Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Ashland Sells Water Technologies Business For $1.8 Billion

Restructuring: Activist investor pushed for divestment of underperforming assets

by Melody M. Bomgardner

February 21, 2014

| A version of this story appeared in

Volume 92, Issue 8

Ashland will sell its water technologies business to the private equity firm Clayton, Dubilier & Rice for about $1.8 billion in cash. The business was first offered for sale in July, three months after activist investors Jana Partners took a 7.4% stake in Ashland. Analysts predicted at the time that Jana would push the company to divest underperforming businesses.

The water technologies sale will allow Ashland “to focus on our core specialty chemicals business and to accelerate return of capital to shareholders,” Ashland CEO James J. O’Brien says. The company plans to use almost all of the $1.4 billion in net proceeds for share repurchases.

Water treatment and management was once an important part of Ashland’s strategic shift from petroleum refining to specialty chemicals. The firm expanded the business, which focuses on the pulp and paper industry and industrial water treatment, through acquisitions, notably of Degussa’s water business in 2006 and of Hercules in 2008. The water unit now has annual sales of $1.7 billion and employs 3,000 workers, according to Ashland.

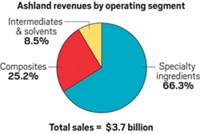

In January, Ashland announced plans to restructure and slim down after the sale of the water business, which is scheduled to close on Sept. 30. At that point, the firm will have three divisions: specialty ingredients, performance materials, and Valvoline motor oil. The restructuring will result in the elimination of up to 1,000 jobs.

Other chemical firms have been targeted recently by activist investors. A hedge fund run by investor Daniel S. Loeb has advocated for Dow Chemical to split off its commodities businesses, for example.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter