Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Year Ends On High Note

Fourth Quarter: Chemical industry reports strong 2010 sales and earnings powered by economic recovery

by Melody M. Bomgardner

January 31, 2011

| A version of this story appeared in

Volume 89, Issue 5

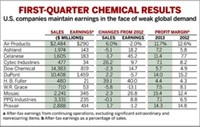

Early earnings reports show the chemical industry wrapped up 2010 with a strong finish. Firms saw both sales and earnings continue to expand in what is normally a slow quarter.

At DuPont, fourth-quarter sales increased 15.3% to $7.4 billion, and earnings grew at a similar rate of 15.2% compared with the year-ago quarter. The company was able to raise prices as well as sales volumes, particularly in its electronics and performance chemical businesses.

Ellen J. Kullman, DuPont’s CEO, reflected on the full year’s results in a conference call with investors, saying, “We will look back on 2010 as the year we benefited from recovery, created our own momentum, and emerged as a stronger, well-positioned company.”

According to Laurence Alexander, chemicals analyst at Jefferies & Co., DuPont’s earnings per share of 50 cents beat consensus expectations by 18 cents. With the recession over, he wrote in a note to clients, the “investment case shifts to the near-term opportunity to gain share in the seed business and to transform and revive the portfolio through acquisitions.” One of those transformations will come from DuPont’s $6.3 billion deal to acquire the enzyme and food ingredient firm Danisco (C&EN, Jan. 17, page 7).

At Albemarle, profits jumped 37.1% on an 8.4% growth in sales, demonstrating “the strength of our portfolio and our team’s ability to drive operational efficiencies,” boasted CEO Mark C. Rohr in a report to investors. The firm saw incomes soar in all three segments: polymers, catalysts, and fine chemicals.

PPG Industries’ 8.4% sales growth was the result of strong performance in its businesses that do not rely on the construction industry. The coatings maker saw a recovery in sales volumes for industrial coatings, optical and specialty materials, and glass. Demand for the firm’s products came from the aerospace, marine, and automotive markets.

Industrial gas maker Air Products & Chemicals reported that higher sales across all segments provided a 10.0% boost to sales revenues and a 28.2% growth in earnings. Meanwhile, rival firm Airgas reported earnings per share of 80 cents, a 23% increase over last year’s fourth quarter. The result might help the firm repulse Air Products’ $70.00-per-share takeover attempt.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter