Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Xylem Analytics Dives Into Instrumentation

An analytics business arises out of a new water technology company

by Ann M. Thayer

December 12, 2011

| A version of this story appeared in

Volume 89, Issue 50

The product of 11 acquisitions over eight years, Xylem Analytics has emerged as a major analytical tool company that will likely rank among the world’s top 25 instrumentation firms in 2011. Its September purchase of the environmental water monitoring firm YSI alone added a $100 million chunk of sales and pushed its annual revenues to more than $300 million.

“The analytical instrumentation market is hugely fragmented, and we have had very good success in targeting businesses and finding opportunities,” says Chris McIntire, Xylem Analytics’ president. He is also a senior vice president of Xylem Inc., a $3.2 billion provider of technology for treating, transporting, and testing water. Xylem Inc. was created on Oct. 31 through a spin-off from ITT Corp., an industrial conglomerate.

What is now Xylem Analytics was conceived in 2009 by ITT executives who identified instrumentation as an attractive complement to their water technology business. In early 2010, ITT acquired Nova Analytics for $390 million, or about three times annual sales. The acquisition moved ITT into lab-based water analysis.

At the time, ITT said in a press release that it was pursuing “very compelling growth characteristics in the analytical instrumentation market.” Nova was the product of nine acquisitions arranged by McIntire and other founders starting in 2003, and ITT quickly followed up with deals to add instrumentation firms YSI and O.I. Corp.

Today, Xylem Analytics has about 50% of its sales in field equipment, 30% in the lab area, and 10% each in on-line process and marine applications. McIntire says the division’s growth rate is better than the mid-single-digit rate of its target market.

“The fit with Xylem just couldn’t be better,” he adds, because of the ability to share knowledge about applications across the company and with customers. Within Xylem’s focus on water, the analytics division broadly provides water-related testing and other equipment in the environmental, food, and pharmaceutical markets. “Analytical instrumentation overall is a solid and consistently growing market,” McIntire points out.

Xylem Inc.’s emergence as a stand-alone company offered a more detailed view into its operations, particularly the analytics business, that “helped legitimize the company’s claim to be focused on the higher-tech spectrum of water technology,” wrote Citigroup stock analyst Deane M. Dray in a recent report to clients. Analytics are among the higher-margin sales in what he calls an “attractive global water market.”

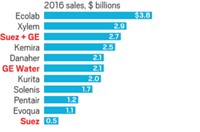

Danaher, another conglomerate that has been amassing an analytical instrumentation business, leads the fragmented water test market with a 21% market share, according to Dray. But until Xylem Analytics came along, no other firm held more than a 5% share. He now ranks the company second or third in line with Thermo Fisher Scientific, which leads in the ion chromatography niche.

Xylem Analytics’ specialty is electrochemistry, an area in which it leads as a supplier of related products. “Electrochemistry really is an aqueous type of a measurement,” McIntire points out. All told, the company offers roughly a dozen technologies enabling measurement of about 50 different test parameters.

The YSI acquisition added sensors, instruments, software, and data collection methods for environmental water monitoring. It also helped balance the business geographically, which had been weighted toward Europe. Xylem Analytics now has about 35% of sales in North America, 39% in Europe, and 26% in the rest of the world.

“Our mission has been to create an instrumentation company of strong branded businesses, selling premium products,” McIntire says. But premium doesn’t mean expensive: Xylem’s average analytics sale is in the $300 to $400 range. “We want products that provide critical data and information our customers need to report, to comply, and to regulate,” he explains. “We think of it as hundreds of dollars of our products protecting millions of dollars of our customers’.”

This thinking drives Xylem Analytics’ approach to new products and its existing brands. Many of the acquired businesses are decades old and have a “solid base of business performance,” McIntire says. Although Xylem has united these smaller operations under the umbrella of a large company, it has kept almost all of the brand names that customers know.

Out of a similar respect for people, knowledge, and existing operations, McIntire says, cutbacks have been minimal. The plan is to help the businesses think more strategically, run more effectively, make better decisions, and “grow to success,” he explains.

Although acquisition has been Xylem Analytics’ main means of expansion, McIntire says underlying business growth has been solid as well. “Looking to the future, we see the opportunity to deliver more organic growth as we lay acquisitions alongside it,” he adds.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter