Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

The New Copycats

Engineering biosimilars, or near copies, of leading biologic drugs, pushes the limits of bioprocessing know-how

by Ann M. Thayer

October 3, 2013

| A version of this story appeared in

Volume 91, Issue 40

Goodbye, Lipitor. Hello, Remicade. Chemically synthesized drugs like cholesterol-lowering Lipitor, the one-time pharmaceutical sales leader, gained a host of replicas churned out by generic drug companies once patent protection expired. But in the near future, that kind of drug will no longer be the hottest object of imitation.

Now the blockbusters to copy are biologics like Remicade. The drug, which made billions of dollars last year treating people with diseases such as rheumatoid arthritis, is due to lose patent protection in many countries in 2015. But biologic drugs are produced in a living cell, not a chemical plant, making each of them a mix of complex, variable biomolecules. The best copies can be only highly similar to the original. The aim in developing a “biosimilar” is to reproduce the overall structural, functional, and clinical characteristics of an original product so that it has the same safety and efficacy.

The technical challenges are high. Even minor manufacturing changes yield different products. Compared with the small-molecule generics game, biosimilars require much more time and money for a payoff that is still uncertain.

“This business is not going to be for the faint of heart,” says Jim Roach, chief medical officer and senior vice president for development at Cambridge, Mass.-based Momenta Pharmaceuticals, which is developing biosimilars. “There will be a very high hurdle by the regulatory authorities, and perhaps the U.S. Food & Drug Administration in particular, to ensure that compounds are close enough to take advantage of an abbreviated approval pathway.”

FDA has not finalized guidelines for these drugs, but the European Medicines Agency (EMA) has. Since 2006, the agency has approved 14 versions of three therapeutic proteins: epoetin, a red-blood-cell stimulant; filgrastim, an anemia drug; and somatropin, a human growth hormone. Japan, Canada, and Australia are approving biosimilars under standards similar to EMA’s. In less regulated markets, less carefully evaluated copies are available.

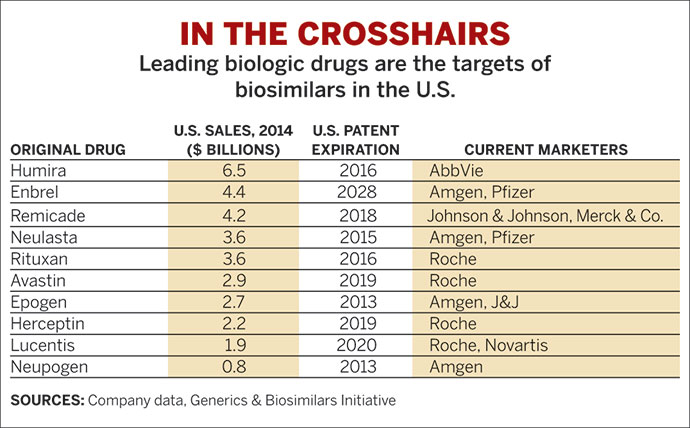

Last month, EMA raised the stakes for the industry when it approved the first copy of a monoclonal antibody (mAb), a biosimilar version of Remicade. Not only are six of the world’s top 15 drugs biologics, but five are mAbs that had combined sales of $38 billion in 2012. The approval, eight months after the agency finalized guidelines for biosimilar mAbs, has opened the door for copycats of this more complex class of drug.

Combined sales of biosimilars in highly regulated markets were about $700 million in 2011, according to IMS Health. By 2016, the market research firm predicts, sales will exceed $4 billion, or about 2% of the total biologics market. By 2020, as patents and other market exclusivities expire on more big-selling biologics, biosimilar sales should jump to more than $11 billion.

But because FDA has moved cautiously, the biggest market for biosimilars—the U.S.—has yet to be cracked. The agency published draft guidance only in 2012. Once the agency finalizes and clarifies its regulations, industry participants expect applications, if not the first approvals, to emerge by the end of 2015.

More than 560 biosimilar candidates targeting 120 approved products are already in development across the globe, according to industry consultant Ronald A. Rader. His Biotechnology Information Institute in Rockville, Md., tracks development reports and patent and exclusivity expirations on marketed products. The companies doing the developing range from pharma giants like Pfizer and Amgen to scrappy start-ups formed to enter the biosimilars business.

And the competitive landscape is shifting rapidly. As companies began work and issues arose, a few pulled back either entirely or on specific products. For example, both South Korea’s Samsung Biologics and Israel’s Teva Pharmaceutical Industries halted programs to copy Rituxan, a mAb for cancer from Biogen Idec and Roche. Similarly, competition arising from a new formulation or patent extension, such as the one Amgen got for its arthritis and psoriasis drug Enbrel, caused others to change course.

Teva and Switzerland’s Lonza recently shuttered a four-year-old biosimilars joint venture. It would have required “more capital than initially planned and will also take more time until [the products] reach the market,” Stephan Kutzer, head of Lonza’s pharma and biotech market division, said in July. The company will stay focused on contract manufacturing and cell line development. Teva, which already sells filgrastim in Europe, plans to continue in biosimilars.

Another notable retrenchment occurred in 2012 when Merck & Co. canceled a deal with South Korea’s Hanwha Chemical, 18 months after setting it up. The partners had planned to create an Enbrel biosimilar as well. Two months later, Merck handed development of its biosimilar candidates over to Samsung Bioepis, a two-year-old joint venture between Samsung and Biogen Idec.

In general, the decision to pursue biosimilars “really comes to down to the economics of it all,” says Andrew F. Bourgoin, senior pharmaceutical research analyst for biologics at Thomson Reuters. “The market is not established and the norms are not there, so the expectations are surrounded by uncertainty.”

Among the companies forging ahead, collaborations are widespread. The Samsung-Biogen deal is one. Other partnerships have arisen between large companies with biologics manufacturing and marketing expertise and small firms focused on biosimilars.

Since late 2011, Momenta has been collaborating with the health care company Baxter for up to six biosimilars. Last month, Baxter signed a $246 million deal with the year-old start-up Coherus BioSciences to develop an Enbrel biosimilar for Europe, Canada, Brazil, and other markets. Coherus also has a deal with Daiichi Sankyo for biosimilars in parts of Asia.

Deal making “highlights the fact that there are voids in the key factors that companies need to compete,” Bourgoin says. “Partnerships may pull from two or three different companies to create the whole package.” In contrast to the dynamics around small-molecule generics, “it’s no longer a generic company versus big pharma,” he says. “It is companies that have the capabilities to compete and companies that don’t.”

Deals can also open other doors. Many companies are trying to gain experience and establish a brand by competing in less-regulated markets, Bourgoin explains. They may then look to leverage their brands in more-regulated markets through a partner with regulatory and market access.

For example, the winner of EMA’s Remicade approval was South Korea’s Celltrion and the U.S. generic drug firm Hospira. Celltrion already had South Korean approval for the product and has filed for approval in Japan. Hospira, meanwhile, has EMA approvals for epoetin and filgrastim biosimilars and is working with Celltrion on eight mAb candidates.

Other links are forming between generic drug makers and leading biotech firms, including Dr. Reddy’s Laboratories with Merck Serono and Actavis with Amgen. “There is a strategic benefit to working with a partner like Actavis,” says Gustavo Grampp, Amgen’s strategic planning and operations director for biosimilars. “They have a lot of experience in generic drugs and specialty pharma, which Amgen doesn’t. It also makes sense to bring in additional capital and share financial risk.”

Amgen has four oncology and two inflammatory disease mAb biosimilars in development. As the world’s leading biotech innovator by sales, Amgen “understood that the business is going to change and mature, and we have been part of the effort to create a good science-based biosimilar pathway,” Grampp says.

In the U.S., Bourgoin believes, the early entrants and the ones best positioned for success will have access to manufacturing capabilities, clinical trial experience, and an understanding of the convoluted biologics patent landscape. “Companies that are already established in this area or have launches in more regulated markets will be the first movers,” he says.

Sandoz, the generic drug arm of Switzerland’s Novartis, has been making recombinant therapeutic proteins for 30 years. Having decided in 1995 to develop biosimilars, it is now the market leader with 2012 sales of $335 million from three products. Sandoz has five more biosimilars in late-stage clinical trials, including versions of Rituxan and Enbrel.

As the first to pursue approval in Europe a decade ago, Sandoz had to overcome the regulatory and legal obstacles of an uncharted field, recalls Joerg Windisch, the firm’s chief science officer for biopharmaceuticals. “You also had to really know what you were doing in development.” He has spent much of the past 17 years creating Sandoz’ biosimilars development organization, which now numbers a few hundred people.

Developing biosimilars requires tremendous up-front analytical work, in large part because developers don’t have access to an originator’s confidential information or regulatory data about the reference product. “We don’t need it either, because we can define the target through analytics,” Windisch says. For example, sequencing even very large mAbs is an option for getting the most basic information on the amino acid sequence.

“Anyone who is credible in this space needs to spend a good amount of time looking up front at the reference product, including obvious things like the sequence and glycosylation,” Amgen’s Grampp says.

To start, a developer must obtain samples of the reference product for analysis. This assessment, which can involve 40 or more analytical methods, according to Sandoz, is at the core of determining biosimilarity between the reference and a copy. “We look at the product as it exists, we analyze it, and that defines the target we reach,” Windisch says.

A company must look at all of a product’s critical quality attributes and evaluate each one with respect to its potential effects on safety and efficacy, he says. “It is a very systematic, bioinformatics-supported process.” For a mAb, the list may include 140 or more chemical, structural, and functional attributes.

“We know a lot about what matters to a mAb,” Windisch says. “We know, for example, what glycosylation does with respect to efficacy and the impact on antibody-dependent cytotoxicity. We know a lot about what influences immunogenicity.” Thoroughly analyzing and closely matching the reference product is critical before testing a biosimilar in patients and “really at the core if you want to succeed,” he adds.

Because biologic drugs are complex glycoproteins, developers analyze multiple reference samples. “No biologic is similar to itself or a previous version of itself, or even a previous batch of itself,” Windisch explains. In the biologics industry, manufacturers are accustomed to conducting comparability studies after production changes to assure regulators that a product has not changed in any meaningful way.

Because of the inherent variability of biomolecules, each measured attribute of a reference product will have a range of values. Manufacturing the biosimilar to fall within these goalposts takes work. “It takes us two to three times longer to develop the manufacturing process for a biosimilar than for a novel biologic because we have to hit a predefined target,” Windisch says.

One complication is that biosimilar developers want to make the most of modern production techniques to copy products first made in the 1980s with very different methods. “We are ending up in the same place, but it is a different road we are taking to Rome,” Windisch says.

But doing so can prove problematic because biomolecules are extremely sensitive to the cell line, process, and purification methods used—even to the point of becoming what regulators might consider a new, better product rather than a biosimilar.

“We have asked regulatory agencies whether having a superior purity profile from using a modern process would preclude using a biosimilar approval pathway,” Grampp says. “They have been very clear in saying that they welcome improved purity as long as it doesn’t affect the efficacy of the product.”

Hitting the target that Windisch describes takes many iterations. At each iteration and scale-up step, the goal is ensuring that the biosimilar zeros in on the target specifications. Corporate know-how allows researchers to “tweak the process in a way that is likely to bring particular attributes even closer,” Momenta’s Roach says.

“It isn’t as simple as just having the analytics to understand the structure,” he says about creating a biosimilar. “It is then about how you apply that knowledge through each stage of biologics process development and improvement, starting with cell line selection, clonal selection, and all the way through upstream and downstream product development.”

Advertisement

Momenta has developed analytics technology and manufacturing experience from reverse engineering complex polysaccharide and polypeptide drugs—such as Sanofi’s blood thinner Lovenox and Teva’s multiple sclerosis drug Copaxone. That experience can help circumvent the disadvantage of having access to the final product but no knowledge of how it was made.

Momenta’s scientists decipher everything they can about a reference product and define it to “the highest level of resolution as is technically feasible,” Roach says. “If you really understand the product very well, there can be things you might see in the analytics or certain fingerprints that point toward the process the innovator may have used.”

Companies estimate that developing a biosimilar will take up to eight years and $250 million, depending on the size and number of clinical trials needed. “The expenses associated with cell line characterization, pharmaceutical sciences, analytical comparability, and the volume of analytics is easily four to five times greater than what you typically see in chemistry, manufacturing, and control packages for innovative products,” says Diem Nguyen, manager of Pfizer’s biosimilars unit. The time and money is much more than the few years and tens of millions of dollars needed to develop a small-molecule generic drug, although it is still less than half of what’s required for an entirely new drug.

“General biologics manufacturing requires capital and material investments that can be quite costly as well,” Nguyen adds. “Clearly, with the hurdles associated with development and investment, as well as with the regulatory guidelines, companies wouldn’t pursue this if they didn’t believe there are unmet medical needs and an ability to find a robust commercial model.”

FDA has said it will handle applications on a case-by-case basis and, like European regulators, look at the “totality of the evidence” from analytical, preclinical, and clinical studies. The agency’s current thinking is that the scope of clinical work required will depend on safety concerns about the original product and how much analytical, structural, and functional information a developer provides. In the agency’s model, a larger analytical foundation will help decrease uncertainty around biosimilarity, and less uncertainty might mean less clinical testing.

Indeed, the question of how much clinical testing on patients must be conducted looms large for firms seeking to launch biosimilars in the U.S. Demonstrating that there are “no clinically meaningful differences” in the safety, purity, and potency of a biosimilar compared with the reference product falls on their shoulders, FDA has said. Regulators will want to know whether any analytic disparities translate into clinical performance. Narrowing the scope of any clinical studies or lessening their numbers must be scientifically justified by the company applying for approval.

Developers anticipate that they will likely need to conduct at least a pharmacokinetics and pharmacodynamics (PK/PD) study and perhaps some immunogenicity and safety studies. “The PK/PD study is actually very important because it is extremely sensitive in picking up potential differences,” even more so than traditional clinical measures, Windisch says. Because it can provide so much information, “this study is typically larger for a biosimilar than for the original product.”

In most cases, a PK/PD analysis is also a good predictor of efficacy, Windisch adds. Safety and efficacy clinical trials will only confirm, not establish, biosimilarity found through analytics and preclinical work. “You cannot test similarity into a product, you only rule out that you absolutely have not overlooked anything,” he says. As a result, developers of biosimilars must carefully design their clinical trials to pick up differences from original drugs by looking at the most sensitive patient populations.

But the challenge, Nguyen says, “is that some of the agencies have differing views on what ‘good’ looks like in terms of comparability from an analytical perspective, and they also have differing views in terms of clinical trial design.” A healthy dialogue with regulators is critical to incorporate the feedback they are providing.

“We try to come with creative solutions to be able to harmonize the agencies’ needs,” Nguyen says. Pfizer likes to run global development programs. “We try to develop one program for most of the markets and then look to adjust for market-specific requirements,” she says. The company is now working on five mAb biosimilars for oncology and inflammation.

Despite their confidence, developers for the U.S. market face many unanswered questions and an uncertain regulatory future. Beyond scientific and clinical considerations, a heated debate is under way about whether biosimilars should bear same nonproprietary “generic” name as the reference product, as they do in Europe, or a name that will differentiate it.

Another hot topic is that the first biosimilars, unlike easily replicated small molecules, will not be interchangeable or substitutable in prescriptions. Although the U.S. government has opened the door for biologics interchangeability, FDA has yet to indicate how to meet that standard. Expectations are that it will require proof of biosimilarity, possibly to a higher degree than for a biosimilar designation, as well as more clinical studies to show the same clinical effect and no ill effect from switching between a copy and an approved product.

Interchangeability may come eventually. Although experience with the most complex molecules, mAbs, is limited, biosimilars have proven safe and effective in highly regulated markets, Thomson Reuters’ Bourgoin points out.

But “the last thing that the FDA would want is a biosimilar that may have used a different process in its manufacturing and wasn’t vetted through additional testing or trials to go wrong,” he says. “The agency is in a place right now where it really wants to get this right.”

Convincing regulators will be just the first step. Because many people view biosimilars as falling somewhere between a generic and a new product, providers believe they will have to educate doctors, insurers, and patients about what the products are and how they were developed before they’ll be willing to make a switch. And since biosimilars won’t be interchangeable and may carry distinct names, companies will aggressively market them, Bourgoin predicts.

Biosimilars sell for up to 30% less than original products, so price is not as much of a factor as for small-molecule generics, which can sell for 85% less than the original. Competition is anticipated to center instead on data quality, purity, and safety as well as the supplier’s product development and manufacturing experience.

Firms in Europe have learned that uptake varies widely depending on the country and disease area. Innovator companies will fight back as well. Some firms, such as Amgen and Pfizer, will be on both sides of the fence.

The really big selling biologic drugs, such as Remicade, won’t lose patent protection in the U.S. until 2016 to 2019. And being first to market with biosimilars may not offer many rewards. In addition to testing the regulatory waters and launching an entirely new type of product, the early entrants will likely bear the brunt of patent challenges.

As the market becomes established, more players are expected to emerge, driving down prices and limiting return on investment for developers. Longer term, competition will probably increase globally as regulations become harmonized.

Hurdles to get from the lab to success in the market are “massively underestimated” by many potential players, Sandoz’ Windisch believes. His advice after 17 years in the business: “You need certain capabilities to be successful in the field, and you can’t take shortcuts.”

To download a PDF of this article, visit http://cenm.ag/biosimilars.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter