Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Losses Ease At Japanese Firms

Annual Results: Most chemical makers feel less pain, but Shin‑Etsu's profits plummet

by Jean-François Tremblay

May 17, 2010

| A version of this story appeared in

Volume 88, Issue 20

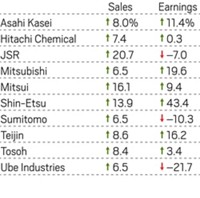

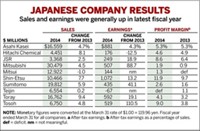

Despite lower sales figures, major Japanese chemical companies mostly cut their losses or improved their earnings in fiscal 2009, which ended on March 31. The main exception was Shin-Etsu Chemical, Japan’s most profitable chemical maker. Its earnings dropped 46% compared with a year ago, making the firm’s performance the worst in at least 12 years.

Sumitomo Chemical and Mitsubishi Chemical reversed their huge losses. Sumitomo posted a record loss of $633 million a year ago but recorded net earnings of $158 million in fiscal 2009. Mitsubishi, which lost more than $700 million a year ago, returned to profitability with a modest $137 million gain. Petrochemical producer Mitsui Chemicals, which lost a horrendous $1 billion last year, was not able to get back into the black.

Companies posting better results attributed the improvement to several factors. First and foremost, income statements last year were ravaged by gigantic write-downs on the value of inventories, but this was not a factor in the 2009 fiscal year. Furthermore, while the economy was miserable at home, Japanese majors encountered buoyant conditions in China, where they conduct more and more business every year.

“Generalizations are difficult with Japanese chemical makers because their range of products and geographic markets varies a lot from one company to another,” says Shuichi Nishimura, a managing director at Nomura Securities, in Tokyo, and the brokerage’s senior chemical analyst. “But the first half of the fiscal year was very tough for them. The second half was a lot better because the terrible capacity utilizations at their customers’ manufacturing sites improved, and demand outside Japan, especially in China, strengthened.”

Despite the generally improving profit picture, Japanese companies stress that they continue to face extremely difficult conditions in their home market.

Shin-Etsu, the world’s largest producer of polyvinyl chloride and silicon wafers, blamed economic weakness for its drop in earnings. The firm said demand for polyvinyl chloride was poor in Japan and Europe, as well as in the U.S., where housing is in a “long period of stagnation.” Silicon wafers, meanwhile, suffered from weak pricing.

The 2010 fiscal year will likely be another lackluster one, Nishimura says. Although the first half is shaping up to be much like the second half of 2009, petrochemical producers are bracing for lower profits as new facilities start to come on-line in the Middle East and China.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter