Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

First-Half Chemical Earnings Grow In Tough Climate

In-demand specialties helped offset weakness in agriculture and construction

by Melody M. Bomgardner

August 24, 2015

| A version of this story appeared in

Volume 93, Issue 33

Overcoming the strong dollar, U.S. chemical companies managed to grow earnings by an average of 2.0% in the first half of 2015. Of 20 firms tracked by C&EN, 15 saw sales decline, due in large part to the negative effects of currency exchange. Yet even among those 15, eight reported higher earnings, continuing a trend of expanding profit margins in the chemical industry.

But the full picture was less than rosy as chemical executives remain gloomy about the global economy. “Growth remains volatile and uncertain despite growth in some economies,” remarked Dow Chemical Chief Executive Officer Andrew N. Liveris in a call with investors. He added that worldwide economic growth rates are approaching 3%, with the U.S. a bright spot and China “a mixed bag.”

Liveris said China’s domestic economy is driving demand for automobiles and construction, which is good news for Dow. But overall growth within China is slowing, economists say. And earlier this month the Chinese government signaled it is worried about the strength of the country’s export economy when it devalued its currency.

ON THE MOVE

Chemical businesses are changing hands as companies seek greater value.

September 2014: Sigma-Aldrich agrees to be bought by Merck KGaA for $17.0 billion.

November 2014: Chemtura sells AgroSolutions business to Platform Specialty Products for $1.0 billion.

January 2015: Albemarle completes acquisition of Rockwood Holdings for $6.2 billion.

March 2015: Olin agrees to buy Dow Chemical’s chlorine business for $5.0 billion.

April 2015: FMC completes sale of alkali chemicals to Tronox for $1.6 billion and completes acquisition of Cheminova for $1.8 billion.

July 2015: Solvay agrees to buy Cytec Industries for $5.5 billion.

DuPont spins off specialty chemicals business Chemours.

August 2015: CF Industries agrees to buy most of OCI in an $8.0 billion deal.

In the works: Axiall plans to sell its aromatics business and may sell its building products business.

W.R. Grace will spin off its construction and packaging products businesses.

Air Products & Chemicals plans to divest its material technologies business.

Huntsman Corp. will spin off or divest its pigments and additives business.

In the short term, the move strengthens the U.S. dollar, potentially harming exports of U.S.-made products by making them more expensive. In the first half of this year, U.S. chemical exports to China were off by 3.6% compared with last year, while imports increased by 7.2%, according to the American Chemistry Council (ACC), a trade group. That suggests the chemical trade deficit with China—which was $729 million in 2014—is likely to expand.

For the big U.S. chemical firms, the financial effect so far has been mainly on paper. For example, international companies such as Dow make and sell many of their products in local markets. Thus the impact of the currency effect is felt only when they translate their foreign sales figures into U.S. dollars.

Instead, weak demand for agricultural and construction chemicals in the Americas and Europe had a bigger impact on earnings, particularly in the second quarter. In addition, makers of basic chemicals saw prices fall significantly, pulled down by lower raw material prices, though producers of some downstream specialties such as performance plastics and electronic chemicals were able to pocket more of the cost savings generated by cheaper feedstocks.

“For every strong specialty area, there appeared an offsetting, weak area,” said John Roberts, an analyst at investment bank UBS. He made the comment in a note to investors on Dow, but the remark proved true across the chemical industry. In Dow’s case, strong performance plastics results were partially offset by weakness in agriculture, yet overall the firm posted an earnings increase of 9.7% compared with last year’s first half.

At DuPont and FMC Corp., soft demand from farmers took a bigger bite from earnings. DuPont saw profits erode by 13.2%, and FMC’s earnings declined 17.2%. Both firms recently doubled down on agriculture in an effort to lasso long-term growth. DuPont spun off its performance chemicals firm, Chemours, in July. In April, FMC bought Danish pesticide maker Cheminova and sold its alkali chemicals business to Tronox.

While purveyors of crop chemicals and seeds had a difficult season, fertilizer makers made out better. In particular, Mosaic flourished amid higher demand for phosphates and higher prices for potash. These twin engines delivered a profit windfall of $685 million, up 47.0% compared with last year.

In contrast, the environment for construction chemicals has not been nurturing, and both W.R. Grace and Axiall are planning business sales or spin-offs to exit that market. Earnings at both companies plummeted in the first half.

Grace plans to form a new public company from its construction products segment and its Darex packaging business in early 2016. And Axiall is reviewing alternatives for its building products business. It previously announced plans to sell its aromatics business by the end of this year.

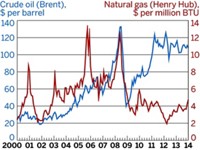

Those moves will leave Axiall with only chlorovinyls, a business that had a poor second quarter because of weak pricing for caustic soda and polyvinyl chloride compounded by unplanned outages. Lower natural gas prices helped but did not rescue results. Similarly, PVC maker Westlake Chemical reported lower prices for all of its products. But its acquisition of Vinnolit, a specialty PVC resin business, enabled it to grow sales by 13.0% and earnings by 7.0%.

Indeed, in the current slow-growth, strong-dollar economy, chemical firms seem able to increase sales only through acquisition. Albemarle’s purchase of Rockwood Holdings and its lithium business helped Albemarle boost sales by more than 50% and earnings by 34.5%. Eastman Chemical’s purchase of amines specialist Taminco helped it grow sales by 4.4% compared with last year.

According to ACC, the second half of the year will look much like the first half. “There was upward momentum in plastic resins used in light vehicles, which are on track for a very good sales year, but we also continue to see declines in oil-field chemicals and U.S. exports overall, largely as a result of softer oil prices and a strong U.S. dollar,” said ACC Chief Economist Kevin Swift.

Data from ACC’s economic indicators, which it compiles into a Chemical Activity Barometer, suggest the economy will heat up a bit in coming months. The barometer, Swift said, “is still signaling slow, albeit potentially accelerating, gains in business activity into the early part of 2016.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter