Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Finance: Chemical Firms Will Use Their War Chests To Expand Into Emerging Markets

by Melody M. Bomgardner

January 12, 2012

| A version of this story appeared in

Volume 90, Issue 2

In 2011, slow economic growth, fears of a double-dip recession, and the March earthquake and tsunami in Japan cast a shadow over the finances of the global chemical industry. Nevertheless, most firms remained quite profitable during the year, and many have set ambitious growth goals for 2012 and beyond.

COVER STORY

Finance: Chemical Firms Will Use Their War Chests To Expand Into Emerging Markets

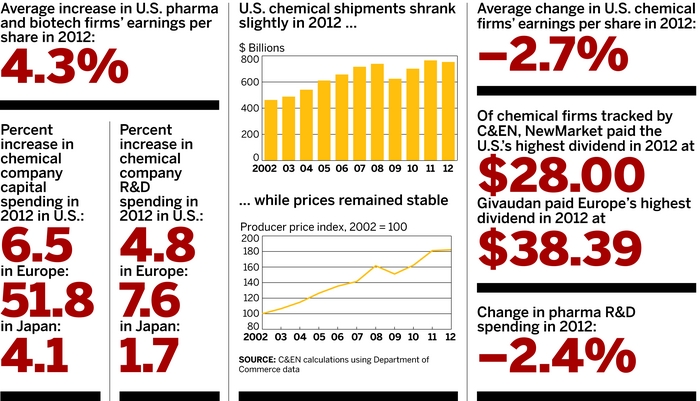

Starting in the first quarter of 2010, the recovery from the Great Recession marked seven straight quarters of earnings growth of 30% or more for U.S. chemical firms. The secret to their success was steeply higher prices on specialty and performance chemicals, where demand was stagnant, and huge investments in segments such as seeds and crop protection, where demand was soaring. For both U.S. and European companies, exports to Asia and Latin America made up for lackluster results in domestic markets.

Firms continued to implement cost reduction strategies and pay down long-term debt, and they entered 2012 with strong balance sheets. “What chemical companies saw in the recession was a lack of access to the financial markets. They recognize that in order to pursue long-term growth projects they need to be able to finance them with a better credit profile,” observes John Rogers, lead chemicals analyst for the credit rating firm Moody’s.

Several large deals were made in early 2011, including DuPont’s purchase of Danisco for $6.3 billion and Solvay’s acquisition of Rhodia for $4.8 billion. In 2012, in contrast, “a vast majority of firms will be looking for smaller acquisitions—product line focused or geographically focused—to plug into their system,” Rogers predicts. Buying companies, adding product lines, and serving new geographic markets are the only sure paths to increased sales in 2012, he adds.

The chemical giants BASF, Dow Chemical, and DuPont have ambitious goals to increase the proportion of sales they make in emerging markets, Rogers says, predicting that the firms will make big strides this year. “For all of these large companies, developing markets will grow. In general, companies will have fairly robust capital plans despite what seems to be a relatively soft economic outlook.”

According to the American Chemistry Council, capital spending by the chemical industry should increase 9.5% in 2012 to $557 billion. ACC Chief Economist T. Kevin Swift forecasts 90% of new capital investments will be made in emerging markets through 2016.

Although China is the largest of these markets, Rogers points out that chemical firms must fine-tune their strategies to be successful there. The Chinese government is investing heavily in the country’s commodity manufacturing base. So while Chinese producers focus on these basic chemicals, Western exporters should shift to value-added products, he counsels.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter