Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Sobering BIO

The financial crisis meant fewer attendees at the biotech industry's annual meeting

by Lisa M. Jarvis

May 25, 2009

| A version of this story appeared in

Volume 87, Issue 21

THE PAST YEAR has been tough for biotech companies, and the Biotechnology Industry Organization's annual meeting, held last week in Atlanta, reflected the challenging times. Attendance was down by 30 to 40% from the 20,000-plus people who flocked to San Diego for last year's event. One of the surest signs that the turnout made for a more subdued event was the shorter lines at Starbucks than in previous years, several conference-goers pointed out.

The biotech industry finds itself caught in "the perfect storm of economic meltdown, political volatility, and scientific challenge," James C. Greenwood, CEO of the trade association, told conference attendees.

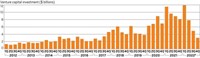

In the wake of the credit crunch, venture capital money has shifted to steadier markets, and biotech firms are having trouble raising capital. According to BIO, 180 companies, or 45% of all publicly traded biotech firms, have less than a year of cash left on their balance sheets. As a result, at least 25 public companies have delayed or cut research programs since the beginning of the year, by BIO's count. And in the past year and a half, some 125 biotech companies have laid off nearly 10,000 employees.

Biotech firms have been particularly affected by the new risk-averse investing environment, explained Glen Giovannetti, global biotechnology leader at consulting firm Ernst & Young. Biotech has always been a gamble, he noted, but venture capitalists are now worried that they will no longer have a clear exit strategy on an investment. Indeed, there hasn't been a single initial public offering of stock this year, and only one biotech firm went public in 2008, according to BIO.

Although the late-stage new-drug pipeline does not look substantially different overall after the cutbacks, many people at the conference were concerned about what the economic fallout may mean for the industry's ability to support new science. "The real fear is that the guy with the innovative idea isn't going to find the money to support it or get the visibility to attract big pharma," noted Michael D. Kowolenko, senior vice president of Wyeth's biotech unit. The industry won't feel the impact of the gap in financing until five or more years from now, he added.

There is an upside to the financing crunch for deep-pocketed big pharma and biotech players hoping to fill their pipelines or add new technology: Assets can be picked up on the cheap. As Giovannetti observed, the partnering sessions were easily the most active area of the BIO conference.

But although big companies are clearly on the lookout for favorable deals, some caution against buying drug candidates or businesses that aren't the best fit. "Just because there's a sale going on, it doesn't mean you have to buy the sweater," Amgen Chief Medical Officer Sean Harper said.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter