Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Biobased Chemicals

The Sweet Smell Of Microbes

Flavor and fragrance molecules made by fermentation promise abundance regardless of the weather

by Melody M. Bomgardner

July 16, 2012

| A version of this story appeared in

Volume 90, Issue 29

The flavor and fragrance industry experienced a shortage of patchouli oil in 2010 when soggy weather gave Indonesian growers a poor harvest of Pogostemon cablin, a perennial shrub in the mint family that is the source of the fragrant oil. That disappointment was followed by volcanic eruptions in the islands, which spawned earthquakes and a tsunami, further disrupting supply.

The patchouli market has since recovered. “Prices have come down over the last couple of months. It is a good moment to buy now before the demand starts to pick up,” advises Eramex Aromatics, a German supplier of flavor and fragrance raw materials, in its March 2012 market report.

The same cannot be said for some other flavor and fragrance raw materials. Among the difficult-to-source oils, Eramex reports, are bitter orange, grapefruit, rose, and sandalwood. Price swings and supply disruptions can be caused by disasters both natural and man-made. They include droughts and floods, as well as poaching and government corruption in the far-flung regions where many essential-oil crops are grown by small landholders.

It is no wonder, then, that purchasers of fine-smelling and -tasting substances would seek alternatives to nature-grown materials. Indeed, major flavor and fragrance houses such as Givaudan, Firmenich, and International Flavors & Fragrances are intrigued by the possibility of using biotechnology to produce key components of essential oils from abundant sugar feedstocks via fermentation.

For assistance, they are turning to the growing number of biotechnology start-ups that are targeting the flavor and fragrance industry. These firms, which include Allylix, Amyris, Isobionics, and Evolva, claim their microbial platforms can produce just about any plant-derived molecule. Once they scale up, they say, supply shortages will be a thing of the past.

The move toward biotech routes for these high-value molecules has also attracted interest from the big chemical firms DSM and BASF. DSM spun off Isobionics in 2008 and has been working closely with the 10-employee firm since then. In March of this year, BASF announced that its venture arm has invested $13.5 million in San Diego-based Allylix.

Curiously, both Allylix and Isobionics are promoting the same two citrus molecules—valencene and nootkatone—as their first products. Valencene is extracted from the peel of the Valencia orange. Nootkatone comes from grapefruit peels but can also be produced from valencene. Both are currently used in fruit-flavored beverages and in perfumes but have potential for use in personal care and cleaning products.

Industry experts say it is too early to tell what portion of the market for flavors and fragrances might move to biotech production. The overall industry, including synthetic molecules made from petroleum feedstocks, was worth $21.8 billion in 2011, according to flavor and fragrance consulting firm Leffingwell & Associates.

The ability to make high-demand molecules such as valencene and nootkatone through fermentation could significantly alter supply dynamics, says Kalib Kersh, an analyst at consulting firm Lux Research. “There is potential for biosynthetic routes to completely replace any natural sources,” he observes.

Beyond the two citrusy heavy-hitters, though, the scent trail of other likely target molecules grows faint. Most development work is done in partnerships similar to those used by large pharmaceutical companies and their biotech research partners but under extremely secretive conditions. None of the three major flavor and fragrance houses responded to C&EN’s requests for interviews.

A search of the patent literature shows that the flavor and fragrance industry is looking to biotechnology to produce complex molecules more cheaply, and in greater quantities, than is possible by either chemical synthesis or extraction from plants. In the case of plant-derived molecules, for example, a Firmenich patent lists terpene molecules that could be made by engineered microbes, including patchoulol, linalool, nerolidol, valencene, and sclareol.

Fermentation-derived products may also replace some chemically synthesized molecules. The claim is that the process would be more environmentally friendly and produce ingredients that can be labeled as natural. Givaudan, for example, has patented a microbial route to vanillin. This common flavoring agent, a replacement for costly natural vanilla, is now synthetically derived from phenol.

Kersh suggests that the biotech companies will start by focusing on commonly used molecules. For example, citrus peel extracts are already used in large quantities, but there is plenty of demand for more of the essential oils. In the future, he anticipates, biotech firms will also tackle molecules that are only available in small quantities from botanical sources.

“If you have a rare compound that you can only isolate from a particular orchid that grows in the swamps of Florida, then only a handful of people in the world can have access to that. Even with a greenhouse full of orchids, it may become a top-end luxury fragrance at exorbitant feedstock prices of something like a hundred thousand dollars a pound,” Kersh says.

With microbial production, however, a once-rare fragrance or flavor could be made in much larger quantities. Biotech manufacturers can supply their customers with the rare molecule for less than what they would pay for plant-derived compounds, while expanding production a bit at a time as new markets open up. Eventually, Kersh says, the expansion could reach a scale where the molecule could be used in common consumer products.

The universe of molecules that could be made by biotechnology is large. To replace nature-made scent and flavor ingredients, biotechnologists can examine extracts of blossoms such as lavender, jasmine, or ylang-ylang. Or they can look at the stems and leaves of fragrant herbs like geranium and patchouli. Seeds and fruits with pungent smell and taste include anise, coriander, vanilla, and juniper. The palette expands with the addition of fruit peels, roots, grasses, evergreen needles, woods, resins, and balsams.

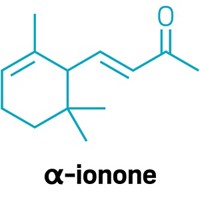

If the goal is to trade up to fermentation-produced molecules from those made by chemical synthesis, possible targets include esters, ethers, aldehydes, hydrocarbons, and ketones.

At Allylix, Chief Executive Officer Carolyn Fritz will narrow down the firm’s target molecules only to the broad category of terpenes, which are found in plants, marine creatures, and microorganisms. More than 75,000 terpenes have been identified so far, she tells C&EN, and several hundred thousand more exist in nature.

Fritz explains that scientists developed chemical synthesis routes to a few simple monoterpenes in the 1970s and ’80s and found a significant market for them. “Then they went on to look at sesquiterpenes and diterpenes, but they found they are too complex and too chiral. The opportunity we have—the beauty of biology—is that it produces single isomers,” Fritz says. “By metabolically engineering our strains, we can produce large volumes cost-effectively, including complex chiral compounds.”

Terpenes are made up of multiple isoprene units. Whereas monoterpenes contain two isoprenes, sesquiterpenes such as valencene and nootkatone contain three. Allylix recently added a third sesquiterpene to its product list. Called Epivone, it is structurally related to β-vetivone, one of the key components of vetiver oil, an essential oil with a rich, woody aroma.

In addition to developing the three terpenes on its own, Allylix works in exclusive arrangements with flavor and fragrance houses that develop finished products, as well as with consumer product companies that create their own formulations.

The DSM spin-off Isobionics, based in the Netherlands, has a business model similar to that of Allylix, and also shares its focus on terpenes. Its newest product is the sesquiterpene β-elemene. Today, β-elemene is obtained via a costly extraction from ginger root, says Laurent Knoors, commercial manager at Isobionics. Although β-elemene has flavor and fragrance applications, it is mainly of interest as a potential anticancer drug.

Knoors stresses that Isobionics’ link to DSM is a major advantage. It shares a location with several related DSM operations on a campus called Chemelot in Geleen, the Netherlands. The staff has next-door access to hundreds of fermentation, microbiology, and analytical experts. At the same time, “we are a small company and act very quickly,” Knoors says. The firm has between five and 10 new products in the pipeline, which Knoors declines to disclose.

Amyris, a publicly traded biobased chemicals and fuels firm, is close development partnerships with the two leading flavor and fragrance firms—Givaudan and Firmenich—that provide a competitive advantage, says Ena Cratsenburg, vice president of business development.

According to Cratsenburg, both agreements are for fragrance ingredients and both have two phases. First is a codevelopment phase where the partners work together to develop a biobased product. Upon successful development, the partners move to a second, commercialization phase in which the flavor and fragrance house would use the ingredient in its own products, and Amryis would get a share of the sales value of the ingredient.

Because of their size, Givaudan and Firmenich “have incredible demand all by themselves,” Cratsenburg points out. “What makes these two projects so interesting and powerful for us is not only do we have a partner working with us on development of ingredients to ascertain quality and end-user preferences using their in-house perfumers, but at completion they are the ones who will be the biggest buyers.”

Cratsenburg won’t reveal the candidate ingredients. However, in February, Amyris executives disclosed to stock analysts that the firm is working with Firmenich on a fermentation-derived version of patchouli. Although patchouli is often associated with incense, it is also a standard ingredient in fragrance blends for personal and home care products. The two main contributors to the oil’s fragrance are the terpenes patchoulol and norpatchoulenol.

In its patent application, Firmenich includes details about how researchers make terpenes through microbial fermentation. Typically a bacterium such as Escherichia coli, or a yeast such as Saccharomyces cerevisiae, is engineered for isoprenoid production by insertion of one of two genetic pathways used by plants to make terpene precursors. The microbe also gets genes coding for a terpene synthase—an enzyme that makes a particular terpene from one or more precursors. The resulting terpene can be functionalized through hydroxylation, isomerization, oxidation, reduction, or acylation.

As for the Givaudan partnership, Cratsenburg says the fragrance starting material is farnesene, a sesquiterpene that Amryis makes from fermentation. She says the target molecule is currently in use and is derived from petroleum feedstocks. The fermentation route allows Givaudan to leapfrog certain steps in chemical production, conferring cost and environmental benefits.

Another of the start-ups, the Swiss firm Evolva, has identified pathways for the fermentation production of saffron components, one of which is the monoterpene glycoside picrocrocin. It anticipates commercial availability in 2015 or ’16. In addition, Evolva has two ongoing flavor ingredient collaborations with International Flavors & Fragrances, the third-largest company in the industry.

Evolva’s work is not limited to terpenes. Since early 2010 it has been working with university researchers to construct biosynthetic pathways to vanillin. In addition, it has made key components of the plant-derived sweetener stevia via fermentation in yeast.

Large buyers of flavor and fragrance ingredients are not choosing partners solely because of their early product targets, Lux Research’s Kersh points out. “They don’t want to just buy a strain—they want a deeper partnership with someone who has the ability to make biocatalysts,” he says. The biotechnology firms have made note of this need; all are promoting their ability to develop a full pipeline of any desired molecules under long-term partnerships.

At Amyris, Cratsenburg says the key word in the young industry is platform. “Our technology fundamentally takes what exists in nature, makes it via fermentation in a sustainable and consistent way, and allows us to give a flavor and fragrance company a whole new platform to innovate around.”

Today, if a flavor or fragrance house customer wants to include a plant-derived ingredient in a consumer product it is limited to ones that will not be greatly affected by the vagaries of nature or governments. “But as long as we can put it in our microbial platform and use sugar as feedstock, reliability is not an issue,” Cratsenburg says.

That means that patchouli lovers can look forward to a time when they can find their favorite woody scent in all sorts of products, unaffected by drought, monsoon, or volcano. ◾

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter