Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

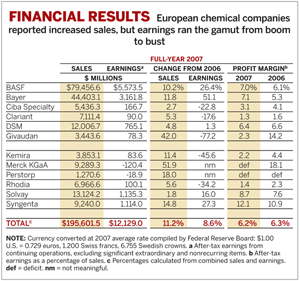

Europeans Ring Up 'Unusual' 2007

Chemical companies' sales and earnings show impact of portfolio changes

by Patricia L. Short

March 10, 2008

| A version of this story appeared in

Volume 86, Issue 10

FOR EUROPEAN chemical producers, year-end financial reports indicate no "typical" result for the industry players in 2007. Significant ups or downs, reflecting the spate of acquisitions and divestitures that occurred last year, influenced many companies' earnings performance.

Rhodia, unlike some of its European peers, didn't benefit from one-off earnings boosts that came from buying or shedding businesses. However, the French firm did reap a sizeable profit from businesses it has classified as "discontinued."

Thus, Rhodia's 2007 net earnings more than doubled compared to 2006, but once the discontinued operations were stripped out, the company was left with a 34.2% decline in earnings to $100 million for the year. Despite that drop, the company's chief executive officer, Jean-Pierre Clamadieu, said he is encouraged by the results and confident that Rhodia has turned the corner from its severe financial problems of the past few years. In fact, he said the company's "solid performance together with [its] confidence looking ahead" has encouraged the board to propose the first dividend in five years to Rhodia's long-suffering shareholders.

Net sales at Rhodia were up almost 6%, driven by significant volume increases of 7.1%, Clamadieu reported. Price increases of 3.9% exceeded the rise in raw material and energy costs, he said, whereas the foreign exchange rate had a negative 4.8% impact.

Elsewhere in the European industry, outright portfolio changes helped shape companies' performances.

For example, results at Bayer were swelled by the proceeds from the sales of two specialty chemicals businesses and the firm's diagnostics operations; its stated net earnings were $6.46 billion, an increase of nearly 180% over 2006. Excluding those extraordinary gains from the calculation, however, reveals a more moderate 51% earnings gain, due largely to a full year's contribution from the drugmaker Schering, which Bayer acquired early in 2006. Bayer's 2006 results included Schering figures only for the second half of the year.

According to Bayer Chairman Werner Wenning, 2007 was Bayer's most successful year to date. He said sales and profits improved across Bayer's three business sectors of health care, crop protection, and materials science. He also said profits improved geographically. In Europe, he noted, Bayer boosted sales by 13% for the year, and in Greater China, sales were up by 30%.

Nonrecurring gains also benefited Merck KGaA. Merck's stated net earnings were $4.80 billion, a 256% increase over 2006. However, that figure includes nonrecurring profits from discontinued operations of $4.95 billion—essentially the net gains from the sale of its generics business to Mylan for $6.7 billion.

Stripping out that contribution showed that Merck was hit hard by interest payments connected with financing its 2006 acquisition of Serono. The company took a loss of $120 million before the reported total was boosted by significant nonrecurring items.

Kemira was able to post a net profit, but it had significant nonrecurring charges during 2007, particularly write-offs totaling $64 million in the fourth quarter. Those write-offs covered Kemira's Chemidet carbonates business, water treatment operations in Denmark, hydrogen peroxide operations in the Netherlands, and its operations in the U.S.

Earnings at the Finnish company, down 46%, were hit by high year-end raw material and energy prices, strikes, and a delay in starting up its big new paper chemicals plant in Uruguay (C&EN, Feb. 25, page 20). The weakened U.S. dollar didn't help either, the company said in its results statement.

Clariant, which has had its share of financial woes since it was spun out of Hoechst in 1995, posted $90 million in earnings when nonrecurring charges were excluded. If the German company's loss from discontinued operations had been included, it would have shown net earnings of only $4.2 million, which is still a decided improvement from the loss of $65 million the company had to absorb in 2006.

Clariant CEO Jan Secher reported that "we have significantly improved our cash flow, although profitability was impacted by higher raw material and energy costs, as well as unfavorable currency movements."

Adverse currency exchange rates impacted several companies' 2007 results.

Sales at Belgium's Solvay, for example, were up almost 2% over 2006, but they would have been up 4% had currency remained at a constant rate, the company said. This was particularly true in its pharmaceuticals operations, Solvay said, where the weakness of the U.S. dollar knocked 3% off sales.

In Solvay's chemical and plastics sectors, in contrast, the company's more globally balanced operations were less affected by exchange rates: Chemical sales were up slightly, and plastics sales rose 4%.

On the other hand, currency exchange rates actually added 1% to sales at Ciba Specialty Chemicals, CEO Brendan Cummins reported. Product-wise, what helped the company were Asia-Pacific region sales, which grew by nearly 6% over those of 2006, whereas sales in the Americas declined by 3.2%. The net result is that the Swiss firm's business in Asia has caught up with that in the U.S. for the first time, Cummins said. In 2007, each region represented 27% of sales.

THE CHANGING EMPHASIS, Cummins said, "is a direct result of our participation in the automotive and construction industries. Asian countries are to get major attention from us; we will be accelerating our activities there."

BASF's sales were strong across all geographies, said Chairman Jürgen Hambrecht in reporting the German company's 2007 results. In Europe, for example, sales were up by 10%, driven by the catalysts and construction chemicals divisions, both of which have been boosted by acquisitions in the past two years. Compared with 2006, however, operating earnings from BASF's oil and gas businesses declined by 1.3%; rising oil and natural gas prices hit BASF, which is primarily a purchaser and distributor rather than a producer.

Sales in North America were up 13% in local currencies, Hambrecht said, but only 5% in euro terms, as the weak U.S. dollar bought fewer of BASF's home-currency euros when North American sales were entered into the company's books.

Echoing Ciba's Cummins, Hambrecht pointed out that BASF's sales in Asia-Pacific rose by more than 18%, with the greatest contribution made by the company's new catalysts division. Operating earnings in the region, at $1.14 billion, were more than four times higher than in the previous year, he added, because of strong earnings growth in chemicals and plastics, as well as significantly fewer special items.

Moreover, the company's business in Asia will continue to get high attention from its managers, Hambrecht said, noting that the company is conducting feasibility studies on two new projects in China. Hambrecht would not go into detail about those initiatives, but he added, "These projects are on the fast track; we will have the approval phase soon."

Swiss crop-protection chemical maker Syngenta benefited from what CEO Michael Mack called "the turning point for agricultural markets. Following several years in which demand has exceeded agricultural production, stocks of major commodities reached record low levels, prompting sharp rises in crop prices," he pointed out. That encouraged growers to increase investments in their crops, which translated into increased demand for crop-protection chemicals and premium seeds.

In Syngenta's agricultural chemicals operations, Mack said, sales were up in all regions. Latin America led the pace with 37% growth as the region recovered from sluggish demand caused by bad weather conditions.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter