Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

A Mixed Bag From Pharma

U.S. companies saw limited growth in third-quarter sales, while flu therapies boosted European results

by Ann M. Thayer

November 16, 2009

| A version of this story appeared in

Volume 87, Issue 46

The third quarter marked the first of this year’s quarters in which combined sales posted by the leading pharmaceutical companies rose. Although the broad picture is much improved, underlying results from individual firms continue to be mixed. The “haves” benefited from their positions in emerging markets and in supplying treatments for the 2009 H1N1 influenza virus, whereas the “have-nots” saw their sales eroded by unfavorable currency exchange rates and lower product sales.

Overall third-quarter sales for the 12 major drug companies that C&EN tracks rose 3.5%, and earnings were up 7.5% compared with the year-earlier period. Even after two down quarters, the third-quarter increase was just enough to push year-to-date sales growth into positive territory. Combined company sales for the first nine months of 2009 improved 1.5%, while earnings gained 4.5%. Although earnings growth may slow at times, the drug industry remains highly profitable; the group’s profit margin was stable at about 24%.

This year, pharmaceutical industry efforts have been focused on the need for new vaccines and drugs to fight the flu pandemic (C&EN, Sept. 28, page 15). By mid-September, the Food & Drug Administration approved the first H1N1 vaccines. Soon after, the major Europe-based vaccine producers—AstraZeneca, GlaxoSmithKline, Novartis, and Sanofi-Aventis—began making shipments.

Although these companies created effective flu vaccines, they have been plagued by production challenges and couldn’t ramp up production as quickly as expected. Vaccine sales only just started to contribute to revenues in the third quarter but nevertheless offered a glimpse at what’s to come.

The most likely long-term impact of the H1N1 pandemic is a “transient boost” in sales, according to the market research firm Datamonitor. It expects sales of seasonal and pandemic flu vaccines in seven major geographic markets (France, Germany, Italy, Japan, Spain, the U.K., and the U.S.) to expand to more than $4 billion in the 2009–10 flu season, compared with $2.8 billion in the previous season.

At AstraZeneca, U.S. sales of 2009 H1N1 vaccine totaled $152 million in the third quarter—about one-fifth of the company’s quarterly revenue growth in constant-dollar terms. And two years down the road, they represent a good return on AstraZeneca’s $15 billion purchase of vaccine producer MedImmune. Overall sales for AstraZeneca were up 5.5% for the quarter, to $8.2 billion, also boosted by double-digit growth of existing products in emerging markets.

Sanofi should enjoy the greatest vaccine market penetration due to the number of supply contracts it has signed and because its H1N1 vaccine was approved for vaccinating the widest age range of patients, according to the Waltham, Mass.-based market research firm Decision Resources. Sanofi’s H1N1 vaccine sales were $114 million in the third quarter, and the company is predicting another $500 million in the fourth quarter. Its other products also performed well in most regions, paced by sales growth of more than 20% in emerging markets.

Novartis also has a lot to gain, according to Decision Resources, because the Swiss firm has signed nearly $1 billion in government vaccine supply contracts. Novartis started shipping vaccine doses in September, too late to have a significant impact on third-quarter sales. However, by the end of 2009, it expects to produce 90 million to 100 million doses, which will generate $400 million to $700 million in fourth-quarter revenues. For the third quarter, its total sales rose 3.2% to $11.1 billion; they were flat for the nine-month period at $31.3 billion.

While waiting for vaccines to emerge, governments and the health care community turned to antiviral drugs to fight the flu. Roche and GlaxoSmithKline, the only two companies with effective flu therapies, ramped up manufacturing to meet demand from governments stockpiling the drugs.

Along with anticipated sales of about 440 million doses of H1N1 vaccine this year, GSK’s sales of its inhaled antiviral agent Relenza jumped to $715 million in the first nine months of 2009, compared with $86 million in the same period in 2008. The company’s total sales for the first nine months grew 16.2% to $31.2 billion, driven by double-digit gains in emerging markets that offset declining U.S. pharmaceutical sales.

The clear winner in the new market for H1N1 flu-related drugs is Roche, according to Decision Resources analysts. Because Roche’s Tamiflu is not inhaled like GSK’s Relenza, it is easier to use and stockpile. It also does well in consumer markets.

In the first nine months of this year, Tamiflu sales skyrocketed 362% to almost $2 billion. The drug has become the company’s fourth-largest seller after three anticancer drugs it gained in acquiring Genentech earlier this year.

For drug companies that lack flu-related products, it has been pretty much business as usual. Several such firms have used acquisitions to expand their portfolios and market reach. At the end of the quarter, Abbott Laboratories, for example, announced a $7.6 billion deal to acquire Solvay Pharmaceuticals and further diversify its business into emerging markets.

Abbott and other U.S. drug companies, including Eli Lilly & Co. and Bristol-Myers Squibb, reported single-digit sales growth for the third quarter coupled with double-digit profit growth. Bristol-Myers attributed its growth to its expanding biopharmaceuticals business, which includes antibody developer Medarex, bought for $2.1 billion on Sept. 1.

The two biggest mergers—Pfizer joining with Wyeth and Merck & Co. with Schering-Plough—closed after the end of the quarter. Merck and Schering-Plough separately reported earnings before completing their $41 billion merger on Nov. 3. Merck beat analyst expectations with higher-than-expected sales and earnings for the third quarter. For the nine months, however, sales were down 2.7% and earnings dropped 4.9%.

Schering-Plough’s sales slipped 1.7% for the quarter and 4.3% for the nine-month period. However, the company managed to come in with earnings up 4.6% for the quarter and 6.1% over nine months.

“We powered through—even in the face of tough global economic and currency headwinds,” said Fred Hassan, Schering-Plough’s chief executive officer at the time. Although he assisted with planning the integration of the two drug firms, Hassan does not have an executive position with Merck going forward.

Pfizer completed its $68 billion acquisition of Wyeth on Oct. 15. Because of the timing, Wyeth did not report third-quarter results. Pfizer did, but its results do not include Wyeth. Along with Johnson & Johnson, which just recently announced a restructuring plan to improve its operations, Pfizer was among the industry’s poorest performers.

For the third quarter, Pfizer’s earnings dropped 17.2% to $3.5 billion on sales down 2.9% to $11.6 billion. Nine-month figures were no better: Sales declined 6.9% and earnings dropped 13.4%. The company attributed much of the decline to the effect of foreign exchange rates and lower demand, particularly in the U.S.

With the integration of Wyeth, Pfizer will take on a new operating model that reorganizes it into five business units. The acquisition should enhance Pfizer’s revenues and earnings as well as diversify its product lines into biologics and vaccines, according to Deutsche Bank stock analyst Barbara Ryan.

Whether part of a large drug company or the basis of a small one, biotechnology-derived drugs are generally considered a growth area. The sector didn’t disappoint in the quarter, as reflected by the combined sales and earnings of six leading biotech companies that C&EN tracks. The combined profit margin for this group is around 30%.

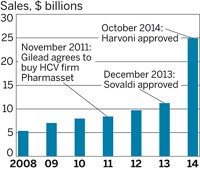

A standout among the six was Gilead Sciences. Its third-quarter revenues grew 31.4% to $1.8 billion while earnings climbed 38.8% to $730 million. Gilead’s antiviral drugs, which largely target the HIV market, contributed significantly to its growth. The company is also one of the few smaller companies to benefit from H1N1-related sales. As the discoverer of Tamiflu, Gilead derives royalty income on Roche’s sales. That amounted to $114 million, a 13-fold jump compared with 2008.

Among the remaining five biotech firms that C&EN tracks, the two larger firms—Amgen and Biogen Idec—posted negative and modest sales growth, respectively, but enjoyed solid earnings growth for the quarter and nine-month period. In contrast, expanding sales helped Cephalon, which launched a new wakefulness drug, and Celgene, which saw its oncology drugs gain market share.

The third quarter was particularly tough for Genzyme, which had to halt production of some leading products because of contamination at its Allston, Mass., plant. Not only did sales in the quarter drop 8.8%, but earnings plummeted 44.4% because of lost revenues and increased costs for remediating the facility. The company has restarted some operations and anticipates resuming shipments in the fourth quarter.

Like Genzyme, many pharmaceutical and biotech companies are looking forward to better times in the fourth quarter. The economy has begun to show signs of life in the past few months, and several companies have raised their earnings outlook for the full year. Among these are Abbott, AstraZeneca, Bristol-Myers, Lilly, Roche, and Amgen.

Overall, the economic downturn has not afflicted the pharmaceutical sector as severely as it has other industries. That’s not to say that drug companies haven’t seen the need to make changes in their businesses. J&J, GSK, Lilly, and Bristol-Myers have restructuring or cost-cutting programs under way. And large-scale cuts in personnel are still coming as Merck absorbs Schering-Plough and Pfizer absorbs Wyeth (see page 5).

Over the past year, companies on both sides of the Atlantic have been responding to marketplace shifts such as increased pricing pressure and potential health care reform in the U.S. GSK has responded with particular force. “The dynamics of GSK’s business are changing,” pointed out CEO Andrew Witty in the company’s earnings report. He stated bluntly that his strategy is designed “to grow and diversify the business away from a dependency on ‘white pill/Western markets.’ ”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter