Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Policy

Investing In Nanotechnology

Funding for the discipline is on the rise, but returns remain small

by Ann M. Thayer

February 24, 2006

While increasing amounts of money are being funneled into nanotechnology research and nanotech-related companies, commercial and financial returns from these investments are up to now limited, two recent reports suggest.

According to the independent research firm Cientifica, governments worldwide sank a total of more than $18 billion into nanotechnology between 1997 and 2005. Another $6 billion in combined spending, a 25% increase over that in 2005, is forecast for this year.

According to the independent research firm Cientifica, governments worldwide sank a total of more than $18 billion into nanotechnology between 1997 and 2005. Another $6 billion in combined spending, a 25% increase over that in 2005, is forecast for this year.

“Nanotechnologies will then have received the same level of funding in absolute dollar terms as the entire Apollo program,” the Cientifica report says. In its first eight years, the Apollo space program achieved the first manned flight around the moon, Cientifica notes, while “the entire output of the nanotech program in the layman’s view still consists of only stain-resistant pants.” The economic effect of nanotechnology remains tiny; nanotech-enabled products now generate only a few million dollars in sales.

Cientifica’s analysts interviewed government representatives worldwide as well as individuals ranging from directors to bench scientists at R&D laboratories. Their general conclusion is that nanotechnology is still in its infancy, despite the level of investment. In 2005, Europe, the U.S., and Japan each spent more than $1.2 billion on nanotech R&D, up from just about $100 million each a decade ago.

But actually getting the money and then using it takes time. Researchers told Cientifica that there is a long time lag, an average of two to three years, between government announcements and actual disbursement of monies. And, once monies are received, it can take a minimum of 18 months to build, staff, and equip a new dedicated nanotech laboratory effort.

Most money is earmarked for basic science, Cientifica points out, and thus the time horizon to commercial applications is very long. “The true impact of nanotechnology will only start to be felt from 2007 onward,” its analysts concluded.

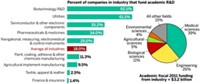

In the meantime, private investment money has been flowing into small companies to try to capitalize on nanotech’s commercial opportunities. Since 1995, venture investors have put a total of about $2 billion into small nanotech companies, reports Lux Research, a private research and advisory firm. Venture-capital firms invested about a quarter of the total, or $480 million, in 2005 alone. Much of it went into large, late-stage funding rounds for a few prominent small companies.

From 1995 through 2005, there have been 258 investments in 143 start-ups spread across 13 countries. “Venture capital still remains a drop in the bucket,” says Matthew M. Nordan, Lux Research’s vice president for research. Corporate and government funding combined have outstripped venture investments by a factor of 19, according to Lux’s figures.

Although some venture capitalists find investing in nanotech attractive, if high risk, most have not yet seen any return. Of the 143 companies surveyed, Lux reports that only 9% have been acquired or gone public, allowing investors to cash out. And whereas 83% of the small nanotech companies are still operating, 8% are “dead or in danger.” Nordan predicts that this year will bring more public offerings, along with consolidation among small firms and opportunities for large corporations to make inexpensive acquisitions.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter