Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Pharma's Tough Balancing Act

Weaker third-quarter earning at the major drug companies reflect drug withdrawals and generic competition

by Lisa M. Jarvis

November 19, 2007

| A version of this story appeared in

Volume 85, Issue 47

Every day, drug companies perform a balancing act that involves combating generic competition to their products, doing damage control following unexpected drug withdrawals, and maintaining a well-oiled R&D engine—all while trying to meet the lofty sales and profit expectations of shareholders and financial analysts.

The biggest of the pharmaceutical behemoths—Pfizer, GlaxoSmithKline (GSK), and Novartis—seem to be having a tough time juggling those tasks. All three experienced declines in either sales or profits in the third quarter, and all are facing challenges that will only add pressure to their bottom lines in 2008. In contrast, Merck & Co., once an industry laggard, had a robust third quarter.

The issues confronting Pfizer are few new drug launches and generic competition on former blockbusters such as the blood pressure medicine Norvasc and the antidepressant Zoloft. The company's third-quarter sales fell 2.4% from the 2006 quarter to $12.0 billion, its second straight quarterly decline, while net income rose 1.0% to $4.0 billion.

Pfizer also announced it is abandoning its inhaled insulin product Exubera, which has suffered from paltry sales since its launch last year. "Despite our best efforts, Exubera has failed to gain the acceptance of patients and physicians," said the company's chief executive officer, Jeffrey B. Kindler, when its earnings were released. "We have therefore concluded that further investment in this product is unwarranted."

The move will result in a breathtaking $2.8 billion write-off for assets related to the failed product, a charge that includes $661 million in inventory, $454 million in fixed assets, and other exit costs.

In addition to the financial dent, the Exubera debacle may have tarnished Pfizer's reputation as a "partner of choice" for smaller drug companies. Nektar Therapeutics, Pfizer's partner in the Exubera venture, learned about the drug company's decision to ditch the product in the same way as everyone else—when the press release came out.

That kind of communication—or lack thereof—could hurt Pfizer's chances in the increasingly competitive mergers and acquisitions arena. Most of the pharma majors are scrambling to fill pipeline gaps through licensing deals and acquisitions; meanwhile, attractive assets are few and far between. The Nektar incident might cause prospective partners to think twice about inking a deal with Pfizer.

Yet Pfizer is in dire need of refilling its pipeline, according to Morgan Stanley analyst Jami Rubin. Its once-booming cholesterol-lowering drug Lipitor, which accounts for more than half of its earnings per share, is losing its clout.

Though Lipitor has patent protection in the U.S. through 2010, the drug has lost sales to newer cholesterol drugs and generic versions of Merck's Zocor and Bristol-Myers Squibb's Pravachol. Third-quarter Lipitor sales came in at $3.2 billion, a 5% decline. In the U.S., sales were down 13%, and they are expected to continue to shrink over the next two years.

"With no meaningful visible blockbusters in sight, Pfizer appears as if it is coasting toward an abyss," Rubin says.

Like Pfizer GSK is also facing generic competition on key products, as well as dampened sales of its type 2 diabetes drug Avandia. It came under scrutiny this spring after a study in the New England Journal of Medicine suggested that it significantly increased the risk of heart attacks.

The company's net income dropped 5.9% in the third quarter to $3.9 billion, based on a 3.0% dip in sales to $11.2 billion. Despite the declines, newer products are performing well. Sales of vaccines at GSK grew 49% to $1.2 billion, boosted by strong demand in the U.S. That pace should continue, given the recent European launch of Cervarix, GSK's cervical cancer vaccine.

Furthermore, the epilepsy drug Lamictal posted sales of $563 million, up 14%, and Requip, used for Parkinson's disease and restless legs syndrome, saw sales improve 39% to $178 million. GSK hopes to expand the markets for those drugs by launching extended-release versions, which are currently under regulatory review.

But Avandia sales fell to $461 million, down 38% worldwide and 48% in the U.S. The Food & Drug Administration is currently reviewing its safety guidelines for all the diabetes drugs in Avandia's class.

After GSK's results came out, Citibank analyst Kevin Wilson altered his forecast for Avandia for the second time since May, when the safety concerns emerged. Wilson originally thought the entire issue would be resolved by now and that sales would bounce back next year, but he says he no longer expects a recovery. In fact, he is forecasting that sales of the drug will fall another 37% in the U.S. in 2008, followed by a modest 3% uptick in 2009 based on price increases.

Though GSK has a fairly robust pipeline of prospective new drugs, it is also on the brink of losing patent protection on the migraine drug Imitrex and the asthma treatment Advair. Both patents are set to expire next year, and GSK is taking measures to shore up its cost structure. The company unveiled a $3.1 billion restructuring plan in tandem with its earnings announcement.

The company was vague about what the restructuring program would mean in terms of job losses. CEO Jean-Pierre Garnier said it would include "streamlining our manufacturing, adapting our selling model, and improving efficiencies in R&D." Roughly 80% of the expected savings will come from manufacturing site reductions, outsourcing, and administration cuts.

Novartis also had a tougher quarter and, like GSK, announced job cuts in conjunction with its earnings press release. Sales were up 9.0% to $9.6 billion, but profits fell 12.2% to $1.6 billion. CEO Daniel Vasella said the company would shave 1,260 U.S. sales and marketing jobs to generate $230 million in annual savings.

Although Novartis' vaccines and diagnostics business is growing by leaps and bounds—sales rose 53% to $572 million in the quarter—the company's prescription drug business has come under pressure. Sales increased just 2% to $5.9 billion, due to weakness in the U.S., where generic competition has cut into sales of Lamisil, Lotrel, and Famvir. Additionally, the company withdrew the irritable bowel syndrome drug Zelnorm, which brought in $561 million in 2006, from the U.S. in March due to safety concerns.

Furthermore, Novartis is experiencing lengthy delays in the launch of an important new product, the diabetes drug Galvus. Though European regulators approved Galvus in late September, Novartis recently released new safety data that show elevated liver enzyme levels in patients taking a once-daily 100-mg dose of the drug. The company is now attempting to remove this dosage recommendation in favor of a 50-mg dose before the drug is launched in Europe.

Novartis is also still talking to FDA, which in February asked the company for additional clinical trial data for Galvus. Analysts fear that the later the diabetes drug is launched, the harder it will be to make inroads against Merck's Januvia, which is in the same class as Galvus and has been on the market for more than a year.

Indeed, Merck is benefiting from Januvia's status as the newest diabetes drug. Januvia contributed to the company's 50.0% third-quarter profit surge to $1.7 billion and 12.3% rise in sales. Analyzing Merck's results, Morgan Stanley's Rubin called the company "the leader of the pack" in the pharmaceutical world.

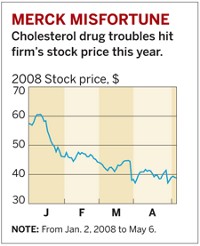

Januvia and Janumet, which combines Januvia and metformin, both blood sugar stabilizers, brought in third-quarter sales of $204 million for Merck. The cholesterol drugs Zetia and Vytorin, which Merck markets with Schering-Plough, also helped the bottom line. Overall, sales of cholesterol drugs rose 26% to $1.3 billion.

Merck's healthy performance could spell both good and bad news for its struggling competitors. On the positive side, Merck was in a position similar to GSK's and Pfizer's just a few years ago, when it suffered the one-two punch of the withdrawal of Vioxx and the patent expiry on Zocor. On the other hand, it didn't participate in the merger spree that created some of the growth problems at the biggest drug firms.

Still, Merck's bounce back after a fall from grace could provide some solace for the other companies facing sales and profit declines.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter