Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Solar Suppliers Get Busy

Growth of photovoltaic market drives demand for raw materials

by Melody Voith

September 8, 2008

| A version of this story appeared in

Volume 86, Issue 36

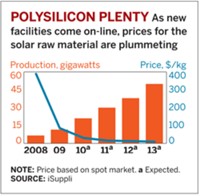

CHEMICAL FIRMS that supply raw materials to the solar industry are abuzz with plans to satisfy steeply rising demand. As a result, photovoltaic manufacturers looking to expand can expect fewer supply bottlenecks, better products, and lower prices for critical solar components.

DuPont will more than double capacity for its Tedlar films, which are used in photovoltaic backsheets, starting in late 2009. The polyvinyl fluoride films provide resistance to weather, ultraviolet radiation, and moisture for both traditional polycrystalline silicon and newer thin-film solar cells.

"The photovoltaic industry is in the midst of a substantial surge globally," says Cynthia C. Green, vice president of DuPont Fluoroproducts. DuPont anticipates that the industry's 50% growth rate will boost its solar product sales to more than $1 billion annually within the next five years.

The rise in demand is also sparking innovations to decrease the cost per watt of solar electricity. Dow Corning just announced the development of a clear silicone encapsulant that it claims increases solar-cell production rates compared with the ethyl vinyl acetate used in the current manufacturing process.

The desire to lock in long-term raw material supplies at reasonable prices is behind new agreements between Asian photovoltaic manufacturers and their polysilicon suppliers. Suntech Power Holdings has signed up for seven years' worth of silicon from DC Chemical for $750 million. And LDK Solar inked a seven-year contract to supply enough silicon wafers to generate 440 MW of electricity to Hyundai Heavy Industries.

Likewise, photovoltaic manufacturers are eager to ensure industrial gas supplies for new production lines. Gas manufacturer Linde Nippon Sanso has signed contracts with two European manufacturers of thin-film solar cells, Inventux Technologies and T-Solar, to provide on-site production of bulk nitrogen, oxygen, hydrogen, and silane. Air Products & Chemicals will supply gases to Schott Solar's new facility in Albuquerque, N.M.

According to Mark Thirsk of Linx Consulting, an adviser to suppliers of electronic materials, chemical firms are smart to plan for growth but need to be aware that market conditions could change. "We are busy building all this capacity on the assumption that subsidies will keep the market growing or that industry momentum will make cost a wash between grid or solar power," he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter