Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Energy

Buying A Sustainable Economy

The record recovery act energy spending may trigger a new clean-energy industry

by Jeff Johnson

July 27, 2009

| A version of this story appeared in

Volume 87, Issue 30

Almost daily, new funding press releases roll out from the Obama Administration—$2.4 billion for the “next generation” of electric vehicles, $3.9 billion for “smart grid” technologies, $467 million for geothermal and solar projects, $3.2 billion in local energy efficiency projects, and on and on. This stands in stark contrast to a year ago, when announcements were magnitudes lower in dollars and months apart in time.

The difference: President Barack Obama is trying to combat a recession and job losses with a huge ramp-up in green-energy spending. His goal is to generate new jobs while simultaneously transforming the energy marketplace, heading off global warming, and building a U.S. clean-energy economy and industry.

His energy spending marks a sharp departure from the past 25 years, both in quantity and focus. Indeed, the most similar jump in federal energy spending was a short-lived burst during the energy crisis of the 1970s, when then-president Jimmy Carter tried to develop an infrastructure to replace the supply of imported oil that was shut off by the Arab oil embargo.

Carter was motivated by high oil and gas prices, but when prices fell in the 1980s, then-president Ronald Reagan declared the Carter policies a failure and killed the projects. Reagan also cut federal energy funding and limited it to support for basic energy research and development, which has pretty much been the case ever since. Obama, however, is changing that.

In mid-February, when Obama signed the American Recovery & Reinvestment Act, the Department of Energy found itself with some $38.7 billion in new funds and as much as $60 billion in potential loan authority to support new clean-energy investments. Although the $38.7 billion is but a small part of the overall $787 billion stimulus package, it is a big deal to DOE.

The recovery act money comes on top of DOE’s regular budget of about $26 billion per year, but some $16 billion of that goes to nonenergy programs—care and maintenance of nuclear weapons and cleanup of former weapons facilities. Hence the recovery act dollars are more than three times higher than DOE’s energy-related budget, and the dollars must enter the economy with great haste—the act requires that they be entirely allocated, if not spent, by Sept. 30, 2010.

“This is not just an energy act,” says Skila Harris, one of eight DOE recovery team members in the energy secretary’s office. DOE has 200 to 300 staff working on recovery act issues.

“The act is designed to stimulate the economy and specifically to encourage employment with two powerful strains. One is to get the economy going by hiring people, and, two, we want to create a legacy infrastructure of projects that will last and add value to this economy and society for years to come. This is not like energy legislation of the past,” Harris says.

DOE spokeswoman Jen Stutsman adds, “The act lays the foundation for a clean-energy economy going forward.” She stresses that the federal money is set aside for capital investments and government incentives with the goal of catalyzing private-sector investors to put in their share and “get them off the sidelines” during these hard times.

To this end, the act provides $6 billion in loan guarantees. Emily Slota, another recovery team member, estimates that this level of funding will support $45 billion to $60 billion in private loans for clean-energy projects.

Of the $38.7 billion, some $23 billion is in new funding opportunities, such as $3.4 billion for carbon capture and sequestration demonstration projects and $2.0 billion to expand manufacturing for battery makers (see page 24). This latter amount includes $1 billion for DOE’s share of the FutureGen coal gasification and carbon sequestration project in Illinois (C&EN, June 22, page 28). Some $4.5 billion is aimed at supporting projects that expand and modernize the electricity grid, which is key to building more wind and solar projects.

Renewable energy demonstration and deployment projects get some $1.5 billion, earmarked for biomass ($800 million), geothermal ($400 million), solar ($117 million), and smaller amounts for wind and fuel cells. Industrial efficiency and combined heat and power projects, which are of direct importance to chemical companies, receive $219 million.

Half of the $23 billion supports state and local weatherization and efficiency projects, rather than directly encouraging energy technology capital spending.

Science gets a boost through a $1.6 billion allocation, again mostly for capital projects, but this amount also includes $277 million for the “energy frontiers” program, which aims to overcome “roadblocks in new energy technologies,” according to DOE. Similarly, the new Advanced Research Projects Agency—Energy program will receive some $400 million to support development of “immature, high-risk technologies” that DOE believes have high potential. This funding, however, is primarily for research and capital spending projects at DOE and university facilities, not for traditional basic research, which DOE has supported in the past.

Despite the size of the recovery act spending, several industrial economists and engineers say it is insufficient to build an infrastructure and develop a new clean technology industry that is needed to avoid the impact of climate change. Spending levels, they say, should be commensurate with the potential damage due to climate change.

The recovery act funds continue a plan that goes back to Obama’s presidential campaign and his first address to Congress last February, in which he elevated the importance of clean energy and a sustainable energy policy. Along with underscoring the importance of independence from foreign oil, Obama tied clean energy to jobs and the creation of technologies to end carbon dioxide emissions and their contribution to climate change.

“It begins with energy. We know the country that harnesses the power of clean, renewable energy will lead the 21st century,” Obama told Congress.

“And yet, it is China that has launched the largest effort in history to make their economy energy efficient. We invented solar technology, but we’ve fallen behind countries like Germany and Japan in producing it. New plug-in hybrids roll off our assembly lines, but they will run on batteries made in Korea.

“Well I do not accept a future where the jobs and industries of tomorrow take root beyond our borders—and I know you don’t either. It is time for America to lead again.”

Envisioning investment in renewable energy as a stimulus rather than as a drain on the economy, Obama said that in order “to truly transform our economy, protect our security, and save our planet from the ravages of climate change, we need to ultimately make clean, renewable energy the profitable kind of energy.”

Obama made the same point during his presidential campaign, underscoring his plan to create some 3 million “green jobs” through a new clean-energy industry.

His plan, he explained in February, was to double the nation’s supply of renewable energy in the next three years and “make the largest investment in basic research funding in American history.”

Climate-change legislation, he told Congress, is a big part of his program. A “market-based cap on carbon pollution” would drive the production of more renewable energy in America, he said, promising to invest $15 billion annually for 10 years to support energy innovation leading to new technologies such as “wind power and solar power, advanced biofuels, clean coal, and more fuel-efficient cars and trucks built right here in America.”

And in late June, when commenting on the House of Representatives’ passage of climate-change legislation, the President, appearing with Energy Secretary Steven Chu, said the bill was not a “job killer,” as he said opponents characterized it, but a “driver of economic growth” to a clean-energy economy (C&EN, July 6, page 8). Weatherization to make energy-efficient buildings will create jobs for construction workers, engineers, welders, and others, Obama claimed. The bill showed that the nation would not be a “prisoner of the past; we are going to reach for the future,” he said.

The climate bill’s House passage, Chu added, “signals that the ship has turned. The long-term signal is very clear. This is the heart of why it is so important.” Industry, he said, has a “certainty” that carbon emission reductions are coming.

Views on the likely impact of the recovery act are mixed, but most energy economists, engineers, and scientists recognize that this is a sea change in government funding and are holding their opinions in check, waiting to see what happens. Only $8.0 billion has been obligated so far, with just $264 million having been spent.

Many observers question whether $38.7 billion is enough to make much of a dent in a program that is attempting to change how the world generates and uses energy.

In mid-July, 34 Nobel Laureates called on Obama to increase federal funding for climate-change technology in the cap-and-trade bill to the $15 billion per year he promised during his presidential campaign (C&EN, July 20, page 32). They said that such a level of funding is essential to achieve the 83% reduction in CO2 emissions the bill seeks, which is the amount thought to be necessary to curb global warming.

The need for greater capital spending is also underscored by Robert Fri, visiting scholar at Resources for the Future and former deputy administrator at the Environmental Protection Agency and the Energy Research & Development Administration, which preceded DOE.

“We know as a technical matter that you can build a coal-fired power plant that captures carbon and sticks it in the ground, and we can build a modern nuclear power plant,” Fri says. “But until we actually build them, we really don’t know what they are going to cost, how they will perform, or how long they will take to build.

“But that is the kind of information the private sector needs to know to decide if they are going to build one of these,” he explains.

Fri applauds the loan guarantee program because it requires commercial companies to build, manage, and raise money for a project, rather than relying on the government, and he argues that companies put more faith in the results of corporate-led projects.

“In the case of nuclear, the recent experience in Finland and France with new plants has not been so good,” Fri continues. They have been expensive and late, he says, but that may be due to management, not technical problems. “But even so,” he says, “you have to prove they can be managed properly.”

Building such new facilities is risky, Fri says. The facilities might not work as planned or might be too expensive to build or operate. If that turns out to be the case, the country would have “created a couple of white elephants,” Fry says, “but it is a risk we have to take.”

At $6 billion to $7 billion for a nuclear power plant, it’s a significant risk. This example underscores the scale of spending needed to redirect the world’s energy future—a scale that is particularly huge when one considers the history of U.S. energy investments.

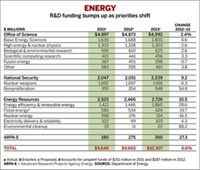

Since the mid-1990s, energy R&D has accounted for about 1% of all federal R&D investments, according to a study funded by Pacific Northwest National Laboratory and conducted by James J. Dooley, senior staff scientist at the Joint Global Change Research Institute and PNNL.

The study, based on several R&D reports and databases, found that between 1961 and 2008, the federal government spent $172 billion for energy technology development. (All dollar values from Dooley’s report are in 2005 dollars.) During the same period, however, the government spent overall nearly $4 trillion in cumulative R&D funding. In all but one year, defense R&D was more than half of the total.

R&D spending mirrors the changing demands of society, government, and Congress. During the space race of the 1960s, for instance, space R&D accounted for up to one-third of all federal R&D, and in the mid-1990s, health R&D—mostly through the National Institutes of Health—ramped up to nearly one-quarter of the federal R&D investment for that period.

Looking at energy spending over the past 47 years, 36% of the cumulative total was fission- and fusion-related R&D, even though nuclear R&D was dramatically cut in the 1990s, according to Dooley. The next largest category, 34%, was basic energy science funding. Next came fossil fuel and renewable energy R&D investments, which were evenly divided among the remaining 30%.

Advertisement

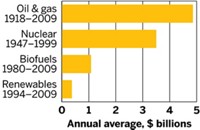

One-quarter of all energy R&D spending occurred in a short time span between 1974 and 1980, when the U.S. responded to high oil prices driven by reductions in imported oil because of the Arab oil embargo, Dooley says. Following the 1973 embargo, federal investment in energy R&D doubled in three years and nearly doubled again during the Carter Administration, reaching $7.5 billion in 1980. Springing from that spending were the first significant federal solar, geothermal, and energy conservation programs, Dooley says, which began in 1974. Renewable energy R&D hit a high of $1.4 billion in 1979.

That was a “crisis atmosphere,” Dooley says, and government was pushed to support what are considered commercial activities. He cites a $4 billion project to create facilities to make synthetic fuels, or synfuels, from coal, another $2 billion spent on a large solar demonstration program, and a program to enlarge an ongoing project to develop advanced nuclear “breeder” reactors, which began in the 1960s and has cost $16 billion.

The sense of urgency came to an end in the early 1980s after Carter lost the 1980 presidential election to Reagan and oil prices tumbled. With some fanfare Reagan killed the synfuel, breeder, and solar programs and cut federal energy R&D overall, shifting and narrowing its focus to basic energy research, where commercial, free-market forces are not likely to play a role.

As a result, basic energy science became the primary recipient of federal funds, and between 1981 and 1998, federal energy R&D fell by more than 50% in real terms. In recent years, Dooley estimates that basic science has accounted for nearly 60% of all energy R&D at the expense of other programs, particularly applied technology development.

“In the past,” Dooley says, “the goal was to generate as much energy as possible and deposit CO2 into the atmosphere, and now we are talking about something completely different. To change that behavior will take a large signal. It will not happen on its own.”

Others disagree, however, and back Reagan’s hands-off policies focusing on basic energy research and denying government support for commercialization, as well as his decision to kill the synfuels program.

“The synfuels program is an example of people absolutely sure government investment was needed and private investment wouldn’t do the job,” says David Kreutzer, an economist and senior policy analyst at the Heritage Foundation, a conservative think tank. “Detractors said private investment didn’t get involved because the project didn’t make sense, and they were right.

“The government made an investment, and it never paid out,” Kreutzer notes. “We see the same hubris now—people in government believe they are better at investing than investors are.”

DOE’s Harris, who worked in the Carter Administration on the synfuels program, disagrees. “There is one thing that is very different now. These programs were premised on high oil prices, and when there was a glut of oil on the market and prices fell, the premise went away. Today’s effort is based on a whole different set of value propositions, such as climate change,” she says.

But Kreutzer says private investors would not have made the mistake of relying on oil prices as the driver. They did better research, he says, and knew “the sky was not falling: We were not running out of petroleum resources, and prices would not remain high.” He adds that both in the 1970s and today, he would put his money with the “people who are putting their own money at risk,” rather than with those who are “extorting taxes” to fund risky projects.

“There never has been anything like a free market in energy,” counters Frank Laird, professor of technology and public policy at the University of Denver. “It is a fantasy. The first tax subsidies go back to 1918 and went to oil and gas. The question is, which energy sources do you support?”

Carter’s problem, he says, was that he had few mature technologies to rely upon to assuage a public concerned about high energy prices. Synfuels appeared available to Carter, but they had technological and significant environmental problems.

Concerning climate change, Laird says the private sector has no incentive to invest in technologies that don’t generate CO2, and that makes government’s role key. “The broad societal benefits from reducing greenhouse gases currently can’t be captured in profits. Government has always been intimately involved in energy, and there is good reason for it to continue to do so. And by the way, nobody complained when government support resulted in the Internet, new biomedical technologies, or other high-tech industries.”

DOE is trying to limit its interference in the market, stresses Patrick Davis, program manager of DOE’s Vehicle Technologies Program.

He acknowledges the $2 billion directed to support battery manufacturers “is a departure from what we normally do. The government hasn’t in the past been involved in making direct investments.” The situation today, however, has caused DOE to change its funding philosophy.

The investments—along with government tax credits and other incentives such as tougher vehicle efficiency standards and Obama’s goal of having 1 million plug-in vehicles on the road by 2015—are a “trigger” to help develop a domestic market for lithium-ion batteries, Davis says. DOE assumes that the market will grow and the industry will finance its own future expansion because the government funding is insufficient to build a new industry.

Davis says that to obtain the grants, companies must have customers lined up, have a functioning business, and match half of the grant. Some 122 companies have applied and are seeking three times the available funds, he says.

“This is a very exciting time and a once-in-a-lifetime opportunity to establish this kind of battery manufacturing industry,” Davis adds, “and we are taking it very seriously trying to get it right.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter