Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Firms Slash Employment

Moves come in response to precipitous drop in demand

by Melody Voith

December 15, 2008

| A version of this story appeared in

Volume 86, Issue 50

SEVERAL MANUFACTURERS of chemicals and related goods are announcing layoffs as they work to reduce production and match a dramatic decrease in demand that began in late October.

Dow Chemical will eliminate 5,000 jobs, roughly 11% of its workforce, as a result of the rapidly deteriorating economy. The company says the move accelerates an ongoing program to streamline operations.

Dow plans to eliminate 700 jobs by closing 20 facilities in "high cost" locations in the U.S. and Europe (see page 16). Approximately 2,000 jobs will be trimmed through the sale of several businesses. The remaining layoffs will be in centralized business services. In addition, Dow will decrease production by temporarily idling 180 plants and will reduce its contractor workforce by 6,000, or about 30%.

Overall, Dow expects the reductions to save the company $700 million in annual operating costs by 2010. The savings are in addition to the $800 million in expected cost synergies from the acquisition of Rohm and Haas, which is scheduled to be complete early next year.

Dow's announcement follows the news that DuPont will reduce its workforce by 2,500, primarily in businesses that support the motor vehicle and construction industries (C&EN, Dec. 8, page 18). The weak automotive market is also having a negative effect on performance plastics supplier A. Schulman. The firm has revealed restructuring plans that will cut 131 positions from its employment rolls and reduce North American capacity by 50%.

Although the focus of economists has been on the weak housing and auto markets, Dow CEO Andrew N. Liveris says the production cuts at his firm were spurred by an across-the-board deterioration in demand and that the entire industrial supply chain outside of food, health, and agriculture is in a recession.

Indeed, falling consumer confidence has caused electronics manufacturers to slow production. For example, consumer electronics giant Sony announced that it will reduce manufacturing sites by 10% and cut headcount by 8,000 positions, or 5% of its workforce.

The slowdown has also forced cost-cutting measures at companies that supply electronics makers. Industrial gas maker Praxair says it has begun to reduce its workforce by about 1,600 positions in the metals, chemicals, and electronics segments. The firm says it has initiated closure of underperforming product lines and businesses.

Corning, which supplies glass to the liquid-crystal display market, will have to work off excess supply and is looking to reduce capacity in 2009 with an unspecified number of job cuts. And materials supplier 3M says it cut nearly 1,800 positions in the U.S., Western Europe, and Japan in the fourth quarter in response to an expected 3–7% decline in sales volume next year.

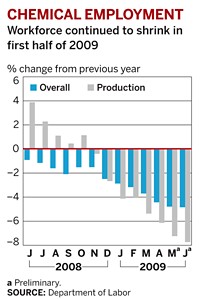

The chemical industry layoffs are contributing to mounting unemployment in the U.S. manufacturing sector. The Department of Labor reports that U.S. unemployment rose by 0.2% to 6.7% in November compared with October, the highest level in 15 years. Nonfarm payroll fell sharply by 533,000 jobs, of which 85,000 came from manufacturing.

According to the American Chemistry Council, the U.S. chemical industry's main trade organization, the industry lost 1,000 jobs in November. T. Kevin Swift, ACC's chief economist, projects that employment in the U.S. chemical industry will decline 3% in 2009.

Richard O'Reilly, an equity investment officer at Standard & Poor's, agrees with Swift's estimates. "3M is considered an industrial bellwether," he says. "When they say they expect negative organic growth in 2009, that's a wow."

In addition to cutting jobs and chemical production, chemical makers are slashing capital spending to preserve cash flow. DuPont, for example, will reduce its 2009 spending by between $200 million and $400 million, and Dow plans to spend $600 million less than it did in 2008. Carbon black maker Cabot says it will cut $50 million from its 2009 capital budget.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter