Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Europe Hangs On

Suppliers to durable goods markets got slammed in late 2008, while those tied to consumable goods fared better

by Patricia L. Short

March 16, 2009

| A version of this story appeared in

Volume 87, Issue 11

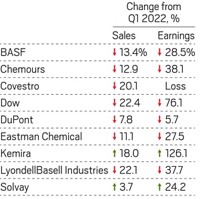

ALTHOUGH SALES performance was mixed for Europe's major chemical companies in 2008, profit declines were widespread across the industry. Among the factors in play were a collapse in demand from industrial customers and currency-exchange effects.

In their end-of-year reports, nearly all companies describe the same basic scenario: three good quarters followed by a dramatic downturn in the fourth (C&EN, March 2, page 10). That was particularly true for companies that supply chemicals to industrial users and manufacturers of durable goods such as cars and construction materials.

"In the fourth quarter, demand from key customer industries, such as construction, automotive, electronics, and textiles fell massively worldwide." reported Jürgen Hambrecht, chairman of BASF, at his company's annual results press conference late last month. Stronger businesses, he said, included crop protection, nutrition, cosmetics, and hygiene.

In Europe as in the U.S., the auto industry has been one of the major victims of the financial crisis. The European truck industry, for example, suffered a startling 99% drop in fourth-quarter demand, which in turn had a severe impact on chemical demand, Hambrecht said at the conference.

And at Bayer's press conference the following week, Chairman Werner Wenning cited a slump in demand from the auto industry, among other industrial markets his company supplies, as hitting its MaterialScience polymer business particularly hard.

"From an operational standpoint, 2008 was the most successful year in Bayer's long history," Wenning reported. "We would be even more pleased with what we achieved last year if there had not been such a dramatic decline in business at MaterialScience in the fourth quarter." In the last two months of the year, he explained, "volumes in this subgroup fell by nearly 30%, and capacity utilization also declined significantly. We have not seen anything like this before."

In the fourth quarter, the MaterialScience unit posted profits before taxes, interest, depreciation, and amortization of $80 million. After depreciation and amortization, however, the unit showed a fourth-quarter loss of $127 million.

Moreover, Wenning conceded, Bayer is braced for an even worse 2009 first quarter for MaterialScience. However, he brushed off any thoughts of selling it. MaterialScience, Wenning said, "is a part of our portfolio. In 2006 and 2007, it achieved record results. It has an excellent portfolio and volumes worldwide—it is one of the best polymer businesses worldwide. We are used to thinking about long-term sustainability."

Bayer's other two groups, HealthCare and CropScience, did particularly well, Wenning said. The two sides of the coin at Bayer illustrate a trend that developed across the European industry in 2008: Companies serving life sciences and household consumables markets continued to show resilience.

How long that resilience keeps up remains to be seen. One chemical consultant notes that while fragrances used in inexpensive cosmetics and toiletries are still doing well in Europe, luxury items such as fine fragrances are feeling the pinch. Consumer-product marketers, in turn, are becoming more cautious about their outlook and their purchase of supplies.

Nonetheless, Givaudan's flavors and fragrances operations enabled it to increase its profits for the year. Similarly, nutrition and pharmaceutical-related businesses helped DSM achieve strong sales and profit growth in 2008.

Givaudan's sales performance, however, reflected the impact of currency exchange on Swiss companies, whose home currency, the Swiss franc, has been particularly strong compared with other currencies. At Givaudan, sales for the year were up 6.7% in local currencies, but those local currencies bought fewer Swiss francs; hence Givaudan's books showed a sales decline of 1.1% for the year.

AT COMPATRIOT FIRMS Ciba and Clariant, the situation is similar. At Ciba, sales were down 3.0% in local currencies but down a sharp 9.3% in Swiss francs. And at Clariant, sales were up 1% in local currencies, but the official accounts showed a decline of 5.4% from 2007.

Bucking the currency trend for Swiss companies was Syngenta, which reports its results in U.S. dollars. At Syngenta, sales were up by 25.8%, primarily because of growth in sales volumes, but also from price increases.

The company also is blessed by being in one of 2008's strongest performing sectors: crop protection and seeds. According to Michael Mack, chief executive officer, "2008 was an extraordinary year for agriculture in which acreage expanded and technology adoption accelerated." Syngenta was able to take full advantage of the favorable market picture, he said, because of the breadth of its portfolio and its global presence.

"We achieved particularly strong growth in emerging markets, which now account for over a third of our sales," Mack added.

Of the major chemical companies that have reported 2008 results so far, Rhodia enjoyed the strongest improvement in net profits. Not so long ago, the French firm seemed inexorably linked with the phrase "financially beleaguered." But in 2008, it was able to pull off a nearly 60% improvement in net profit on continuing operations.

And that improvement came despite a net loss of $31 million for the fourth quarter—a reflection of what the company called an unprecedented drop in demand. "Against this backdrop, we took swift and efficient actions to preserve cash and reduce costs," CEO Jean-Pierre Clamadieu noted. It's a course of action that no doubt will be seen more and more this year.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter