Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

Merck Will Acquire Biotech Firm Idenix

Pharmaceuticals: Deal for close to $4 billion brings key addition to its hepatitis C virus portfolio

by Lisa M. Jarvis

June 9, 2014

Hoping to steal a chunk of the hepatitis C virus drug market from Gilead Sciences, Merck & Co. is shelling out $3.85 billion for Idenix Pharmaceuticals, a Cambridge, Mass.-based biotech firm developing small-molecule HCV drugs. With the deal, Merck gains IDX21437, a nucleotide polymerase inhibitor now in Phase I/II trials that could become the cornerstone of a more convenient treatment for the virus.

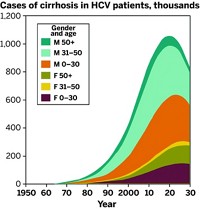

Drugs to treat HCV, a serious liver infection that affects about 3.2 million Americans and 150 million people worldwide, are expected to bring in more than $20 billion in annual sales by 2018, according to the market research firm Evaluate Pharma. Much of the market’s recent growth has come from Gilead’s nucleotide polymerase inhibitor Sovaldi, a pill launched in December 2013, that is a major advance in treating HCV infection.

Previously, HCV patients faced a lengthy treatment regime that combined a protease inhibitor with ribavirin and the injected drug interferon. Sovaldi cut out the need for interferon and shortened the treatment time. Sales of Sovaldi are projected to reach $10 billion this year, which would make it the fastest new drug launch in history.

Now, Gilead is asking FDA to approve a fixed-dose combination of Sovaldi and the NS5A inhibitor ledipasvir that would eliminate the need for ribavirin. The pill would treat people with genotype 1 HCV, the most common strain of the virus in the U.S.

According to information sent to investors, Merck’s goal is to come up with a once-daily, fast-acting, ribavirin-free drug combo that can treat HCV patients regardless of genotype. But to make that happen, Merck needed a nucleotide polymerase inhibitor to pair with its NS5A inhibitor MK-8742 and its NS3/4A protease inhibitor MK-5172, both in development.

Although Merck believes IDX21437 is its solution, many have stumbled in the race to produce a safe and effective nucleotide polymerase inhibitor. INX-189, the centerpiece of Bristol-Myers Squibb’s 2012 acquisition of Inhibitex for $2.5 billion, was pulled from development after a patient died in a Phase II study. Pharmasset and Idenix also ended nucleotide programs due to safety concerns.

Given the scarcity of safe and potent nucleotide polymerase inhibitors, Achillion Pharmaceuticals, the last biotech with a fully owned molecule in that class could be next on big pharma’s shopping list, according to Howard Liang, a stock analyst with the investment firm Leerink Partners.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter