Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Coca-Cola Pushes Bioplastic Plans

Polymers: Soft drink giant, with help of Indian firm, aims to secure raw material for biobased bottles

by Alexander H. Tullo

October 8, 2012

| A version of this story appeared in

Volume 90, Issue 41

Advancing a program for making soft drink bottles from biobased polyester resin, Coca-Cola and an Indian partner, JBF Industries, plan to build an ethanol-based ethylene glycol plant in Brazil.

The plant, planned for Araraquara, in the state of São Paulo, will have an ethylene glycol capacity of 500,000 metric tons per year. Its feedstock will be sugarcane and sugarcane-processing waste. JBF will own the plant, and Coca-Cola will take a majority of its output to make the PlantBottle, a polyethylene terephthalate (PET) bottle that is nearly 30% biomass-derived. Construction will begin at the end of this year, and plant start-up is set for early 2015.

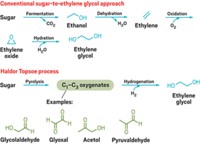

Coca-Cola introduced the PlantBottle in 2009. Since then, it has secured ethylene glycol from India Glycols, the world’s only large-scale producer of ethylene glycol from ethanol. The firm’s process dehydrates ethanol into ethylene, which it converts into ethylene oxide and then ethylene glycol. Coca-Cola says it will continue to work with India Glycols.

JBF makes $1 billion worth of PET resin per year for packaging, fibers, and film. In recent years, the company has expanded internationally. It started a PET joint venture in the United Arab Emirates in 2007 and plans to build a PET plant in Belgium.

Coca-Cola and JBF won’t disclose the cost of the facility in Brazil. In an Indian regulatory filing, JBF says the two firms are still working out the details.

A plant to convert the ethanol into ethylene and then to ethylene glycol will likely cost upward of $500 million, says William L. Tittle, a principal at the chemical consultancy Nexant. If it includes additional sugar processing and ethanol fermentation facilities, it would be considerably more. This latter cost, Tittle says, may be worth bearing. “Back-integration is the way to make the economics work,” he says.

Coca-Cola has also been trying to find a biobased alternative for PET’s other raw material, terephthalic acid. To that end, the company signed collaboration agreements last December with the biobased chemical firms Gevo, Virent, and Avantium.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter