Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Earnings Growth Stalls

Second Quarter: Deteriorating chemical demand blamed on weaker-than-expected economy

by Melody M. Bomgardner

July 30, 2012

| A version of this story appeared in

Volume 90, Issue 31

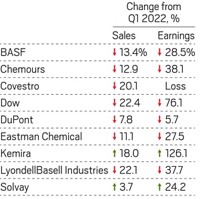

Chemical executives entered the second quarter with expectations of growing demand, but they now face the opposite scenario. Economic weakness in developed economies worsened during the quarter, and growth slowed in emerging markets. For the first time since the end of the Great Recession, chemical firms reported notable decreases in both sales volumes and prices, causing earnings growth to be flat or negative.

The news was particularly grim at Dow Chemical. In a conference call with analysts, CEO Andrew N. Liveris said he had been expecting demand to continue growing in the second quarter, followed by further improvements in the latter half of the year. “However, we saw an accelerated slowdown in the global economy that weighed down heavily on most sectors and geographies,” Liveris said. The CEO presented a matrix of Dow businesses and regions—called a heat map—showing that outlook downgrades outweighed upgrades by a ratio of 10 to 1 in the second quarter.

Overall, Dow’s sales dropped 9.6%, and earnings shrank 34.4% to $649 million compared with the year-ago quarter. Some segments performed well, including agriculture, performance plastics, and materials for organic light-emitting-diode displays. Volumes of products sold in Asia increased by about 2%. Otherwise, sales and earnings in all sectors and regions declined. Dow also took a significant hit in its pricing power; prices dropped in all segments except agriculture.

At DuPont, earnings were rescued by nontraditional businesses, particularly those that came from last year’s acquisition of the Danish food ingredient maker Danisco. The firm increased sales and earnings by some 7% each.

“The newly created reporting segments of nutrition and health and industrial biosciences delivered strong performance this quarter and are expected to combine for over $4.5 billion in sales this year,” CEO Ellen J. Kullman told investors on a conference call. The two new segments more than made up for demand weakness in electronics and performance chemicals.

Analysts who follow the industry had lowered their outlook for the quarter as they watched economic indicators erode in recent months. Most chemical companies are reporting results in-line with the reduced expectations, according to Laurence Alexander, a stock analyst at Jefferies & Co. “We expect outlooks to be more cautious due to the lack of visibility near term and concerns about the resilience of the U.S. consumer, [European Union] budget pressures, and emerging market deceleration,” he told investors.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter