Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

JSR Bets On Old Business

Diversified advanced materials firm renews commitment to synthetic rubber

by Jean-François Tremblay

August 3, 2009

| A version of this story appeared in

Volume 87, Issue 31

Since the 1980s, JSR has successfully diversified its operations away from synthetic rubber to become a leading supplier of advanced materials to the semiconductor and display industries. While doing so, the firm, once known as Japan Synthetic Rubber, insists it has not neglected its traditional business.

“JSR has given the impression to its employees and outsiders that petrochemicals were our past and electronics our future,” says Mitsunobu Koshiba, JSR’s president since April. But “elastomers, semiconductor materials, and displays are equally important to us,” he says.

With Koshiba at the helm, JSR will continue to invest substantially in R&D to maintain competitiveness in the fast-changing electronic materials industry. It will also strive to provide new materials for the energy and medical fields. But synthetic rubber, which may seem a mature and uninteresting product, will also benefit from substantial attention.

JSR’s renewed commitment to rubber with Koshiba as president is unexpected. The holder of a master of engineering degree from Chiba University who has also done some graduate work in materials science at the University of Wisconsin, Koshiba, 53, has worked mostly in JSR’s electronic materials business. From 1990 to 2002, he was head of JSR Micro, a Sunnyvale, Calif.-based subsidiary responsible for JSR’s semiconductor materials business in North America. And just before becoming president of JSR, Koshiba was in charge of the company’s fine chemicals business, which includes everything except rubber and plastics.

Despite having spent relatively little time managing JSR’s rubber operations before this spring, Koshiba has enthusiastically embraced them as president. “We have a very strong competitive position in rubber for high-performance tires,” he says. It would in fact be quite the strategic shift for JSR to neglect its rubber business. In the latest fiscal year, JSR derived 22% of its operating income and one-third of its sales from rubber. The tire producer Bridgestone is both a major customer and the company’s biggest shareholder, with a 16% stake in JSR.

Substantial innovation occurs in JSR’s rubber operations, just as it does in its electronic materials and display businesses. Over the past few years, JSR developed and commercialized a new solution-polymerized styrene butadiene rubber that enables tires to grip the road while reducing fuel consumption.

The idea to develop rubber for tires that better adhere to the road came from Europe, “where people drive their cars madly, even in rainy weather,” Koshiba says. JSR produces the rubber commercially in Japan and Germany.

Few companies have mastered the technology for producing solution-polymerized synthetic rubber, says Samuel Liew, consultant for olefins and elastomers in Asia at Chemical Market Associates Inc., in Singapore. The few firms capable of producing the material—a small group including JSR, Lanxess, Kumho, and Nippon Zeon—can charge a premium for it. The rubber enables tire producers to make high-end tires with desirable characteristics such as low noise, high road adherence, and low roll resistance. “Generic-type tires can be very cheap, but then, you also have the very premium grades of tires,” Liew says.

Currently, the market for fuel-efficient, high-performance tires could not be better, Koshiba points out. “Under the Obama Administration, there is a lot of talk about energy and environment,” he says. “Of course, that means there will be more energy-efficient engines, but tires will also play an important role in improving energy efficiency.”

The 12 years spent in California, Koshiba says, left him with a global view of development and commercialization of new products. “The old Japanese way is to do all the R&D and optimization in Japan, then market overseas,” he says. He believes that global players like JSR need to develop, test, and commercialize their products in the world’s most advanced markets, whether they are in the U.S., Japan, China, or Europe.

Compared with electronic materials, innovating with rubber is relatively inexpensive, Koshiba observes. “One single tool in semiconductor research can cost $50 million,” he says. “For rubber, you just need simple tools, such as those for measuring mechanical strength and mechanical properties.”

For JSR, the key challenge, Koshiba says, is the shrinking supply of butadiene in Japan as the petrochemical industry downsizes. For now, he says, JSR has secured alternative sources of the key synthetic rubber raw material from other countries.

The company projects that its sales will reach only $3 billion in the fiscal year, down substantially from $4.3 billion two years ago. “This takes us back to our sales level in 2004,” Koshiba acknowledges. But he will more or less maintain the company’s $200 million R&D budget in the fiscal year that ends on March 31, 2010. Instead, he will reduce the company’s overhead by downsizing manufacturing facilities. Cutting into R&D, he believes, would “sacrifice” the company’s future.

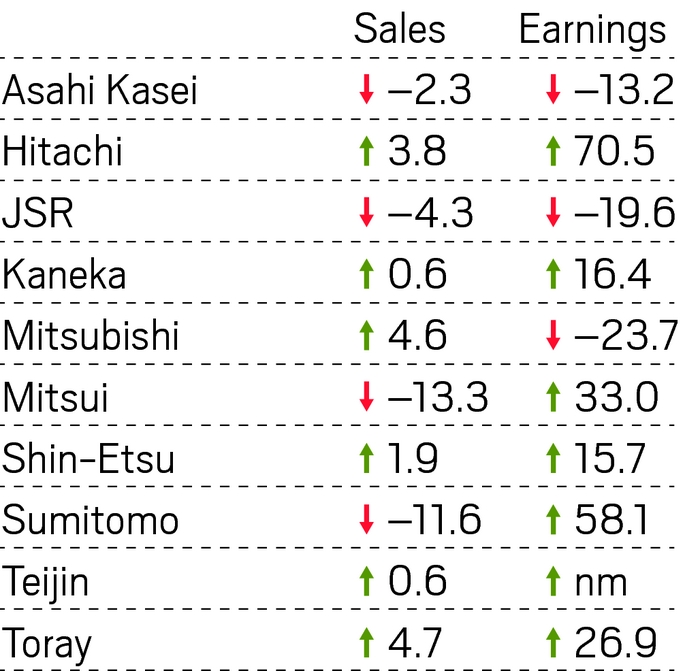

In the fiscal year that ended on March 31, JSR turned a net profit of only $141 million, a 62% drop from the previous year. Still, compared with other major Japanese chemical companies, which posted record losses, JSR’s performance was robust.

But the numbers are misleading, Koshiba says. In the last fiscal year, he explains, JSR built inventories of expensive products made with expensive oil. Oil prices have dropped this year, and so has the value of products in JSR’s warehouses. “We will lose money when we sell those inventories,” he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter