Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Industry Sustainability Study

BASF, Air Liquide lead in creating sustainable value; Dow is last, BASF-funded study finds

by Alexander H. Tullo

March 1, 2010

| A version of this story appeared in

Volume 88, Issue 9

BASF and Air Liquide are the chemical industry leaders in creating sustainable value, and Dow Chemical comes in last, a new study finds.

The results of the study were compiled by academics at Queen’s University Management School, in Belfast; France’s Euromed Management school, in Marseille; and the Institute for Future Studies & Technology Assessment, in Berlin. BASF provided financial support for the project.

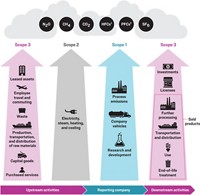

The study took data for AkzoNobel, Air Liquide, BASF, Bayer, Dow, DSM, DuPont, Reliance Industries, and Shell Chemicals in 13 sustainability-related categories such as R&D spending, number of employees, worker accidents, and greenhouse gas emissions. The researchers determined how much of a company’s net operating cash flow is generated by one unit of each category. They measured the result against the weighted average for the entire group. The team of researchers then averaged the differences for all 13 categories to come up with a bottom-line figure dubbed “sustainable value,” which reflects broadly how efficiently companies are using resources.

On the basis of 2007 data, BASF generated the most sustainable value, and AkzoNobel, Dow, and DSM generated negative sustainable values. Correcting for company size, however, Air Liquide comes in first, followed by BASF and Bayer.

One of the report’s authors, Frank Figge of Queen’s University, says a goal was to make sustainability more intuitive for managers by putting it in monetary terms. “What we are trying to do here is to account for resource use in the same way in which you would account for economic data or economic capital,” he tells C&EN.

In a statement, Dow says the report doesn’t accurately assess the sustainability of a company, especially given the study’s categories and its use of cash flow to measure returns. “While no measuring system is perfect, this one falls well short of the standards to which we hold ourselves,” the company says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter