Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

Platinum Drugs Take Their Toll

Small firms struggle to make their compounds the new standard in cancer therapy

by Ann M. Thayer

June 28, 2010

| A version of this story appeared in

Volume 88, Issue 26

Cisplatin’s approval in 1978 dramatically altered the prognosis for cancer patients. The cure rate for testicular cancer, for example, rose from about 10% to near 90%. Platinum compounds, including the follow-on drugs carboplatin and oxaliplatin, are now a cornerstone of solid-tumor chemotherapy. Alone or in combination with other agents, they are used to treat 40–80% of cancer patients.

Although platinum compounds were a leap forward, they are not perfect. The drugs are used to combat a host of malignancies, but their efficacy often is limited when the cancer develops resistance. They can be inactivated by proteins, especially those containing thiol groups, and only a small amount of drug may reach tumor cells. Cisplatin also has significant side effects that are somewhat reduced in carboplatin and oxaliplatin.

In reviews of the field, researchers estimate that a few thousand platinum complexes have been evaluated in the past 40 years and that about 30 have reached the clinic. No clear winners have yet outperformed the first three commercial drugs or resolved all of their shortcomings. Still, a few are being used in Asia: Shionogi has nedaplatin in Japan, SK Chemicals offers heptaplatin in South Korea, and lobaplatin is sold in China.

Although the past decade has seen a lull in new platinum compounds reaching the clinic, interest in synthesizing novel structures has been on an uptick (Dalton Trans. 2009, 10651). Yet, the most recent clinical contenders—satraplatin and picoplatin—have already taxed the reserves of small companies trying to develop them. If these firms can’t raise the finances to go on, it’s unclear who will take the lead in developing the platinum compounds that continue to emerge from academic research labs.

Candidates tested so far don’t offer the substantial advantages over approved drugs they need to show in terms of efficacy, says Enrico D. Polastro, a Brussels-based senior industry specialist at the consulting firm Arthur D. Little. Another hurdle is that anything new will have to compete against proven therapies that are rapidly declining in cost as generic versions appear.

After launching cisplatin, Bristol-Myers Squibb developed carboplatin through a collaboration with the British precious-metals firm Johnson Matthey and the Institute of Cancer Research (ICR) in London. Generic versions of both have been sold for a decade now.

Meanwhile, Sanofi-Aventis licensed oxaliplatin from Switzerland’s Debiopharm and developed it for treating colorectal cancer. Approved in 1996 in Europe and in 2002 in the U.S. under the name Eloxatin, it is usually administered with 5-fluorouracil and leucovorin in a combination called Folfox.

At its peak, Eloxatin was Sanofi’s fifth-biggest product, hitting sales of $2.1 billion in 2006, but patents expired in Europe that year. In April, Sanofi reached a settlement in the U.S. with several major generic drug firms that authorizes them to sell oxaliplatin starting in August 2012, about six months before the first U.S. patent expires.

Because they are less harmful to the kidneys, oxaliplatin and carboplatin address one of the major side effects of cisplatin, but they are also less potent. In fact, oxaliplatin has only modest activity by itself against colorectal cancer. Still, it is the only one of the three that is used against that disease, whereas the other two work in many of the same cancers. Doctors continue to use cisplatin, having learned to make therapy manageable by watching the dose and hydrating patients.

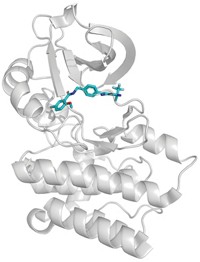

Cisplatin is a neutral Pt(II) complex with two chloride and two ammine ligands. This simple structure gives rise to its proposed mechanism of action. Once in a cell, water displaces a chloride to create a reactive platinum species. This activated species forms an adduct with DNA and intrastrand cross-links when the second chloride is displaced. Wedged in place like this, the drug is believed to disrupt DNA transcription and block cell division. When mechanisms that try to repair damaged DNA fail, the cell dies.

The ligands influence the activity and fate of platinum complexes. Carboplatin was designed with a bidentate dicarboxylate ligand, instead of the chlorides, for lower reactivity and reduced side effects. And oxaliplatin has two bidentate ligands. Like cisplatin, both compounds are believed to be transformed in a cell to similar reactive species. Because they are indiscriminate and can hit any dividing cell, all platinum drugs cause some degree of myelosuppression, or toxicity to blood-forming cells in the bone marrow.

Platinum drugs aren’t foolproof, and three primary mechanisms of acquired resistance have been identified, explains Ronald A. Martell, chief executive officer of Poniard Pharmaceuticals. These include decreased platinum accumulation when cells figure out how to keep or pump the metal out. Another is enhanced DNA repair. And intracellular mechanisms can increase the presence of interfering thiols.

A goal for new compounds is to overcome these issues. Picoplatin, also a product of the alliance between Johnson Matthey, ICR, and BMS, has added steric bulk to avoid binding with thiols. The collaboration ended, however, soon after BMS withdrew support for picoplatin, as well as the group’s first oral candidate, satraplatin, according to Johnson Matthey scientist Chris Barnard, who was in Matthey’s biomedical group at the time. Subsequently, Matthey transferred picoplatin to AnorMED, a firm it set up in 1996 with venture capital backing.

AnorMED worked on picoplatin until 2001 with AstraZeneca, which decided not to pursue it after Phase II clinical trials. In 2004, AnorMED licensed picoplatin to the Seattle-based cancer drug firm NeoRx. Two years later, NeoRx changed its name to Poniard and started to focus on picoplatin.

Poniard has generated Phase II proof-of-concept data showing antitumor activity in four cancer types, Martell says. The company is developing picoplatin as a first-line, or primary, therapy for metastatic colorectal cancer. In this case, clinical studies aimed at getting approval would be designed to show “noninferiority,” meaning that the drug would have the same efficacy as the existing therapy, Folfox, but significantly less severe side effects.

As a first-line treatment for metastatic prostate cancer, picoplatin is being added to the current regimen of docetaxel and prednisone in clinical studies. “Picoplatin has a very manageable combinatorial nature,” Martell says. Combination therapy is standard practice in solid-tumor oncology, he explains, because different cytotoxic agents can work at overcoming redundant mechanisms used by tumor cells to stay alive.

An alternative path toward approval is to show superiority over existing therapies. For ovarian and lung cancer, picoplatin is being studied as a second-line treatment for patients whose disease is refractory (isn’t responding) or has become resistant to initial treatment. “Once there is disease progression to the second line, there are very limited treatment options,” Martell says. “It also is a perfect clinical opportunity to show that picoplatin overcomes platinum resistance.”

In 2007, Poniard began a Phase III trial testing picoplatin as a second-line therapy for small-cell lung cancer. Presented this month at the American Society of Clinical Oncology meeting, the results were “a near miss,” Martell says. “The study failed, but the drug didn’t. This is not a question of biology.” Picoplatin had an effect, and it would have appeared significant had it not been blunted by a flaw in the study, he argues.

Knowing this and the results of earlier studies, Martell believes Poniard could run another trial that might offer a higher probability of success and demonstrate a survival advantage. Phase III trials in other cancers would be a next logical step as well. “The question then, corporately, is how do we go about running all of these clinical trials?” he asks. At the end of the first quarter, Poniard had about $38 million in cash, after reporting a $12 million loss.

In March, Poniard decided to focus on its regulatory approval strategy and cut its workforce to just 12. “We are looking at whether the best option is to partner the compound, merge with another company, or raise additional capital,” Martell says. “It is not a question about whether or not we believe in the drug. Unfortunately, it comes down to a capital resource question, as it often does for small companies like ours.”

Satraplatin, meanwhile, has been moving through a different group of small companies. In 2001, Johnson Matthey licensed it to NeoTherapeutics, in Irvine, Calif., which later took the name Spectrum Pharmaceuticals. The following year, Spectrum sublicensed the compound to the German firm GPC Biotech. In early-stage clinical trials, satraplatin showed promising anticancer activity in prostate, ovarian, and small-cell lung cancers, and in others when combined with radiation therapy. GPC partnered in late 2005 with Pharmion, which was acquired by Celgene in 2008.

Although encouraged by initial Phase III prostate cancer trial data to file for regulatory approvals in early 2007, GPC later pulled its U.S. application after the Food & Drug Administration decided to wait to see overall survival results. Soon after, GPC announced that the trial didn’t meet the desired endpoint. Celgene also withdrew a European filing, and the two companies parted ways in 2008.

In 2009, GPC merged with Houston-based Agennix. The company is evaluating future development options for satraplatin, including its deal with the drug firm Yakult Honsha, which had agreed in 2007 to develop it in Japan. If Agennix decides to move ahead, it will need partners and external funding to run any new trials, the firm has stated.

Finding partners may be hard, since many major drug firms have tested the waters and stepped back from developing new platinum drugs. “Big pharma now is looking more to develop selective therapies and not cytotoxics,” Polastro points out. Still, clinical trial records show that many continue to test therapies in combination with the existing platinum drugs.

This trend could be positive, if big companies want platinum compounds beyond what’s available today. “Most of the targeted therapies today work best when combined with a cytotoxic agent, and the agent of choice is largely a platinum-based therapy,” Martell points out.

What might be available are compounds that are considered “rule breakers” because they don’t follow the 1973 structure-activity criteria that researchers laid out for what would make an effective platinum-based cancer drug. The rules relate largely to the geometry of the platinum complex, the nature of the ligands, and the metal’s oxidation state. Although the more successful compounds have followed these rules, developers are breaking out of the mold to explore different antitumor activity.

“It’s been a long time since truly novel platinum compounds that are structurally and functionally quite different have come into predevelopment,” says James A. Bianco, CEO of Cell Therapeutics Inc. CTI researchers and collaborators recently described what they say are promising new bisplatinates (Mol. Pharm. 2010, 7, 207). They arose out of earlier work on triplatin tetranitrate, also known as BBR3464.

In 2003, CTI merged with Novuspharma, which was then a four-year-old spin-off from Boehringer Mannheim and Roche with rights to BBR3464. Containing three coordinated platinums connected by aliphatic linkers, the chainlike BBR3464 was designed to make inter- and intrastrand cross-links. It came from the lab of chemistry professor Nicholas P. Farrell of Virginia Commonwealth University and was the first such compound to enter clinical trials.

“By modifying the mode of DNA binding, you may be able to have a more potent class of platinates,” Bianco says. In preclinical models, BBR3464 was found to be 100 times more potent than cisplatin, but it was unconvincing in human trials conducted about 10 years ago. A second-generation bisplatinate version, in which the central platinum is replaced with an amine, still had some of the same problems.

In 2006, CTI revisited the idea, Bianco says, looking for ways to provide higher metabolic stability and decrease protein binding while maintaining the cross-linking capability. Two improved candidates have either butyrate or capronate moieties instead of chloride ligands. Both have been tested in tumor models and showed higher cytotoxicity than cisplatin and oxaliplatin.

Despite recent cost-cutting measures and the need to raise more capital, CTI’s efforts continue, Bianco says. “We are currently working on the scale-up and qualification of the manufacturing to have clinical material ready either by the end of this year or hopefully in the first half of next year,” he says. The decision on the choice of lead compound will come out of that effort.

Advertisement

Others see promise in rule-breakers. “The original structure-activity relationships are just not viable anymore,” says Massachusetts Institute of Technology chemistry professor Stephen J. Lippard. Satraplatin, for example, broke the rules because it is a Pt(IV) complex and has added axial acetato ligands. Tetraplatin and iproplatin are Pt(IV) compounds that also made it into the clinic, but they were abandoned after initial testing.

Having spent many years working to understand the mechanism of platinum drug activity and design new compounds, Lippard believes that Pt(IV) compounds are among those that still offer potential.

“You can take a Pt(II) compound and oxidize it to Pt(IV), so now you have both blocked stereochemical access to the platinum and have made the metal-ligand bonds significantly more inert to substitution, so that tends to ameliorate side effects,” he says. “The idea is to keep the Pt(IV) compound unreactive until its gets inside the cell and is reduced back to the Pt(II) active form. It is a Trojan horse or prodrug approach to putting platinum in the cell in a safer way.”

Another approach is using carriers to increase the lifetime of the drug in the blood and help deliver it to the tumor target. Carriers being studied include nanoparticles, liposomes, biocompatible polymers, and bioactive molecules. “There is a huge amount of activity again in platinum compared to five or 10 years ago,” Lippard says. “I think there will be another significant set of new compounds on the market as well as a refashioning of the existing compounds.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter