Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Merger Activity Keeping Up In '08

Billion-dollar chemical acquisitions continue, but the number of deals is down

by Melody Voith

August 25, 2008

| A version of this story appeared in

Volume 86, Issue 34

THE CHEMICAL INDUSTRY has not seen a significant slowdown in merger activity this year despite weakness in the global credit markets. On the first business day of 2008, AkzoNobel kicked things off by completing its $16.3 billion takeover of ICI. The deal was first announced in June 2007, a record year for large mergers. The deal is also, by far, the largest one finalized in the first half of the year.

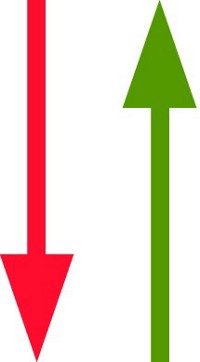

That one big-ticket item pushed the total value of completed deals to $36 billion by the end of June, according to Young & Partners, an investment banking firm that provides merger, acquisition, divestiture, and other services to chemical and life sciences firms. The figure means that the value of mergers and acquisitions (M&A) may be on sufficient pace to break last year's record of $55 billion. In fact, the first half of this year saw seven completed deals worth more than $1 billion; 11 such megadeals were completed in all of 2007.

Interestingly, no large deals were announced in the second quarter of 2008. But two big deals announced in the first quarter—Incitec Pivot's purchase of Dyno Nobel for $1.9 billion and Tata Chemicals $1 billion buyout of General Chemical Industrial Products—were completed in the period.

From there, industry consolidation seemed to gain momentum again in the summer. In July, two powerhouse mergers were announced: Dow Chemical's agreement to acquire Rohm and Haas for $18.8 billion and Ashland's deal to pay $3.3 billion for Hercules.

Even before the two megamergers were news, it was clear that the chemical industry would not turn away from a good deal in spite of gloomy economic conditions, according to Saverio Fato, global chemicals industry leader at PricewaterhouseCoopers (PWC), a tax and advisory services firm. "There was already the message that companies were trying to use M&A to drive a step change in their business in response to raw material volatility and to get access to end user markets."

Deal value is not the only story in chemical industry M&A activity, however. The number of completed buyouts worth more than $25 million was 34 in the first half of 2008, a rate that when annualized falls well short of the 81 completed in 2007. The difference may be due in part to fewer investments by private equity buyers; they were responsible for 18% of deals in the first half compared with 28% in the first-half of 2007. Private buyers have been less active since the second half of 2007, when access to credit began to tighten, says Peter Young, president of Young & Partners.

ACCORDING TO PWC's Bruce Chalmers, director of transaction services and coauthor with Fato of the company's "Chemical Compounds" report, strategic M&A activity happens on its own schedule and is affected more by the conditions of the companies involved than by the overall economic outlook. "The well-positioned strategic players have plans in place and know who they want to buy," Chalmers says. "They are waiting for good timing, based on a good financial position and availability of the target company. We've seen companies wait for years or try several times before they get what they want."

According to Dow, its union with Rohm and Haas will form the world's leading specialty chemical and advanced materials company. Now deal watchers are turning their attention to BASF and DuPont; both companies have used recent earnings reports to reaffirm their aggressive goals for growth.

In a conference call with investors, DuPont Chief Executive Officer Charles O. Holliday Jr. said his company's strong cash position in this time of weak credit markets would allow it to find good deals for its agriculture and nutrition and its safety and protection businesses. He also said DuPont would seek opportunities in developing regions such as China and India, but that it would not seek out "some big, massive acquisition."

Young says an increasing proportion of takeover targets are in Asia and the Middle East. Young & Partners' analysis divides the globe into three segments: the U.S., Europe, and the rest of the world/Asia. In the first half of 2008—and for the first time ever—the ROW/Asia category led in the share of deals done at 41%. Europe came in second, with 35%, leaving 24% of targets in the U.S.

Chemical deals are increasingly happening across international borders, one sign of the globalization of the industry. In the first half of 2008, 68% of deals were cross-border, a slight uptick from last year's 63%. Young says the chemical industry in non-Western markets has grown in scale and maturity. "M&A activity in a region starts when the market reaches a certain level of development; it has to be past the start-up stage. Now the growth in demand is shifting to Asia and the Middle East," he says.

PWC's Fato says the shaky economy may put a damper on mega mergers during the rest of 2008, but he suspects that buyout activity will likely continue at a brisk pace. "There is no relief in sight for volatility," he says. "Chemical companies will continue to reposition themselves to remain competitive with bolt-on or niche acquisitions. We're in uncertain times, but there is still a sense of urgency."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter