Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Europe’s Chemical Companies Remain Upbeat About 2012

Chemical Earnings: First-half results are weak, but companies remain optimistic

by Jean-François Tremblay

August 2, 2012

| A version of this story appeared in

Volume 90, Issue 32

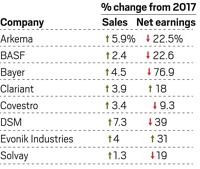

Most major European chemical makers reported lower earnings in the first half of the year. Nonetheless, the companies expect no further profit deterioration in coming months. One company, Bayer, is even raising its earnings forecast for all of 2012.

Because they are based in countries that are at the epicenter of the current global economic downturn, European firms are not particularly optimistic about the strength of demand for chemicals this year. But they are confident about their ability to contain costs and improve cash management. Moreover, the weakening of the euro in recent months has helped them book higher euro-denominated profits on foreign sales.

In addition, demand for certain chemicals—especially agrochemicals—has been strong despite the weak economy. Among major companies reporting results so far, the Swiss agrochemical and seed producer Syngenta is one of only two to post higher earnings versus the year-ago period. Sales in the Northern Hemisphere were strong in 2012, Syngenta explained.

Germany’s Bayer also raised earnings and said it now expects to record 10% higher profits this year, compared with an earlier prediction of only slight earnings growth. The company is particularly bullish about its crop protection business, but it also expects rising sales of pharmaceuticals to buoy its performance.

In contrast, profits at BASF dropped 24% in the first half compared with the year-earlier period. The German giant said the economic environment has worsened. In particular, “the Chinese growth engine has started to stall,” the company noted, and BASF expects overall global economic growth to slow in coming months.

Still, BASF said it will deliver the profits it had earlier promised to generate in 2012. One contributor to BASF’s confidence is resumption of its crude oil production in Libya. In addition, BASF said it will manage expenses with utmost care. For example, the company will slow hiring in Asia this year, putting a brake on what it had planned just a few months ago.

Arkema recorded what appears to be the worst performance of the major chemical firms in Europe: a first-half profit drop of 74%. The French firm said its lower profit was mostly caused by expenses associated with the sale of its vinyl business. For the whole of 2012, it expects to perform as well as it did in 2011.

In recent remarks to analysts, Gilles Auffret, head of Solvay’s Rhodia business, explained the resilience of Europe’s chemical industry. China’s economy is slowing down, but growth remains strong. In the U.S., growth is uneven, strong in some areas and weak in others. Meanwhile, South America is bouncing back. “Generally speaking,” he said, “except for Europe, things are going quite well.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter