Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Japanese Firms Post Huge Losses

Weak demand and inventory write-offs hurt companies

by Jean-François Tremblay

May 18, 2009

| A version of this story appeared in

Volume 87, Issue 20

REELING FROM the worldwide economic slowdown, several of Japan's largest chemical companies posted huge losses—their biggest ever—for the fiscal year that ended on March 31.

Companies blamed their weak financial results mostly on slack demand in Japan and abroad, depreciations in the value of their inventories of feedstock and finished materials, and downward adjustments in the value of their facilities.

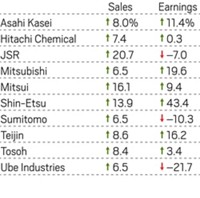

Yet the pain was unevenly felt. Firms with high exposure to the Japanese petrochemical market generally fared worse than others. Mitsui Chemicals, for example, posted a net loss after exceptional items of nearly $1 billion. By contrast, perennial profit leader Shin-Etsu Chemical managed to navigate the turmoil of the global economic crisis and return a net profit of almost $1.6 billion, only about 16% lower than a year ago.

Masami Sawato, director of chemical sector research at Credit Suisse Securities, in Tokyo, says things are likely to improve for Japan's major chemical producers. The worst period, he believes, was the first quarter of 2009, the last quarter of the fiscal year.

"At the end of the fiscal year, Japanese firms had to recalculate the value of their raw materials inventory," Sawato says. "The value of their naphtha feedstock came down more than 40% in the second half of the fiscal year, and some of that lower priced inventory was still actually there on March 31."

Japanese firms also found themselves hammered by weak demand, both domestically and abroad. Between October and December 2008, Japan's gross domestic product shrank by 12% on an annualized basis. And according to a Bloomberg survey of economists, the decline in the Japanese economy may have been even more pronounced—as much as 16%—in the first three months of 2009.

Meanwhile, demand from China weakened in recent months as its export sector suffered from poor sales to the U.S. and other major markets. Although Japan's chemical companies sell most of their output domestically, Sawato explains that China has been an important buyer of chemicals in recent years. "Chinese demand is the major support," he says.

In their financial reports, several Japanese firms revealed special losses caused by asset markdowns. Write-offs at Sumitomo Chemical, a producer of basic chemicals, plastics, electronic materials, and agrochemicals, accounted for more than one-third of the company's record $597 million net loss. Asahi Kasei, a producer of plastics, fibers, residential homes, and engineering materials, remained profitable but posted a $60 million special loss on the sale of plants and equipment.

Sawato expects Japanese companies to close more plants in the current fiscal year. The closures could even include ethylene crackers that produce the basic raw materials for a wide range of chemicals. "The first step will be the scrapping of unprofitable derivative products, and then there will be cuts in ethylene capacity," he predicts.

Shin-Etsu was vague in explaining how it managed to maintain its healthy profitability. The world's largest producer of polyvinyl chloride and silicon wafers, the firm merely said it "conducted aggressive sales activities aimed at its wide range of worldwide customers" while carrying out "rationalization and streamlining of its businesses."

Unlike other Japanese chemical firms that are predicting an improvement in the business climate in the current year, Shin-Etsu says "the severe downturn in the world economy is getting more serious." In an unusual breach from tradition, Shin-Etsu did not provide an earnings forecast for the current fiscal year.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter