Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Mitsui Chemicals: The Worst Is Behind, Incoming CEO Says

by Jean-François Tremblay

March 24, 2014

| A version of this story appeared in

Volume 92, Issue 12

The restructuring moves that Mitsui Chemicals undertook over the past two years will soon put the company on the path to financial stability, says Tsutomu Tannowa, a Mitsui manager who will become the firm’s president and chief executive officer on April 1.

Mitsui Chemicals: The Worst Is Behind, Incoming CEO Says

A business graduate from Waseda University, Tannowa has managed most of Mitsui’s businesses for the past two years. The road ahead, he argues, is relatively straightforward.

“Once we take care of our loss-making businesses, it won’t be too difficult to generate a net profit of roughly 50 billion yen [$488 million] on a constant basis,” he says.

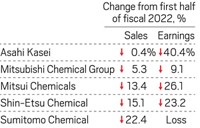

Tannowa may be confident, but turning a profit hasn’t been coming easily for Mitsui, which reported a net loss in three of its last four fiscal years. In its latest fiscal year, which ended March 31, 2013, the loss was about $100 million. The bulk of Mitsui’s operations are in Japan, where the company operates large petrochemical and basic chemical plants.

In recent years, Tannowa points out, Mitsui has been steadily culling its least competitive businesses by closing plants making commodity polymers such as polyethylene and polypropylene. The unprofitable businesses that still require restructuring, he says, are phenol; polyurethanes; and purified terephthalic acid (PTA), a polyester raw material.

“For the past three years, we have actually been profitable at the operating level,” he argues. “The losses we have had were mostly the result of restructuring charges that we don’t expect to come back.”

The restructuring of Mitsui’s phenol, polyurethanes, and PTA businesses is under way. Last month, Mitsui transferred its stake in a PTA subsidiary in Indonesia to its joint-venture partner BP. Earlier in February, the company announced the closure of a phenol plant in Japan. In 2016, Mitsui plans to shut plants in Japan producing toluene diisocyanate and methylene diphenyl diisocyanate, which are used to make polyurethane.

While it culls unprofitable businesses, Mitsui will boost those with better prospects or for which it has competitive advantages. For instance, Mitsui has strong polypropylene compounding know-how, Tannowa says. The company is building a specialty polyethylene plant in Singapore implementing its Evolue metallocene catalyst process. And it will build a facility in southern Japan to produce a specialty isocyanate used in making ophthalmic lenses.

Although the list of changes being implemented appears extensive, Yoshihiro Azuma, a securities analyst at the investment bank Jefferies, is unimpressed. “Mitsui’s product portfolio remains too weak,” he says. “They are facing poor supply-and-demand conditions in their core businesses.”

Tannowa objects, saying that Mitsui is in the process of methodically restructuring its businesses that are least profitable. “We don’t expect Mitsui to report net losses again,” he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter