Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Materials

Special Delivery

Getting fragrance onto clothes presents a challenge for detergent companies and their suppliers

by Michael McCoy

January 29, 2007

| A version of this story appeared in

Volume 85, Issue 5

COVER STORY

Special Delivery

CLOTHES SHOULD SMELL GOOD after they are washed, yet cleaning a garment and keeping a fragrance on it usually are incompatible from the surfactant's perspective.

As Kumar Vedantam, director of technology and applications at Givaudan Fragrances, explains, delivering fragrance to washed clothes faces a fundamental stumbling block. "In the cleaning process," he says, "what you want the product to do is remove oily and particulate soil that gets deposited on a substrate during use." Fragrances, however, are also typically oily materials. "You expect your product to remove one set of oils and deposit another," Vedantam says, "but the surfactant doesn't distinguish between them."

Efforts to overcome this problem are yielding sophisticated solutions that belie how mundane laundry is. Take for example a paper published last July by researchers from Unilever and University College London's department of biochemical engineering, which described biotechnology befitting high-end drug discovery (Biotechnol. Bioeng. 2006, 94, 625).

In the paper, the scientists describe a new, low-cost class of antibodies with affinity for one or more molecular surfaces. But rather than lay out use of these antibodies in drug delivery or therapeutics, the paper proposes adding them to detergent so they can deliver perfume to laundry in the wash.

Although the antibody work is by no means commercial, it shows the extent to which detergent companies such as Unilever are willing to go to coax fragrances and other active ingredients to deposit on the surface of clothing rather than disappear down the drain with the wash water. After all, consumers appreciate a pleasant-smelling bottle of detergent, but it's the scent of a washed and folded garment that leaves a lasting impression and creates a loyal customer.

Targeted delivery of fragrance and other cleaning product ingredients is being pursued by four segments of the detergents industry: fragrance manufacturers, delivery technology specialists, specialty chemical companies, and consumer product makers. All are aware that their task is frustratingly quixotic.

Michael Popplewell, vice president of delivery and material technology with International Flavors & Fragrances (IFF), puts the challenge this way: "You are trying to deliver a molecule with a process that's really designed to remove molecules." As if that wasn't enough, Popplewell notes a second challenge: After washing comes drying, often by heating, and fragrance molecules tend to evaporate along with the water.

Faced with this pervasive loss of fragrance, the industry's first line of attack is to tailor the scent molecules themselves. According to Popplewell, hydrophobic compounds are more likely to deposit on clothes than hydrophilic ones, because they are less likely to dissolve in the wash water. And high-molecular-weight molecules have the best chance of surviving the clothes dryer.

But even with the most robust molecules, Vedantam notes, up to 90% of the fragrance added to a detergent can be lost during washing. Givaudan and its competitors combat this problem with proprietary fragrance molecules that possess what he calls high odor value. These molecules give off a scent that is discernible even at nanogram or microgram quantities, he says.

Dallas Hetherington, business manager for encapsulation and delivery systems at Alco Chemical, a division of National Starch & Chemical, agrees that odiferous molecules offer a degree of effectiveness. "But you still lose a great deal of fragrance down the drain, which can get costly," he says. Plus, such an approach restricts the detergent formulator to a limited palette of aroma chemicals.

Thus, the second line of attack is encapsulation, or some other form of molecular tethering, to control the delivery of fragrance to clothing. For IFF, the main weapon on this front is Celessence International, a British fragrance encapsulation company it acquired in 2003.

Celessence's claim to fame is a controlled-release system that is applied to fabrics and other substrates at the textile mill or garment factory. Fragrance releases gradually over time as the products are used. For example, pillows marketed by the British retailer Marks & Spencer retain their vanilla or lavender and chamomile scent thanks to Celessence technology.

SINCE 2003, Popplewell says, IFF and Celessence researchers have modified the system so it can be employed in rinse-off applications such as laundry detergents and fabric softeners. He says a customer has launched a laundry detergent incorporating the technology and that other applications are in the works.

At Givaudan, in-house R&D efforts have yielded a number of encapsulation and other controlled-release technologies in recent years.

In 2003, the company launched Granuscent, an encapsulation technique that protects volatile fragrance materials in a dry environment and then releases them upon contact with moisture. Although its large particle size was designed for powdered laundry detergents, Granuscent's biggest application has been in a completely different market that Vendantam wouldn't disclose. An older encapsulation technology, Permascent, is being used to protect fragrances in powdered detergents, he adds.

Releasing fragrance from a liquid medium is trickier, Vedantam acknowledges, because soluble encapsulants can't be used. One Givaudan solution is a controlled-release system based on liquid crystals composed of water, fragrance oil, and surfactant that have properties halfway between a solid and a liquid.

IN DEVELOPMENT for about six years and the subject of three patents, the crystals latch onto textiles in the wash, survive the drying process, and emerge to release their fragrance over time. Customer feedback has been positive, Vedantam says, and commercial launch is being readied.

A second new delivery system from Givaudan is a family of pressure-activated microcapsules that release their scent from washed and dried garments in response to movement or friction.

Vendantam says these materials are akin to the coacervation encapsulants used in carbonless paper and scratch-and-sniff magazine inserts. But because Givaudan designed them for laundry applications, they are able to withstand a high-pH environment and exposure to enzymes and bleaches. They have successfully completed consumer tests and are now in the scale-up phase, he adds.

Although fragrance companies such as IFF and Givaudan seem to be pursuing controlled-release technology quite aggressively, Sam Shefer, vice president of Salvona Technologies, argues that they are not necessarily the best sources of such rarified know-how.

Based in Dayton, N.J., Salvona is a specialist in developing and commercializing ingredient delivery systems for food, health care, consumer care, and fabric and household care. Early in his career, Shefer was a chemical engineering professor at Massachusetts Institute of Technology. He later worked for biomedical and consumer product companies, including IFF; nine years ago, he helped found Salvona.

Shefer says his review of controlled-release patent literature of the past five years found an unimpressive level of activity on the part of fragrance companies. He claims to be unsurprised by this finding, as the core competency of such firms lies in perfumery. Plus, he suspects they are ambivalent toward any technology that will allow customers to use less of their products. "There is not much motivation to do this," Shefer observes.

In contrast, he says Salvona has received 15 controlled-release patents and has 80 more pending. The company employs 17 people to develop and manufacture its systems, which it sells in 16 countries worldwide. "To develop this technology you need specialized people," he says. "It's a profession."

In 2003, Salvona licensed a package of 20 controlled-release technology patents to Imperial Chemical Industries and its National Starch and Alco subsidiaries for use in fabric care. Since then, the company has come up with a new technology, called HydroSal, that is aimed primarily at the personal care market but has fabric care applications as well, Shefer says.

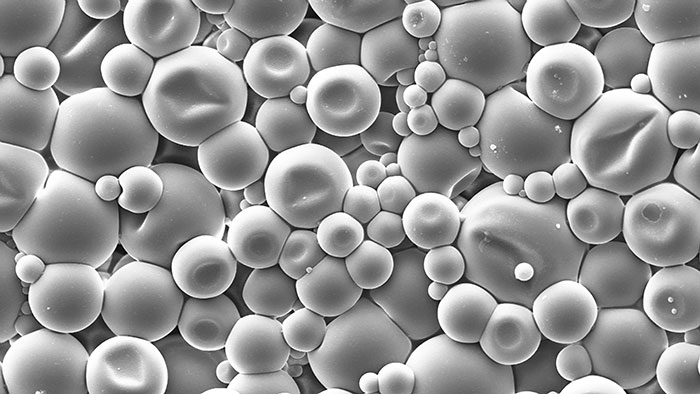

As he describes it, HydroSal starts with 100-nm polymeric spheres that can be infused with fragrance or other ingredients such as whitening or antibacterial agents. The nanospheres are then coated with a 5-nm-thick polymeric layer to provide encapsulation.

This polymer system stays intact in water or alcohol-based personal care and cleaning products and then on the target textile after it is dry. But when the system comes into contact with water or moisture a second time, the outer film swells and slowly releases the encapsulated ingredient, Shefer says.

Like Salvona, several traditional specialty chemical companies also consider controlled release as a core competency. Alco and National Starch, for example, offer techniques of their own devising even as they continue to develop the Salvona portfolio, according to Alco's Hetherington. In fact, he says Alco has built upon the Salvona technologies with what he calls "new art" as part of an effort since last year to expand Alco's delivery systems development group. This group also markets starch-based encapsulation technology developed by National Starch, such as dissolvable films that entrap cleaning ingredients in a dry film format.

International Specialty Products (ISP) is also active in controlled-release technology, offering its homegrown Microflex microemulsions, based on alkyl pyrrolidone and vinyl pyrrolidone polymers that deliver hydrophobic actives such as fragrances and biocides.

At the same time, the company has expanded its controlled-release portfolio with the acquisition of two European encapsulation experts. In 2004, ISP bought Hallcrest, a British developer of water-soluble polymer-based encapsulants. Then last August, it purchased the consumer products encapsulation business of the German firm geniaLab and entered an alliance with geniaLab to develop new encapsulated products for the fabric care, personal care, and home care markets.

Frank Fusiak, North American director of marketing and business development for ISP's performance chemicals business, points out that Hallcrest's coacervation technology is geared to delivering hydrophobic liquid ingredients, whereas geniaLab's JetCutter technology is aimed at delivering solids.

Both Hallcrest and geniaLab, Fusiak says, made their names in the personal care market. Since the acquisitions, ISP has been expanding their reach into home and fabric care as well as industrial and institutional applications. "ISP's success," he says, "comes from its ability to bring technologies to businesses in which they are not normally found."

Most cleaning product manufacturers depend on third-party technology for their specialized ingredient-delivery needs. However, a few giants such as Unilever, Henkel, and Procter & Gamble have their own internal development efforts as well.

For example, P&G has developed specialized techniques to deliver fragrances and softening agents to fabrics and to enhance the "fragrance experience" of selected automatic dishwashing products, according to Sharon J. Mitchell, vice president of R&D for the company's global fabric care business. The company is exploring improved deposition of additional ingredients as well, she adds.

Mitchell says P&G's Tide with Febreze, Tide Simple Pleasures, and Gain Joyful Expressions all employ "specific delivery technologies" to enhance fragrance. Although she won't disclose chemistry specifics, she outlines three steps to efficient fragrance delivery: a technology that is stable in liquid detergents, a perfume accord tuned to maximize the efficiency of the delivery technology, and a technology that gets the fragrance to the fabric in a form that will facilitate release at the appropriate time.

Meanwhile at Henkel, Thomas Müller-Kirschbaum, senior vice president for R&D, technology, and supply chain for the laundry and home care business, says his researchers explore targeted delivery of everything from fragrances to enzymes to bleaches to special fabric care ingredients. And not just in laundry detergents, either.

He points to Henkel's 1999 launch of an automatic dishwasher detergent that used a wax encapsulate to release a rinse aid when the water temperature reached about 60 oC. Since then, Henkel has developed a wider palette of technologies to release rinse aids, water softeners, and shine additives in its autodish products.

FOR LAUNDRY PRODUCTS, one Henkel strategy is what Müller-Kirschbaum calls a precursor approach, in which a fragrance molecule is linked to an organic molecule for protection. In the laundering process, the two halves slowly split apart through hydrolysis or other means, thereby gradually releasing the fragrance.

Precursor technology based on silicic acid esters that bear fragrance molecule appendages won Henkel's 2004 Research/Technology Invention award. The technology received its first patents about 10 years ago and is used today to deliver fragrance in Henkel products worldwide, Müller-Kirschbaum notes. The company since has developed second-generation molecules, he adds, and today is working on the third generation.

Although Henkel has succeeded in developing commercially viable fragrance delivery technologies, Müller-Kirschbaum cautions that the company has by no means solved the problem. "We are in some ways ahead of where we were five years ago," he says, "but I think the whole industry has a way to go."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter