Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Demand Stabilizes In Second Quarter

As destocking ends, chemical firms look for signs of growth

by Melody Voith

August 17, 2009

| A version of this story appeared in

Volume 87, Issue 33

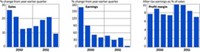

It’s rare to find good news in a collection of earnings reports that show heavy declines from the previous year. In the second quarter, the 23 firms tracked by C&EN suffered a combined earnings rollback of 55.1% compared with last year’s second quarter. But the drop was less than the damage of the first quarter, when the group’s earnings plunged 68.1% year-over-year.

In announcing second-quarter earnings, chemical executives implied, but did not promise, that the worst effects of the global recession are now over. In fact, 20 firms reported slight sales increases from the devastating first quarter, and 18 improved their earnings. Only Cytec Industries, Ferro, and Huntsman Corp. booked losses in the quarter.

For the most part, companies are focused on cost savings, rather than preparing for a recovery that may not come until 2010. Industry leaders Dow Chemical and DuPont both reported $600 million in cost cuts so far in 2009, and both firms reported that sales volumes were down about 20% from last year.

Lower operating costs at Dow and DuPont enabled the firms to increase earnings for two quarters sequentially, even though demand has been weak since the fourth quarter of 2008. Dow’s second-quarter earnings of $152 million were a world away from its fourth-quarter 2008 loss of $574 million.

During the second quarter, all eyes were on incoming orders as a sign that demand is recovering. Andrew N. Liveris, Dow’s chief executive officer, told analysts in a conference call that “this was the first time since the second quarter of last year where we posted sequential volume gains.” And he said the gains were broad-based. “Our electronic and specialty materials, coatings and infrastructure, and performance systems segments all posted impressive volume gains of at least 20% versus last quarter,” he said. In addition, Liveris said plastics demand increased for consumer and industrial packaging.

As the economy recovers, Dow will also gain from its combination with Rohm and Haas, predicts Robert Koort, the chemical stock analyst at Goldman Sachs. As Dow moves away from commodity chemicals, he wrote in a report to clients, “lower feedstock costs, structural cost reductions, and demand recovery should lead to powerful margin expansion.”

At Cytec and Eastman Chemical, executives felt confident enough to declare an end to customer destocking. Cytec posted a $1 million loss for the quarter but said in a report, “We are encouraged by our specialty chemical sales growth of 18% from the first quarter of 2009 and month-to-month improvement during the second quarter, which supports our view that our customers have completed the bulk of their destocking initiatives.” Eastman CEO Jim Rogers also reported that “customer destocking appears to be behind us.”

Despite the positive signs, chemical firms are being cautious in planning for the future, says Tim Hanley, U.S. process and industrial products sector leader at consulting firm Deloitte. “We haven’t seen strong return of demand yet,” he says. “The information so far suggests that the upturn will be bumpy.” Hanley adds that “with costs cut way back, the new orders will have some impact, but that was not reflected much in the second quarter.”

One way companies are coping with economic forces beyond their control is by consolidating capacity and conserving cash. Eastman generated more than $100 million in free cash flow in the second quarter while posting earnings of $63 million. When reporting results, Rockwood Holdings CEO Seifi Ghasemi boasted of his company’s $66 million in free cash flow.

At Lubrizol, cash was a large part of the story of a successful quarter in which the company increased its cash balance to $861 million from $186 million at the end of 2008. Its earnings of $138 million were a 58.7% boost from last year. CEO James L. Hambrick points to ongoing profit margin management initiatives, cost reduction actions taken early in the year, and a years-long effort to improve returns as the main factors for the positive result.

Lubrizol’s per-share earnings of $2.02 beat consensus estimates by 81 cents, according to chemical stock analyst Laurence Alexander of Jefferies & Co. He told clients that Lubrizol’s strong cash flow and “solid balance sheet imply further upside from here.” Lubrizol greatly increased its full-year earnings outlook from $3.95–$4.35 to $5.70–$6.00 per share.

A strong cash position will help those companies that are ready for an upturn, Deloitte’s Hanley argues. He says some firms have already “lined up levers to pull if different scenarios happen,” although surveys show a relatively small minority are prepared for better times. “There is a window of opportunity,” he says. “They may have the chance to get some business they are not in today because they are still running their plant while their competitor shut down completely and will be slow to ramp back up.”

Firms including Dow, Praxair, and Cabot report that their businesses in emerging markets are seeing a rebound. Praxair CEO Steve Angel told investors, “We have begun to see pockets of sequential improvement in Asia and South America, where economic activity appears to be reacting positively to fiscal and monetary stimulus programs.”

The focus on developing countries has shaped restructuring plans at Nalco, a supplier of water treatment products and services. In addition to cutting costs, CEO Erik Fyrwald told investors, the company “took steps in the quarter to expand our teams in growth markets like China and India.” At the same time, Nalco worked “to set a lower cost base in difficult European markets through restructuring actions,” he said.

Hanley sees some signs of impact from government stimulus spending. “According to our work, the big infrastructure projects have not hit the marketplace, but spending has accelerated a little more quickly in China,” he says. In July, the International Monetary Fund raised its forecast for China’s 2009 growth by one percentage point to 7.5%.

In the U.S., a 10.9% increase in government spending was not enough to expand the economy in the second quarter. According to an advanced estimate from the Bureau of Economic Analysis, the gross domestic product shrank by 1.0%. Although this was not as steep a drop as some economists had predicted, personal consumption expenditures, which had increased 0.6% in the first quarter, declined by 1.2%. Durable-goods spending fell 7.5% in the second quarter, and spending on nondurable goods decreased 2.5%.

Government spending on the Cash-for-Clunkers auto rebate program has raised interest in the U.S. auto industry but not enough for analysts at J. D. Power & Associates to increase their U.S. sales estimate of 10 million units in 2009. According to a company report, “The current sales trend suggests the likelihood of a flattened recovery in the second half of the year.”

However, Jefferies’ Alexander points out that chemical company earnings are sensitive to global auto production, not to U.S. auto sales. Jefferies predicts a 5–10% global auto production recovery in 2010, after a 10% decline in 2009. A rebound would strongly benefit DuPont, adding 4–6 cents of earnings per share for every 10% improvement in auto output, Alexander estimates. Auto industry suppliers Cabot, Solutia, Ashland, Cytec, and Lubrizol would also see a boost.

An increase in home building would also benefit the chemical industry. According to the Commerce Department, June residential housing starts increased 3.6% compared with May but were still a staggering 46% below June 2008. Hanley says construction may gain strength in 2010. “There is still a lot of inventory, but we see a little more optimism in the marketplace,” he reports. “It’s a slow recovery; no one is dancing in the streets yet.”

Instead of dancing, Hanley observes, chemical executives are quietly monitoring all the indicators: “They are asking, ‘What will be the new normal?’ ” He says they will continue to pursue strategies to cut back on fixed costs. But at the same time, “they will keep a close eye out for those green shoots and really look carefully at their assets to see that they don’t miss the recovery window.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter