Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Wobbly Economy Pressures Earnings

First-quarter chemical results vary widely by segment and geography

by Melody M. Bomgardner

May 14, 2012

| A version of this story appeared in

Volume 90, Issue 20

Earnings reports for the first quarter of 2012 highlight the diversity of the U.S. chemical industry. While several firms took advantage of a strong and profitable start to the agriculture season, other companies battled weak demand in Europe, slowing growth in Asia, and comatose end markets for electronics and other durable goods.

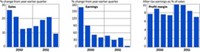

For the 24 firms tracked by C&EN, sales in the first quarter grew an average of 6.4% compared with the year-ago period. It is the slowest growth rate since the end of the recession in the fourth quarter of 2009. In recent quarters, the industry increased revenues and earnings by raising prices, but in the first quarter of 2012, the strategy did not make up for receding sales volumes; earnings sank 8.4% compared with last year.

Early in the year, when chemical executives presented their full-year 2011 results, they warned that the first quarter would likely be weak. Despite the cautious projections, most firms performed close to or slightly above analysts’ expectations. Both Dow Chemical and DuPont, for example, boasted better-than-expected results for their agriculture businesses, but another important segment—electronic chemicals—continued its poor showing.

DuPont’s $4.1 billion in sales of seeds and agriculture chemicals grew 16% over the year-ago quarter. Half of the increase was due to higher volumes, and half was due to increased prices. The agriculture segment helped DuPont beat analysts’ expectations by 6 cents with earnings per share of $1.61. Overall, DuPont earned $1.5 billion on sales of $11.2 billion.

Still, David Begleiter, a stock analyst at Deutsche Bank, pointed out in a note on DuPont that, on average, the firm’s sales volumes were down 2%. Volumes of electronic chemicals took the deepest dive, down 18%. Volumes of performance chemicals and performance materials were both down 10%.

In a conference call with analysts, DuPont Chief Executive Officer Ellen J. Kullman reminded investors that one reason for the poor performance in the electronics segment was customer destocking of materials for photovoltaics. She anticipates a turnaround this year. “Consumer electronics is improving, and growth is very much a function of new application introductions, such as next-generation smartphones and tablets,” she said.

Begleiter agrees that electronics destocking will end soon and anticipates that earnings will accelerate during 2012 because of strong performance in agriculture and “broad-based sequential improvement occurring across industrial businesses.”

At Dow, earnings per share were $2.62, 7 cents below consensus expectations. Still analyst P. J. Juvekar of Citigroup said the largest U.S. chemical firm posted solid overall results for the quarter. As at DuPont, Dow’s agriculture results stood out. Dow sold $1.8 billion worth of seeds and crop protection products, up 14% from the year-ago period. Volume rose 12%, helped by an early start to the North American planting season.

“Encouragingly, management believes there was limited pull forward in the first quarter from seasonally warm weather,” Juvekar wrote in a note to investors. Many of the sales were of new products, and Juvekar says the pipeline has several launches on the horizon, including the new herbicide-tolerant crop trait and chemical combination called Enlist in late 2012.

Compared with last year, however, Dow’s first-quarter earnings declined in every segment except agriculture. Overall, earnings were down 25.0%. Volumes in performance plastics dipped 11% compared with the first quarter of 2011, and pricing power was on the wane in coatings and performance materials. “The quarter played out as we anticipated, with macroeconomic volatility impacting a number of our markets and businesses,” acknowledged Dow CEO Andrew N. Liveris in a conference call with investors.

Certain businesses at Dow had brag-worthy performances in the quarter, Liveris noted, including water and process solutions, elastomers, functional materials, and polyglycols and surfactants, each of which achieved first-quarter sales records. In addition, Liveris was pleased to note the return of demand in the U.S., where the firm posted 5% sales growth.

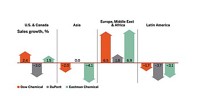

Volume growth in Asia has slowed for both Dow and DuPont. Until recently, the firms looked to Asian markets to overcome sluggish or negative performance in the U.S. and Europe. In the first quarter, however, Dow’s sales in Asia were down 2% compared with last year, in terms of both pricing and volume. DuPont reported a volume decline of 13% in the region, although the impact on sales was offset by changes in the product portfolio and higher prices.

At FMC Corp., agriculture accounted for almost half of the firm’s $941 million in sales for the first quarter. Sales of crop protection products shot up by one-third compared with last year, in part because of the early start to the season in North America and farmers’ anticipation of high crop prices. Demand was particularly strong for preemergent herbicides and new products.

Unlike at Dow, where commodities were relatively weak, FMC saw industrial chemical sales increase 12% as a result of higher selling prices and volume growth in soda ash and specialty peroxygens. Overall, FMC raised earnings to $135 million, a 25.0% jump from last year’s first quarter.

Similarly, Huntsman Corp. was able to benefit from favorable supply-and-demand conditions for the polyurethane chemical methylene diphenyl diisocyanate. Sales of polyurethane ingredients increased 17% compared with last year, helping Huntsman raise overall earnings 60.9% to $177 million.

For Kraton Performance Polymers, which is making its C&EN earnings debut this quarter, sales and earnings moved in opposite directions. Kraton sold a record volume and increased revenues 18.3% year-over-year to $408 million. The early arrival of warm weather and the anticipation of price hikes motivated customers to stock up on the firm’s paving and roofing materials. However, prices for feedstocks such as butadiene increased rapidly from a low point in December 2011, causing profit margins to narrow. Overall, the firm saw earnings shrink 25.1% compared with last year.

Meanwhile, demand for coatings helped PPG Industries increase earnings 22.4% to $279 million. “In the quarter, we benefited from strengthening demand in the U.S. in most end-use markets and growth in emerging regions, which offset weaker European activity,” CEO Charles E. Bunch said in an earnings report. Although the recession had until recently dampened U.S. demand for coatings for cars and buildings, Bunch reported that those segments rebounded in the quarter.

Rockwood Holdings took advantage of upside volatility in the market for titanium dioxide. Higher selling prices and lower manufacturing costs helped the company increase earnings from TiO2 by 38% compared with last year, even though volumes were down slightly. But the steep margins may not last; Rockwood reports increasing raw material costs for slag and ilmenite. Overall earnings at the firm shot up 41.4% to $99 million.

Business was less than brisk at Air Products & Chemicals. Volumes at the industrial gas firm were lower than CEO John E. McGlade expected. “With Europe in recession, we have taken actions to improve our business portfolio and cost positions. While our volumes were held down by lower demand, we did see positive impact from our pricing efforts and new plants,” he told investors. As did Dow and DuPont, Air Products felt the impact of weaker electronics demand. The firm also saw volumes decline in merchant gases, its largest segment.

In contrast, demand from North America raised results at industrial gas rival Praxair. The firm pushed both sales and earnings up about 5% compared with the previous year. “Our first-quarter results demonstrated continued strong growth in North America,” CEO Steven F. Angel explained, “where we are well positioned to continue to grow from greater sales to customers in the chemical, energy, and manufacturing industries who are benefiting from low natural gas costs.” The firm reported sales growth was strongest in the manufacturing, metals, and energy markets.

Although first-quarter results were a mixed bag for the chemical industry, most executives say they are seeing positive signs for the rest of 2012. In the conference call, Dow’s Liveris said his firm saw momentum build within the quarter. Sales in the U.S., Germany, and China all grew at higher than double-digit rates from February to March.

“Across the end markets Dow serves, we are already benefiting from strong fundamentals in agriculture, food, and industrials and are seeing encouraging signs of improvement in construction, electronics, and transportation,” Liveris said.

The progress that Liveris spied in March seems to have continued into April, according to a review of economic indicators by the American Chemistry Council, a trade group of U.S. chemical makers. Chief Economist T. Kevin Swift lists gains in consumer income and spending, sales of light vehicles, and upticks in construction and manufacturing as positives for chemical firms.

“From a global viewpoint, the U.S. gain in factory output [in April] offset weakness in the euro area,” he said. “How long this can continue is the big question.” Employment gains for the month were lower than expected, fueling concerns that the recovery has slowed in recent months, Swift cautioned.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter