Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Hexion Seeks To End Huntsman Deal

Firm cites Huntsman's finances, banks' reluctance as reasons to renege on merger

by Melody Voith

June 23, 2008

| A version of this story appeared in

Volume 86, Issue 25

HEXION SPECIALTY Chemicals filed suit last week seeking to scuttle the blockbuster takeover of Huntsman Corp. that it announced last July. The deal was to combine the two companies into a $14 billion-per-year specialty chemicals powerhouse.

Controlled by the private equity firm Apollo Management, Hexion alleges that Huntsman's increased debt and lower than expected earnings mean that consummating the deal would render the combined company insolvent. Hexion CEO Craig O. Morrison states that the companies "cannot now support the debt load that was agreed to at the time." Hexion further claims that banks won't provide the financing necessary to complete the merger.

Huntsman says it intends to enforce all its rights under the merger agreement. "These actions appear to be a blatant attempt to deprive our shareholders of the benefits of the merger agreement that was agreed to nearly a year ago," CEO Peter R. Huntsman says.

At the time it was announced, the deal required Huntsman to rebuff a takeover offer made by Basell about a week earlier. Hexion said it would pay $2.00 per share more than Basell's offer and later raised its offer again, to $28.00 a share, or $10.6 billion including $4 billion in debt. Basell went on to acquire Lyondell Chemical.

The Hexion-Huntsman merger has been delayed several times for review by antitrust regulators in both the U.S. and Europe. Most recently, the European Union extended its inquiry deadline to July 30. The two companies have overlapping epoxy resins businesses.

The merger was one of numerous big deals announced during the private equity buyout boom of 2007. In the year since, however, the economic climate has worsened. Last month, Huntsman reported that its first-quarter earnings fell to $16.9 million from $57.4 million in the corresponding 2007 quarter.

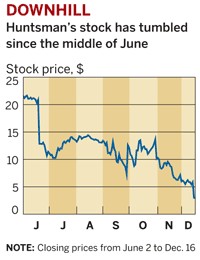

Hexion's announcement, made after the stock market closed on June 18, caused Huntsman's stock price to plummet. It ended the day at $20.86 per share and opened on June 19 at $12.37. Laurence Alexander, a stock analyst at Jefferies & Co., wrote in a report to investors that Hexion may end up agreeing to a lower purchase price to avoid prolonged litigation.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter