Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Earnings Rise In Quarter

Agriculture, electronics, and increased pricing help firms dodge weak U.S. demand

by Melody Voith

May 19, 2008

| A version of this story appeared in

Volume 86, Issue 20

THE U.S. ECONOMY, which posted a paltry 0.6% increase in gross domestic product in the first quarter, is teetering on the brink of recession. But results from chemical companies show that the industry has not been weighed down by the sagging domestic market and is even taking advantage of current conditions to increase profits.

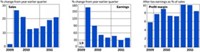

For 24 major U.S. companies, first-quarter earnings are up 25.9% to a total of $4.6 billion compared to first quarter 2007, when earnings growth was stagnant at 0.7%. Combined sales were up 17.7% in the quarter to more than $51 billion. Because earnings rose faster than sales, the companies' total profit margin increased to 9.0% from 8.4% in the year-earlier quarter.

The quarter's most profitable companies benefited from a surge in demand for agricultural chemicals due to high grain prices. The top two, Mosaic and Terra Industries, are pure-play agricultural suppliers. Soaring prices and high sales of nitrogen, phosphate, and potash multiplied supplier profits in advance of the spring planting.

Both Mosaic and Terra have been busy making hay while the sun shines. Mosaic Chief Executive Officer Jim Prokopanko took credit in an April 24 earnings press release for "effectively executing against the backdrop of an exceptional agricultural environment." The demand for agricultural commodities is being driven by factors as diverse as soaring food consumption in Asia, the diversion of corn for ethanol production, and drought in Australia, which is a key exporter of grain to Asia.

For companies that aren't enjoying the agricultural windfall, the key to long-term earnings growth is to do lots of business overseas and offer high-value products, according to Ed Friedman, senior economist at Moody's Economy.com, because the U.S. economy won't turn around anytime soon. "The most recent slowing is in nonresidential building markets," Friedman says. "Commercial construction has slowed practically to a halt." Added to the oversupply of housing, the construction weakness will hurt suppliers of paints, coatings, and other building materials.

The softening U.S. market took a 5.0% bite out of earnings at coatings maker PPG Industries. The company saw revenue growth of 41.3% due to its acquisition of rival SigmaKalon but was not able to translate that growth into earnings. Rohm and Haas' paint and coatings business saw domestic demand decline 4.0% compared with the prior-year period.

In contrast, Friedman points out that "big guys" like DuPont have already figured out the key strategies to deal with weak U.S. demand and high feedstock prices. "The earnings are in diversity—the global players benefit from strong growth elsewhere in the world." In addition, the past few years have given them enough time to make up for feedstock increases by changing focus. "Performance chemicals is the place to be. Folks who make monomer products are squeezed to death," Friedman says.

DuPont is reading the tea leaves on the U.S. economy. In a conference call with investors, DuPont economist Robert Fry reported that "we're seeing some slowing in some of the emerging markets, but growth rates remain very strong by both historical and global standards. Industrial production in China was up 17.8% year-over-year in March."

TOPPING THE LIST of earners at nearly $1.2 billion for the quarter, DuPont saw 62% of its total sales come from outside the U.S., with strongest growth in Asia Pacific and Europe.

DuPont also benefited from the agriculture boom, which caused its earnings to grow 21% in that sector. The company exploited demand from both the crop chemicals and seed angles. Looking ahead, though, agriculture and nutrition is also the business sector that will take the biggest hit from increased costs for ammonia and sulfur, according to the company.

For most companies the good earnings news of the first quarter was due not to huge volumes but to price increases and the considerable upside provided by the weakened dollar. In 2007, companies focused on expanding overseas markets for sales growth; this year's focus will be on managing for profitability.

Indeed, Bank of America Securities stock analyst Kevin W. McCarthy found that "demand for chemicals slowed in the first quarter versus fourth-quarter levels in all regions of the world." The fastest growth is still in Asia and Latin America, while European growth is slowing and North American "growth" is at "a recession-like level of -1.4%" according to McCarthy's report to investors.

At the start of the year, analysts projected chemical profits to suffer in the absence of accelerating volume growth and in the face of rising prices for energy and feedstocks. In fact, many profit margins were rescued by large price increases: Strong overseas demand meant that chemical companies could pass their increased costs on to their customers.

Executives took credit for raising prices in advance of—and to a greater degree than—the concurrent rise in feedstock and energy costs. The pricing tactic powered Eastman Chemical's performance chemicals segment to a 12% increase in revenue and helped to boost its overall profit margin to 6.8% this year from 6.2% in first-quarter 2007.

HIGHER PRICING helped rescue profits in the face of higher costs also at Celanese, Cytec Industries, Lubrizol, Chemtura, Ferro, Stepan, and FMC. In a conference call with analysts, FMC CEO William G. Walter credited higher pricing in both specialty and industrial chemicals segments for its 26.9% increase in earnings.

Firms that were constrained on pricing suffered the most from higher energy and feedstock costs. Cabot, which supplies carbon black on contract, saw earnings decrease by 45.2%. This negative result stands out compared with Cabot's more diversified peers. As CEO Patrick M. Prevost explained to investors, "Our performance during the quarter did not meet our expectations due to the continued rise of carbon black feedstock costs and weaker-than-anticipated results in our other businesses."

Dow Chemical also suffered from higher costs. Despite a 19.2% increase in sales, the company saw earnings erode by 3.3%. P. J. Juvekar, chemical stock analyst at Citigroup, cautioned investors in Dow that "our fiscal year 2008 estimate remains relatively flat, as we expect weaker commodity earnings to drag down results due to a significant rise in feedstock costs."

Rohm and Haas found raising prices fast enough to be an impossible challenge. "We were only able to pass on half of our price increases in the first quarter so our earnings were negatively impacted by $50 million," President Pierre Brondeau tells C&EN. "In the last four or five months there has been such an acceleration of costs we can't see a way to catch up. We cannot play the forecasting game anymore."

To avoid a further hit—first-quarter earnings decreased 9.5% from last year—Rohm and Haas is trying something that appears to be unique in the industry. On May 15, the company instituted an indexed raw material and energy surcharge for its specialty products. The index will be adjusted monthly as raw material costs for each product line changes. In theory, customers could see their costs decrease if raw material costs go down, but Rohm and Haas estimates the company could see $500 million in higher costs in 2008 versus 2007.

While all companies on the list had to deal with higher commodity and energy costs, many received a boost from making products with U.S. dollars and selling them for higher-value currencies such as the euro. The difference increased net sales for companies doing business overseas, and the currency exchange effect went straight to the bottom line. The increase for most companies was about 5%, though the effect ranged from 1% for Eastman to 7% at Celanese.

Industrial gas companies Air Products & Chemicals and Praxair fulfilled their promise of being safe havens from the economic cycle, as predicted by Lehman Brothers analyst Sergey Vasnetsov, who called the two stocks "recession-proof" in a March report to investors.

Air Products saw a 38.0% jump in earnings in the first quarter while Praxair enjoyed growth of 17.8%. Both companies' CEOs attributed the earnings gains to the demand for industrial and specialty gases for energy and environmental applications.

Demand from the electronics industry also benefited the two gas companies and other firms such as Ferro and Sigma-Aldrich that supply that market. Both Air Products and Praxair sell specialty materials and bulk gases for semiconductors, displays, and solar panels.

It's a clever trick to be both "recession-proof" and able to take advantage of cyclical upswings like this quarter's demand for electronic materials. To avoid the bad spots in the economy and profit from the boom areas, chemical firms needed to have strong overseas markets, be diversified while not reliant on commodity chemicals, and rapidly increase prices when necessary.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter