Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Mitsui Slashes Operations

Restructuring: Major chemical company will shutter plants, seek to reverse years of losses

by Jean-François Tremblay

February 14, 2014

| A version of this story appeared in

Volume 92, Issue 7

TURNAROUND

To improve profitability, Japan’s Mitsui is closing seven chemical plants in four locations:

Kashima

◾ Toluene diisocyanate

◾ Specialty diisocyanates

◾ maleic anhydride

◾ Fumaric acid

◾ Omuta

Methylene diphenyl diisocyanate

Chiba

◾ Phenol

Ichihara

◾ Bisphenol a

Seeking to shake up a business dependent on selling commodity chemicals in the stagnant Japanese market, Mitsui Chemicals is closing multiple plants in Japan and bringing in a new CEO.

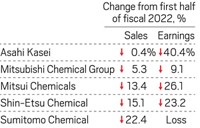

With sales of $17.6 billion in the fiscal year ending March 31, 2013, Mitsui is one of Japan’s largest chemical companies. However, it has not turned a profit for three of the past four years and expects to lose money again in the fiscal year that ends on March 31. The firm says it hopes to return to profitability next year because earlier changes are starting to pay off.

Tsutomu Tannowa will become CEO of Mitsui effective April 1, replacing Toshikazu Tanaka. At present, Tannowa is the senior officer in charge of several of the businesses that are draining the company and is said to be the architect of the downsizing plan. The company has not announced layoffs.

As part of that plan, Mitsui will close several phenol and urethane chemical facilities by the end of 2016. It also announced that it will build the world’s largest plant for xylylene diisocyanate, a urethane monomer mostly used in ophthalmic lenses.

The urethane plants Mitsui is shuttering suffer from high operating costs because of their relative small size. For instance, a methylene diphenyl diisocyanate (MDI) facility slated for closure has an annual production capacity of 60,000 metric tons. By comparison, BASF is building an MDI plant in China with a capacity of 400,000 metric tons.

The phenol plant that Mitsui and Idemitsu, its partner, are closing is large by world standards. But Mitsui says demand in Japan is not strong enough to justify the facility, and the export market is already well supplied.

It’s not clear that the closure program will be enough to pull Mitsui out of its tailspin. “It will not significantly reduce their dependence on sales to manufacturers based in Japan,” says Yoshihiro Azuma, a stock analyst at the investment firm Jefferies. Moreover, the moves will unfold in slow motion. “They’ve announced total cost reductions of $135 million, but the change will not become effective until 2017,” Azuma cautions.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter