Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Sales Are Scarce In First Quarter

Chemical firms cling to shrinking profits, look for glimmer of an upturn

by Melody Voith

May 18, 2009

| A version of this story appeared in

Volume 87, Issue 20

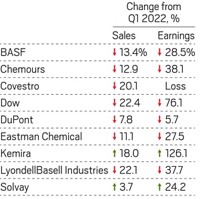

THE ONLY GOOD THING chemical industry insiders can say about the first quarter is that it is in the rearview mirror. Overall revenues for the companies surveyed by C&EN sank 37.8% compared with the year-ago quarter. Earnings plummeted 68.1%, a bigger year-over-year drop than the 60.3% seen in the fourth quarter of 2008.

And the hard times are not over yet. In earnings announcements, chief executives tried to project when the recession will bottom out. They are able to point to signs that the economic decline is slowing, but few see growth in 2009. The CEOs promised to continue to shrink costs, cut capital spending, pay down debt, and build up cash reserves.

All the companies surveyed by C&EN saw sales decline compared with last year's first quarter. Nine companies had a greater than 80% drop in earnings: Cabot, Celanese, Cytec Industries, Dow Chemical, Eastman Chemical, W.R. Grace, Mosaic, PPG Industries, and Rockwood Holdings. In contrast FMC, Lubrizol, Praxair, and Sigma-Aldrich saw only slight decreases. Stepan bucked the trend entirely and posted increased earnings.

For some, the quarter brought more than just decimated results. Specialty chemical firm Chemtura, previously part of the C&EN earnings survey, filed for bankruptcy on March 18. LyondellBasell Industries and Tronox also filed for bankruptcy during the quarter. The three firms were crippled by large debt obligations and inadequate cash flow.

Two other chemical firms once in the survey have been acquired. Hercules is now part of Ashland, and Dow's star-crossed purchase of Rohm and Haas was finally completed in April.

Even without the addition of Rohm and Haas revenues, Dow surprised analysts by making a profit in the first quarter—$109 million, or 12 cents per share, excluding nonrecurring items. J.P. Morgan chemicals analyst Jeffrey J. Zekauskas had anticipated a loss of 5 cents per share and reported a consensus expectation of a 12-cent-per-share loss. In his report to clients, Zekauskas attributed the difference to above-forecast profits in Dow's performance plastics business.

Still, it was a difficult quarter for the firm, the number one U.S. chemical maker. Dow reported that sales volumes decreased 19%, and prices were down 20% compared with the year-ago period. According to CEO Andrew N. Liveris, Dow has zeroed in on the few levers under management control. "Our positive earnings in this recessionary environment were the direct result of our rapid actions to reduce costs and tightly manage operations," he wrote in an earnings release.

At this time a year ago, chemical industry leaders struggled to raise prices to keep up with increasing energy and feedstock costs. This quarter brought the opposite problem: Dow reported that costs were down 49%, putting downward pressure on prices in its basic chemicals business.

The new, larger Dow is now struggling with a big debt load as a result of the Rohm and Haas purchase. In late April, the ratings agencies Moody's and Standard & Poor's lowered ratings on Dow's senior unsecured debt to one notch above speculative grade. The ratings firms were concerned about Dow's debt obligations, especially its $9.2 billion one-year bridge loan.

During Dow's investor conference call, Liveris said the company is focused on strengthening its balance sheet to protect its investment-grade credit rating. He listed possible divestitures that would help close the debt gap. In addition to the previously announced sale of Rohm and Haas's salt business, Dow continues to look for partners for its olefins and derivatives businesses and is seeking buyers for its calcium chloride, rubber, and latex operations. Liveris said Dow would even be willing to sell or spin off Dow AgroSciences, although he admitted it is a strategic asset for the company.

Kyle Loughlin, credit analyst at Standard & Poor's, notes that the credit markets have improved noticeably in the past few weeks, meaning that Dow can borrow more and likely avoid having to sell the agriculture business. "All of a sudden, you're seeing some successful companies getting debt at good rates," he says. Loughlin anticipates that Dow's recent stock and bond offerings will receive a positive reception.

At DuPont, the focus in the first quarter was on generating cash from operations. Under new CEO Ellen J. Kullman, the company more than doubled its cash pile compared with last year's first quarter. DuPont's quarterly earnings of $489 million were down 59.1% compared with last year. They would have been worse but for strong results in the agriculture business, healthy pharmaceutical royalties, and cuts to operational costs and capital spending.

"We are not counting on material improvements in economic conditions in the near term."

DuPont continues to cut costs. Kullman vowed to increase an already-planned 2009 fixed-cost reduction to $1 billion from $730 million. In a May 7 press release, the company said it would continue slimming down in reaction to "fundamental marketplace shifts and demand declines—particularly in motor vehicle, construction, and industrial markets." The cuts include elimination of approximately 2,000 more jobs at the company. Last December, DuPont announced 2,500 layoffs.

THE WEAK DEMAND seen by DuPont was also evident at Eastman, where coatings, adhesives, and performance chemical businesses experienced deep sales declines. Eastman barely managed to stay in the black, with earnings of $18 million compared with $117 million in last year's first quarter.

One firm proved that it is possible to do well even when demand is declining. Stepan boosted earnings to $12 million from $10 million in the year-ago quarter. The company saw volumes decline in its surfactant and polymer segments and took a 7% hit on currency translation due to the strong dollar. But it was able to raise prices by 3% even while raw material costs declined. In addition, because Stepan sells most of its surfactants into the consumer products market rather than industrial ones, it benefited from largely stable demand for the quarter.

Stepan was also successful in cutting operating costs, especially administrative expenses, and reducing working capital. It saved on interest expenses by paying down $10.9 million in debt.

At Lubrizol, aggressive cost-cutting kept first-quarter earnings to a relatively small 6.1% dip. But unlike Stepan, whose R&D budget increased in the first quarter, Lubrizol cut its spending on R&D and testing by $5.1 million—more than 9%.

Lubrizol is not alone in looking to R&D for cuts. Dow shaved $39 million, or 11.8%, from R&D, and Eastman cut $8 million, or 19%, compared with first-quarter 2008. DuPont, however, left its R&D budget mostly intact, trimming only $7 million, or 2.1%.

DuPont's Kullman stressed the importance of research in her conference call with analysts. "A continued focus on our science will enable our performance during these volatile times," she said. "We launched 500 new products in the first quarter, a dramatic increase over the first quarter of 2008, when we launched 297." But she also sounded a sober note, warning that "we now expect larger volume contractions in 2009 than what we expected just three months ago."

In contrast, at Celanese, where earnings sank 93.3% compared with the prior-year quarter, executives sounded mildly optimistic in their earnings announcement. Despite the lousy market in materials for automobiles and electronics, the firm said that global demand for its products improved month over month in the quarter and that it saw signs that the destocking period was ending.

In fact, U.S. businesses decreased inventories by $103.7 billion in the first quarter, more than four times the decrease in the fourth quarter of 2008, according to early U.S. gross domestic product estimates from the Commerce Department's Bureau of Economic Analysis (BEA). Economists, including Federal Reserve Board Chairman Ben S. Bernanke, say the resulting lower inventories should provide some support to production later this year.

The BEA statistics also show a turn in consumer spending. Downbeat consumers cut back on spending by 3.8% in the third quarter of 2008 and by 4.3% in the fourth quarter. In the first quarter of this year, however, consumer spending increased by 2.2%.

Positive signs for two large chemical end markets—housing and autos—are also emerging. A recent National Association of Home Builders survey showed that home builder confidence posted its biggest gain in five years. And consulting firm J.D. Power & Associates says new vehicle sales are starting to show signs of stability. The company anticipates a modest increase in the second half of the year.

Lubrizol has joined in the change of attitude and raised its 2009 earnings outlook to $3.83 to $4.23 per share, up from the $3.48 to $3.88 the company projected in early February. Still, most chemical executives sound more like Liveris. While acknowledging that "there are some signs that the pace of global economic decline is moderating," he cautioned that "we are not counting on material improvements in economic conditions in the near term."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter