Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Dow And DuPont Unveil Job, Plant Cuts

Restructuring: Weak global markets force U.S. chemical titans to retrench

by Marc S. Reisch

October 24, 2012

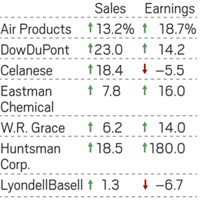

Citing poor demand for chemicals and prospects for slower growth in the months ahead, Dow Chemical and DuPont say they will cut 3,900 jobs between them and collectively take more than $1 billion in charges against earnings.

“The new reality is that we are operating in a slow-growth and volatile world,” declared Dow CEO Andrew N. Liveris. “This requires an agile and efficient response.” Liveris’ remarks came in an earlier-than-planned release of Dow’s third-quarter earnings yesterday, after the firm inadvertently sent details of its restructuring plans to news outlets.

Dow’s restructuring calls for the elimination of 2,400 jobs, or 5% of its global workforce, and the shutdown of 20 facilities. To pay for these actions, the firm says it will take a charge against earnings at the end of the year of about $650 million.

Among the facilities Dow plans to shut down over the next two years are a high-density polyethylene facility in Tessenderlo, Belgium, and a diesel particulate filters facility in Midland, Mich. In addition, the firm will shutter formulated systems facilities in Ribaforada, Spain; Birch Vale, England; and Solon, Ohio.

Because of weak demand for lithium-ion batteries, Dow also says it will write down the value of Dow Kokam, its lithium auto battery joint venture. Formed in 2009 with TK Advanced Battery and the French firm Dassault, the venture operates a facility in Midland paid for in part with a $161 million grant from the Department of Energy.

Dow says it will reduce capital spending in areas that are no longer a priority while continuing to invest in higher-margin businesses such as agriculture and electronics. The shutdowns and write-offs, the firm says, will lead to $500 million in annual cost savings by the end of 2014.

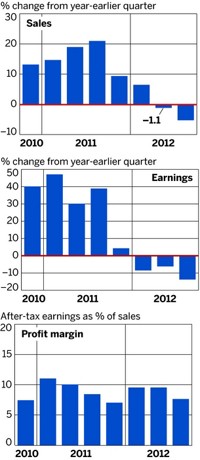

Dow’s earnings for the third quarter, revealed after the stock market closed on Oct. 23, underline the urgency of its cost-containment efforts. Sales dropped nearly 10% to $13.6 billion compared with the same quarter a year ago. Earnings plummeted 39% to $497 million.

DuPont is undertaking smaller but no less significant charges and job cuts. Before the stock market opened on Oct. 23, DuPont said it will take a $394 million charge against earnings and cut 1,500 jobs in the next 12 to 18 months. DuPont’s stock lost 9% of its value that day, contributing to a nearly 2% drop in the Dow Jones Industrial Average, its biggest fall in four months.

DuPont CEO Ellen J. Kullman said the actions will “improve competitiveness and accelerate market-driven innovation and growth.” However, DuPont disappointed investors by telling them that 2012 earnings from continuing operations will be lower than last year’s $3.55 per share.

Also disappointing were the firm’s third-quarter results. Sales fell 9% to $7.4 billion compared with the year-ago period, reflecting declines in the firm’s electronics and performance chemicals segments. Net income dropped to $10 million from $452 million in the year-ago quarter.

DuPont says the charge against earnings will yield about $450 million in savings by 2013. Half of the savings will come from restructuring businesses, such as solar modules and neoprene, to improve competitiveness. The other half will come from eliminating residual corporate costs to support the company’s auto coatings business, which it recently agreed to sell to Carlyle Group, a private equity firm, for $4.9 billion.

Among the takeaways from the actions of Dow and DuPont, according to Jefferies & Co. chemical analyst Laurence Alexander, is that chemical companies will be shifting to more defensive postures for 2013 with staff cuts and project delays.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter