except chemicals. Pretax income for performance plastics increased 39% to $261 million, performance chemicals rose 4% to $191 million, agricultural sciences doubled to $82 million, and plastics rose 5% to $622 million. Chemicals fell 34% to $272 million.

Two industrial gas producers, Praxair and Air Products & Chemicals, showed good quarterly results, with Praxair leading the way. Its earnings increased 21.5% to $220.0 million on a 13.1% rise in sales to $2.02 billion. The company says sales grew in all of its geographic sectors: 11% in North America, 12% in Europe, 33% in South America, and 10% in Asia.

Earnings at Air Products increased 13.0% to $180.7 million, on a 5.0% sales rise to $2.09 billion. "A major driver in these results is our continuing success in delivering productivity to the bottom line," says CEO John P. Jones III. He also notes continued volume growth in the firm's gases business and high activity in its equipment sector, driven by heat exchangers for liquefied natural gas. Air Products was not immune to the effects of the Gulf Coast hurricanes. They cut sales by about 3% and operating income by about $20 million.

Two smaller companies, Albemarle and H.B. Fuller, also posted good results for the quarter. Fuller's earnings more than doubled, rising 113.8% to $23.3 million on a 9.2% sales increase to $413.2 million. Albemarle's earnings were up 73.5% to $34.0 million as sales improved 30.4% to $588.2 million.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter