Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

Europe Approves Antibody Copy

Pharmaceuticals: First biosimilar monoclonal antibody to get a nod is a version of Remicade

by Ann M. Thayer

September 13, 2013

| A version of this story appeared in

Volume 91, Issue 37

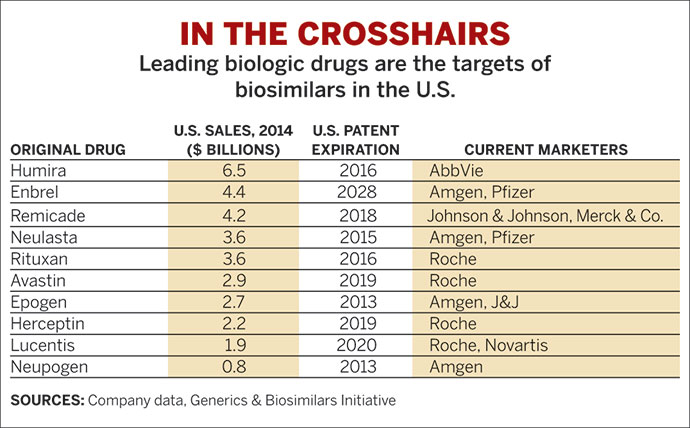

TOP BIOLOGICS

Targets for biosimilar development are mostly monoclonal antibodies. Sales figures are for 2012.

◾ Humiraa (mAb), $9.3 billion

◾ Remicadea (mAb), $8.2 billion

◾ Enbrela (protein), $8.0 billion

◾ Rituxana,b (mAb), $7.1 billion

Herceptinb (mAb), $6.2 billion

Avastinb (mAb), $6.1 billion

a Treats inflammatory diseases. b Treats cancers. mAb = monoclonal antibody. SOURCE: Company data

European regulators have approved the first biosimilar, or near identical, version of a monoclonal antibody (mAb) drug whose patent will soon expire. Although Europe has green-lighted more than one dozen biosimilar versions of protein drugs since 2006, the approval of a mAb paves the way for knockoff versions of multiple drugs that bring in billions of dollars in annual sales apiece.

Inflectra, from Illinois-based Hospira, is a copy of Johnson & Johnson’s Remicade (infliximab), which has been available since 1998 to treat several inflammatory diseases, including psoriasis and rheumatoid arthritis. J&J’s biggest product, Remicade posted sales last year of more than $2 billion in Europe and more than $8 billion worldwide. Sales of Inflectra are expected to be limited at first, however, because Remicade is protected by patents in about 80% of Europe through 2015.

Unlike small-molecule drugs, mAbs and other complex biologics produced in cellular systems are difficult to replicate. Through extensive analytical testing, characterization, and comparison, along with confirmatory clinical trials, biosimilar developers aim to create near copies with the same quality, efficacy, and safety as the original product.

Selling at prices that are 10–30% lower than the original drug, biosimilars promise to make biopharmaceuticals more affordable, but they have captured only limited market share so far, according to Ronald A. Rader, who tracks the sector through his Biotechnology Information Institute. As one of the top targets, Remicade is being chased by at least eight biosimilar developers.

European approval of Inflectra was anticipated, but “we were a little bit surprised by the breadth of indications that the biosimilar got,” Dominic J. Caruso, J&J’s chief financial officer, acknowledged at the Morgan Stanley Global Healthcare Conference on Sept. 11. “Biosimilars are a competitive threat to the business,” he added, “but they are not in the same category as a generic threat to a classic chemical compound.”

Inflectra was developed by South Korea’s Celltrion, which just filed for approval in Japan. In addition to Europe, Hospira has rights to the Remicade biosimilar in the U.S., Canada, and Australia. Although U.S. regulations are not yet in place, the companies anticipate filing for approval in 2015. J&J’s U.S. patents expire in 2018.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter