Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Petrochemicals: Good Times For Now

North American olefins producers are still enjoying prosperity but are wary of a looming downturn

by Alexander H. Tullo

March 26, 2007

| A version of this story appeared in

Volume 85, Issue 13

FOR NORTH AMERICAN petrochemical producers, 2006 was a good year but not a perfect one. The industry faced record-high oil prices as well as softening prices for its own products as the year ended. But no hurricanes knocked out large amounts of capacity, and the industry still saw peak business conditions and strong profits.

Observers say 2007, and perhaps 2008, should bring more good times for producers of ethylene, propylene, and their derivatives. Longer term, however, the industry is bracing for a difficult period when new capacity around the world—particularly in the Middle East—is expected to cause a downturn in the petrochemical business cycle.

Petrochemical companies didn't enjoy the huge profit jumps in 2006 that they did in previous years as they emerged from the deep trough of 2002. But they didn't lose any ground either. Lyondell Chemical, a U.S. petrochemical leader, reported a before-tax profit increase of 2% in its petrochemicals unit to $1.4 billion on an 8% increase in revenues.

ExxonMobil Chemical, one of the world's largest petrochemical producers, posted record results again in 2006; earnings improved 11% to $4.4 billion and sales rose 9% to $34 billion. Sherman J. Glass Jr., the firm's senior vice president for basic chemicals, intermediates, and synthetics, credits the global economy for a healthy 2006. "Our view is that the global economy was strong, and that supported some strong petrochemical growth across the year," he says. "The supply-demand balance was tight, which supported higher prices and stronger markets, despite the fact that over the course of the year feedstock prices rose."

Prices for West Texas Intermediate crude oil, the benchmark for petroleum prices in the U.S., started out the year high, at $63 per barrel, and then climbed to a record-breaking $77 per bbl in the summer as international instability raged and inventories dwindled. Prices slowly eased to about $60 by the end of the year.

Meanwhile, prices for natural gas traded on the New York Mercantile Exchange began 2006 at their peak for the year, $10.63 per million Btu. They then decreased steadily, hitting $4.20 in late September, their lowest level in nearly four years.

Given that a barrel of oil contains about 5.8 million Btu of energy, natural gas was generally a bargain last year compared with oil. The disparity was good news for the North American petrochemical industry. "Probably the most significant issue in 2006 was the divergence of gas and crude to a more competitive position for North America," says Mark Eramo, vice president for olefins at the Houston-based petrochemical consulting firm Chemical Market Associates Inc. (CMAI).

About 70% of U.S. ethylene capacity runs on natural-gas-derived hydrocarbons such as ethane; the rest is based on petroleum-based liquid feedstocks such as naphtha. In Asia, Europe, and Latin America, petroleum-derived liquids are most common. As a result, relatively low natural gas prices gave North American petrochemical producers a cost advantage and encouraged exports of ethylene derivatives such as polyethylene.

Among North American producers, those in Western Canada benefited the most from the lower natural gas prices, Eramo says. "Western Canada was the most competitive source of ethylene outside the Middle East on a global basis."

Val Mirosh, president of olefins and feedstocks at Nova Chemicals, which produces most of its ethylene and polyethylene in Alberta, says ethane-based ethylene producers in the province enjoyed a production cost advantage of up to 15 cents per lb versus similar companies on the U.S. Gulf Coast. The advantage is usually between 5 and 7 cents per lb.

THE ADVANTAGE comes from two sources, Mirosh explains. First, natural gas prices last year were even lower in Alberta than in the U.S. Moreover, although the prices of ethane and natural gas generally move in tandem, the high demand for ethane by producers on the Gulf Coast kept ethane prices there high even as natural gas prices were declining.

High ethane prices cut into some of the advantage enjoyed by North American ethylene producers that crack ethane. Robert Chouffot, Shell Chemical's general manager of base chemicals in the Americas, calls this a natural market equilibration that occurs with any shift to gas-based feeds. "As demand for ethane goes up, you see the price go up accordingly," he says.

In addition, Chouffot notes, as crackers run more gas-based feeds, their output of coproducts such as propylene and butadiene falls. As a result, prices for those products climb, creating an incentive to swing back toward heavier feedstocks.

According to Tim Taylor, senior vice president of olefins and polyolefins at Chevron Phillips Chemical, the net result of these shifts was a favorable feedstock picture for North America in 2006. "The price of natural gas relative to oil has improved the cost position of most North American producers and has made exports viable," he says. "All feedstocks will remain in relative parity with each other for the foreseeable future. Ethane crackers will be neither significantly advantaged nor disadvantaged in relation to other crackers."

Olefins prices remained strong during first-half 2006. According to CMAI, contract ethylene prices began the year at 49.9 cents per lb, slipped in the spring, but rebounded in the summer to reach 50.6 cents in September. Prices for polymer-grade propylene rose from 41.5 cents per lb in January to 53.5 cents in September.

The North American olefins market ended the year on a sour note, however, as demand and prices dropped. Observers attribute the slowdown to a reduction of inventories across the petrochemical supply chain, from olefins to derivatives such as plastic films.

Although destocking is normal toward the end of any year, Eramo says the phenomenon was more pronounced than normal in 2006. Polyethylene buyers on the U.S. Gulf Coast had been building up their inventories more than usual out of fears that hurricanes could disable a chunk of U.S. petrochemical capacity as Hurricanes Rita and Katrina did in late 2005. "You are fearful of another active hurricane season off the Gulf of Mexico, and therefore you build your inventory," Eramo says.

But the disruptive hurricanes meteorologists predicted never materialized, and demand plummeted. Chuck Carr, director of propylene studies for CMAI, says buyers of derivatives like polypropylene halted purchases once they realized they had enough inventory. "Eventually they figured out they couldn't afford to buy any more, and all they were doing was buying high-priced inventories," he says. "And then they stopped. They just started working off inventories, and the prices tumbled."

By the end of 2006, both demand for and prices of olefins and olefin derivatives had slumped. After peaking in September, ethylene prices dropped to 38.2 cents per lb in December, and propylene prices slid to 40.5 cents.

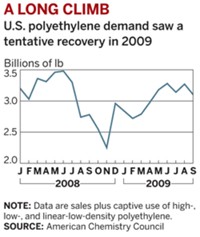

Over the course of the year, however, demand for the major derivatives of ethylene and propylene remained healthy. According to the American Chemistry Council, U.S. sales and captive use of polyethylene increased by 4.6% to 38.0 billion lb, while polypropylene sales and use increased by 1.7% to 18.4 billion lb. Upstream of these plastics, CMAI says, demand for ethylene rose about 5% globally and 4% in North America. Propylene demand rose 6% globally and 2% in North America.

Moreover, despite the fourth-quarter inventory correction, ethylene crackers that are on-line are operating at close to their maximum rates. Global operating rates are above 95%, according to CMAI, while in the U.S., they are above 90%.

Industry observers expect 2007 to be another good year in petrochemicals. No significant new capacity is coming onstream in North America, and not enough is starting up elsewhere in the world to make a large impact, they say. They are, however, expecting an industry downturn eventually, probably near the end of the decade, as a flood of new capacity comes on-line in the Middle East and Asia.

Eramo expects demand for ethylene derivatives to rebound in 2007 from the late-2006 slump. He says demand in Asia and Europe remained strong during the weak fourth quarter in North America. "Demand should come back," he says. "As that happens, you should see a strengthening of the overall U.S. supply-and-demand balance."

CMAI projects that 2007 ethylene demand will rise 4% globally and 2% in North America. The company forecasts that propylene demand over the next five years will grow at a 5% annual clip worldwide and at nearly a 2% rate in North America.

ExxonMobil's Glass expects petrochemicals to beat global gross domestic product growth in 2007. "Unless there is a substantial unexpected depression worldwide, we expect chemicals to continue to grow probably a couple of percent above GDP this coming year," he says. "And I think we are off to a good start."

According to Eramo, the North American market could be influenced by the scheduled opening of two or three ethylene complexes in Iran during the year that could drive U.S. product out of the export market. "The U.S. can compete with Asia, Europe, and South America; it can't compete with Iran," he says.

But Chouffot predicts that the Middle East projects won't have a huge influence on North American petrochemical markets this year. "When they come onstream, I think you will see some weakening, but you are still looking at operating rates in the high-80% range in North America," he says.

Of more concern to industry watchers is the broader onslaught of Middle Eastern capacity planned for the coming years. Eramo forecasts that 42 million metric tons of new ethylene capacity will open between 2006 and 2012, pushing global capacity to 160 million metric tons. Most capacity will be in the Middle East and Asia. Eramo predicts this capacity will precipitate a price decline in 2009 and lead to the next industry trough that year, extending through 2011. "We think it is going to be too much, too fast, in that time period," he says.

Shell's Chouffot points out that the timing and depth of the impact from the Middle Eastern crackers depends on the state of global petrochemical demand when they start up. "One of the keys is how quickly that capacity will come onstream versus the intrinsic growth rate," he says. "We still see very good growth between 2006 and 2011."

And the trough could occur later than CMAI is figuring. Middle East projects have been beleaguered by rising costs and labor shortages, Nova's Mirosh says, and some could be delayed.

The North American industry's last downturn was caused by a convergence of mostly local forces: a spate of new petrochemical capacity in the U.S., rising domestic feedstock prices, and an economic slowdown. The next downturn will come from offshore forces, experts say.

At that point, Eramo says, North American producers will likely turn away from export markets because they can't undersell producers from the Middle East. He expects that more finished ethylene derivatives, such as rolls of polyethylene film and other nondurable goods, will be sent to the U.S. from Asia. And Eramo doesn't rule out the possibility of a rise in North American imports of chemicals and polymers.

OFFSHORE polyethylene producers have definite hurdles in entering North American markets, however. For example, most of the world sells resins in 55-lb bags, but North American companies ship them in rail hopper cars.

But, Eramo says, hurdles like these can be overcome. "The resins can come in, and they do come in," he says. For example, the 2005 hurricanes, and the subsequent scramble by converters for materials to run their plants, spurred unprecedented resin imports from Asia. "We shouldn't kid ourselves. Will they represent a significant portion of the market? Probably not. But it can have an impact."

The U.S. petrochemical industry is already preparing for the next industry downturn via dealmaking. A number of companies that are shifting strategies away from petrochemical, Eramo notes, have been selling assets to those that are committed to the business. For example, Huntsman Corp. sold its European petrochemicals business to Saudi Basic Industries last December and later agreed to sell its North American petrochemicals business to Koch Industries. And last October, Westlake Chemical purchased Eastman Chemical's polyethylene business.

Advertisement

Instead of building new plants in the U.S., chemical producers are focusing on bringing costs down. ExxonMobil's Glass says his company will tackle small operational efficiency projects, some of which "creep" capacity upward at existing plants. Over the years, he says, this method had led to a 70% increase in capacity at some facilities. "At least for the foreseeable future, if we need some additional capacity in North America, that's how we'll get it," he says.

Mirosh agrees that costs and efficiency are the keys to long-term success in North America. "The companies that are the survivors are the ones that are the low-cost producers," he says. Any company that can enhance its cost position, Mirosh adds, is in a "better position to deal with any downturns or troughs in the future."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter