Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Roche's Reversal

Swiss drugmaker wants to bring long-independent Genentech into the fold

by Lisa M. Jarvis

July 28, 2008

| A version of this story appeared in

Volume 86, Issue 30

SWISS DRUG BEHEMOTH Roche made a play for full control of Genentech last week, going back on an earlier pledge to leave the biotech company, in which Roche owns a 56% stake, as an independent company. By acquiring the remainder of Genentech, Roche would become the 7th largest drug company in the U.S. based on market share.

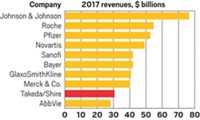

The $89.00-per-share offer, worth $43.7 billion, represents a 9% premium over the closing price of Genentech's stock on July 18. Analysts think Roche has made a lowball bid that Genentech's shareholders are unlikely to accept. Steve Harr, a drug stock analyst at Morgan Stanley, believes Roche will need to raise its offer by 15 to 20% to secure the deal. If the acquisition succeeds, Roche's global sales would jump by almost 30% to some $53 billion per year.

Genentech is likely stuck with Roche because of a clause in their long-term alliance. According to the biotech firm's most recent proxy statement, if the companies can't come to terms on a merger price, Roche can still acquire the company at a price determined by two investment banks.

The surprise move is a reversal in strategy for Roche, which paid $2.1 billion for its majority stake in Genentech in 1990. At the time, Roche agreed to let the biotech company operate independently to maintain its "enterprising spirit." The Swiss firm forged a similar relationship with Japan's Chugai Pharmaceutical in 2001. Roche has since benefited from selling its partners' products outside the U.S. and Japan.

Indeed, Genentech has grown by leaps and bounds since Roche's initial investment. Its sales mushroomed from about $400 million in 1990 to $11.7 billion last year, thanks to a steady stream of blockbuster cancer drugs. In fact, Genentech now has more staff in South San Francisco than Roche does at its Basel, Switzerland, headquarters.

But productivity at Genentech has dropped in recent years; the company hasn't launched a new product since 2006 and has been relying on new uses for old drugs to drive growth. Roche believes sharing intellectual property, technology, and partnerships will encourage innovation at both companies.

Roche also expects the combined company to enable cost-cutting of up to $850 million per year. R&D at its Palo Alto, Calif., site will eventually end, with virology research shifted to South San Francisco and immunology to Nutley, N.J. Roche also intends to weed through the companies' pipelines to eliminate overlaps. Meanwhile, capacity will be optimized—the first step will be shuttering manufacturing in Nutley—capital expenditures will be trimmed, and the combined company will leverage its scale when negotiating with partners.

Roche Chairman Franz B. Humer told reporters at a press conference in Basel that he struggled with the decision to bring Genentech into the fold for weeks, knowing that it would be seen as a turn in strategy. However, Humer said he saw that "we could create substantial synergies by combining those functions where critical mass and cost are decisive factors in the context of global competition in the pharmaceutical industry."

Despite the shift, Roche wants to maintain the "unique research culture" at Genentech, which is the number two biotech company after Amgen and one of the industry's pioneers. The company was formed over beers at a pub in 1976 by Herbert Boyer, a professor of biochemistry at the University of California, San Francisco, who helped invent genetic engineering, and venture capitalist Robert A. Swanson. That casual but science-driven culture has persisted at the firm.

Humer said Genentech's South San Francisco site will operate as an independent research and early development center and also serve as the headquarters of combined U.S. commercial operations. Meanwhile, Roche's five disease biology areas will continue to operate fairly autonomously.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter