Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Materials

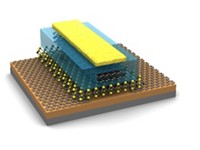

Materials Enable Memory Advances

Development of emerging memory architectures relies on material innovations

by Jean-François Tremblay

July 11, 2011

| A version of this story appeared in

Volume 89, Issue 28

Developing performance materials for the fast-evolving semiconductor memory market has never been simple. Every couple of years, producers need to come up with new electronic materials that enable the manufacturing of chips with ever finer circuitry.

COVER STORY

Materials Enable Memory Advances

But until recently, materials suppliers at least knew which types of memory they needed to develop materials for. Today, the memory market is entering uncharted territory as chip manufacturers consider commercializing entirely new memory architectures.

DRAM, the active memory of most computing devices, is becoming increasingly difficult and costly to manufacture as its circuitry gets finer. Meanwhile, both NOR and NAND flash memories, used in data storage, may be progressively supplanted by superior storage technologies. For chemical companies supplying the electronics industry, these trends translate into exciting opportunities to supply new enabling materials. But they also mean committing to complex, risky, and costly R&D programs.

Materials makers could be looking at a significant opportunity with the emergence of new memory. The global market for semiconductor materials was worth $43 billion in 2010, according to Linx Consulting, which focuses on electronic materials. The market for just one key component—high-k dielectrics—of the current generation of DRAM is worth between $80 million and $100 million, according to Jean-Marc Girard, chief technology officer at Air Liquide Electronics, which supplies chip makers with precursor chemicals that are deposited on semiconductor wafers to create thin films. “A technology using similar materials and tapping into even a fraction of the flash memory market would yield a market of an equivalent size,” he adds.

Capturing that market, though, will require chemistry. “Currently, I would say that we are looking at two-thirds of the periodic table, if not more, for developing advanced molecules used in silicon semiconductor manufacturing processes,” says Ravi Kanjolia, chief technology officer of the performance materials producer SAFC Hitech. “We are looking at new molecules, innovative ways to produce them, new ways to test them and understand their properties and behavior on the surfaces where they are laid.”

The rise of mobile computing is driving efforts to develop new types of memory. Memory is needed both for smartphones and tablet computers, as well as the huge data farms—often referred to as clouds—where users increasingly store their information. “Data farms are a bigger driver for flash memory than portable computers are,” says Weimin Li, director of deposition solutions at ATMI, a developer of advanced materials.

But current memory technology is not suited for such data centers. “The power consumption of these data farms—it’s not sustainable the way the Internet is growing,” Li warns.

At present, he explains, most of the information in data centers is stored in traditional, spinning hard drives that consume large amounts of energy and generate much heat. DRAM is also used in vast quantities in data centers to provide fast access to data. Like the hard drives, it sucks up power because the capacitors in the chips need to be refreshed two to three times per second. This process of consistently rewriting memory generates heat as well.

Replacing the hard drives and DRAM with NAND flash memory is happening in some cases, but the switch presents challenges. NAND is much slower than DRAM and less durable than traditional hard drives. Moreover, the data stored in NAND memory can be rewritten only about 100,000 times.

Several technologies have emerged as contenders to challenge today’s dominant memory architectures. One of them, magnetoresistive RAM, or MRAM, is a possible replacement for DRAM in certain applications. MRAM stores data on thin-film elements in ways that resemble magnetic disks and early magnetic storage methods. But the technology still needs improvement before it replaces DRAM wholesale.

“MRAM, as we understand it, is the post-DRAM,” says Yoshi Tanaka, Tokyo-based global business director for semiconductor fabrication materials at DuPont Electronics & Communications. “But it’s still early days for the technology. MRAM has a lot of catching up to do in terms of storage density to go up to the 1-gigabyte level.”

Another emerging technology, phase-change memory, also known as PRAM or PCM, is a credible substitute for NAND. Making use of chalcogenide glass, the technology is similar to that of rewritable optical discs such as DVDs, but it uses electrical pulses rather than lasers to change information. PCM is already being produced by chip fabricators such as Micron Technology, which claims that it can substitute for both flash and DRAM.

In the short term, flash will be easier to replace than DRAM, SAFC’s Kanjolia says. “My personal opinion is that the emerging memory will chip away at the flash market.” Meanwhile, he says, “DRAM will continue to grow.”

Indeed, DRAM has a lot going for it, says Nick Pugliano, global marketing director at Dow Electronic Materials. “It’s the highest density form of random access memory on the market, it has very high endurance, and it’s very fast,” he says. For these reasons, it will occupy a central position in computing for several more years. “The jury is still out on these emerging memory technologies that are almost unproven from a manufacturing point of view,” he adds. For DRAM, by contrast, the path forward is clearer.

Suppliers of electronic materials, Pugliano points out, can turn to the International Technology Roadmap for Semiconductors for guidance on where memory is headed. ITRS is a set of regularly updated documents produced by a consortium of semiconductor industry representatives. The road map anticipates a role for DRAM for as far out as 2026. It also provides guidance on the development of alternative memory technologies such as MRAM, according to Pugliano.

Materials suppliers need all the guidance they can get because the way ahead is full of uncertainty. The near future will feature DRAM with 20- to 29-nm circuitry, which is expected to enter mass production as soon as 2015. But a lot is unknown about this generation of DRAM, such as what standard material will serve as dielectric insulator.

Strontium titanate is a strong candidate offering the right properties, ATMI’s Li says. But it “is a really difficult alloy that has to be made within a narrow range of compositions to get the right performance,” he says.

Moreover, during manufacturing at the 20-nm scale, the dielectric must be applied uniformly in billions of holes with a 20-nm opening and a depth-to-width ratio of 100:1. The technological complexity—and price—of creating such features is helping to speed up the commercial launch of new memory architectures. “DRAM still has five to 10 years, and after that, the costs will rise if we want to shrink further,” Li warns.

Manufacturing new types of memory will present its own challenges. MRAM, DuPont’s Tanaka points out, uses new metal oxides and magnetic resistive layers. Part of DuPont’s job, he says, is to develop materials that will remove residues from the manufacturing process without damaging the fragile chip surface. “We have to develop new chemistries,” he says.

Other memory architectures will require yet other new materials, Air Liquide’s Girard says. For Resistive RAM (ReRAM), an emerging technology that resembles PCM, “the list of potentially suitable materials covers half the periodic table,” he says. Options include metal oxides such as TiO, NiO, VOx; chalcogenides like those used in PCM; colossal magnetoresistive switching materials such as (Pr,Ca)MnO3; and perovskites.

Fortunately, Girard adds, the properties of most of these materials are already known. The precursors for ReRAM are largely the same ones that Air Liquide studied in the mid-1990s and early 2000s as a dielectric material in DRAM that was being considered at the time. “Our work consists more of assessing the suitability of already developed molecules than in inventing brand-new ones,” he says. “In other words, it’s dedictated application work”

SAFC’s Kanjolia agrees that the materials industry is well positioned to enable the manufacturing of new memory. “We developed a fundamental understanding of phase-change memory a few years ago,” he says. “We have molecules, they are available. We’ve presented our work at conferences and published our results,” he adds. “Now it’s a matter of seeing whether these materials are moving into the mainstream or if our customers are interested to access the feasibilty of their use in their thin-film fabrication process.”

And the potential for a company to enjoy a dominant market share for a given type of electronic material is great. “Choosing the right target applications and collaborations can lead to early adoption,” DuPont’s Tanaka says. “A ‘process of record’ position with a leading device maker then leads to spread of the newly developed technology.”

Ultimately, the success of new materials will be tied to the types of memory that actually make it commercially, Dow’s Pugliano notes. “Substitute memory technologies are in play as options for electrical engineers to design new systems,” he says. “It’s just that now, a lot of technologies like MRAM or PCM are getting more interest because of the technical challenges we see in front of us from DRAM and flash.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter