Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Antibiotics

Antibiotics: Will the bugs always win?

Finding a new antibiotic is hard enough. Throw in regulatory and business obstacles and the job can seem impossible.

by Ann M. Thayer

September 5, 2016

| A version of this story appeared in

Volume 94, Issue 35

The discovery three months ago of the first person in the U.S. infected with Escherichia coli that carries the mcr-1 gene set off alarms among researchers fighting antibiotic resistance. Six months prior, Chinese scientists had found that the gene imparts bacterial resistance to colistin, a 50-year-old polymyxin antibiotic. Colistin-resistant bacteria have also been identified in Europe and Canada.

In brief

The development of bacterial resistance to antibiotic drugs is a growing global problem. However, only a few dozen new treatments are in the development pipeline to tackle the most serious drug-resistant pathogens. Despite a few major changes aimed at smoothing antibiotics’ path to market, companies both small and large continue to face scientific, business, and regulatory challenges. As the following pages show, success in developing new antibiotics will require further policy changes, marketplace incentives, and a better understanding of how to thwart drug-resistant pathogens.

Although colistin fell out of favor in the 1970s because of its toxicity, it has become a drug of last resort against multi-drug-resistant infections. This last line of defense is now under attack.

Antibiotic-resistant pathogens already cause at least 2 million illnesses and 23,000 deaths each year in the U.S., according to the U.S. Centers for Disease Control & Prevention, with a similar number of deaths occurring in Europe as well. CDC considers three—Clostridium difficile, carbapenem-resistant Enterobacteriaceae, and drug-resistant Neisseria gonorrhoeae—as urgent threats.

Among the next level of serious threats are drug-resistant forms of Enterococcus faecium, Staphylococcus aureus, Klebsiella pneumoniae, Acinetobacter baumannii, Pseudomonas aeruginosa, and Enterobacter species such as E. coli. Together, these bugs make up the widely used “ESKAPE” list.

Even as antibacterial resistance knocks down the drugs available to fight infections, only about 40 small molecules and two dozen other approaches, including antibodies and vaccines, are in clinical testing. Although many are intended to treat infections caused by the urgent and ESKAPE-listed threats, only one in five such drugs make it from Phase I testing to approval.

Sources: Pew Charitable Trusts as of May 2016, company information

Antibiotics research had its heyday in the 1950s. But as R&D efforts yielded fewer new drugs and prospects for financial returns shrank, all but a few large pharmaceutical companies pulled out. A number of small firms have picked up the work, but antibiotics R&D remains an uphill battle. Winning it will require a near-perfect alignment of scientific, regulatory, and economic forces.

Only a handful of new antibiotic classes have been discovered since 2000. The Pew Charitable Trusts, which tracks antibiotics R&D, points out that nearly all the antibiotics approved in the past 30 years are variations on existing drugs. It is concerned that when resistance develops to one antibiotic in a class, the other members will soon fall. In May, Pew laid out a road map identifying research goals and steps to overcome scientific barriers impeding antibiotic discovery.

“We have to figure out how better to do antibacterial chemistry,” says Lynn Silver, a former Merck & Co. scientist who consults with Pew and others on antibacterial discovery and preclinical development. In particular, she wants to see more compounds against the gram-negative bacteria that make up most of the ESKAPE and urgent-threat lists. Gram-negative bacteria have a complex outer membrane structure that stymies efforts to develop drugs that can enter them.

“We have no rational way of doing this, and it is what has really prevented us from moving forward,” Silver says. “Most of the advancement in antibacterials has been in modifications to the earlier classes to make them more robust and work against resistant bugs.”

But it has become a race against the clock, because resistance can develop “overnight” with just a single mutation, Silver explains. “It has finally been recognized that the good antibiotics have multiple targets or other features that don’t give rise to resistance.”

A call to arms

Bacterial resistance has eroded the usefulness of tetracyclines, a 70-year-old family of broad-spectrum antibiotics that were once a key defense against infection.

Sources: Pew Charitable Trusts as of May 2016, company information

Sources: Pew Charitable Trusts as of May 2016, company information

Paratek Pharmaceuticals, one of the small companies active in the field, is trying to rearm tetracyclines. It uses structure-activity relationships to make substituent changes on a minocycline core. The goal is to circumvent the two most common resistance mechanisms against tetracyclines, explains Evan Loh, the company’s president and chief medical officer.

One way is avoiding recognition by efflux pumps, which bacteria use to grab antibiotic molecules and throw them out. Another is thwarting attempts by bacteria to protect locations on their ribosomes where tetracyclines and other drugs bind and inhibit bacterial protein synthesis.

The 20-year-old company has oral and intravenous forms of omadacycline, an aminomethylcycline, in Phase III trials. Although active against tougher-to-fight gram-negative bacteria, omadacycline is being tested initially against bacterial pneumonia and skin infections, most frequently caused by gram-positive bacteria.

So far, Paratek has seen little evidence that resistance to omadacycline will develop. “Knock on wood, we have not been able to induce resistance in the lab,” Loh says. However, he says resignedly, “bugs will always win.” If it is used incorrectly and resistance does start to emerge, he anticipates it happening less quickly than for other antibiotic classes, such as the quinolones, that omadacycline would replace.

Loh is excited by the prospect of approval. “There hasn’t been a new tetracycline-based, broad-spectrum antibiotic since Tygacil,” he says. Approved in 2005, Tygacil is an intravenous glycylcycline that Loh worked on earlier in his career at Wyeth, now part of Pfizer.

It was more than 10 years ago that Paratek first tested omadacycline in humans. In 2011, with regulatory guidance in flux and no clear path forward, its then-partner Novartis gave omadacycline back in what was to have been a $485 million deal. For a few years, Paratek struggled to attract funding. It even halted development for a while.

During that time, the 2012 Generating Antibiotic Incentives Now Act directed the Food & Drug Administration to update its policies and issue new guidance. The agency also began granting a special status—qualified infectious disease product (QIDP)—to antibacterial drugs targeting serious or life-threatening infections. QIDPs enjoy expedited approval and five years of market exclusivity beyond existing patent protections. Winning QIDP status helped Paratek get its omadacycline program going again.

Like Paratek, Tetraphase Pharmaceuticals needs to complete one more Phase III trial of its lead product, QIDP-designated eravacycline, to file for approval. The drug arose from the 10-year-old company’s collection of fully synthetic tetracycline analogs. Tetraphase is testing eravacycline against complicated intra-abdominal infections (cIAIs) and complicated urinary tract infections (cUTIs), both likely caused by the presence of gram-negative bacteria.

The results so far have been mixed. A Phase III trial for cIAIs was successful, but one for cUTIs did not meet the end goal. “That study initially had an intravenous-to-oral transition, and it turns out our oral product underperformed,” says Patrick Horn, Tetraphase’s chief medical officer. The company is still committed to developing the oral formulation because few antibiotics targeting multi-drug-resistant, gram-negative infections can be delivered orally.

Tetraphase has two other tetracycline analogs in early-stage trials. Funded through Phase I by the National Institute of Allergy & Infectious Diseases (NIAID), TP-271 is being developed to combat respiratory diseases caused by bioterrorism threats as well as pathogens associated with community-acquired bacterial pneumonia. TP-6076 is a second-generation, gram-negative agent active against carbapenem-resistant bacteria, including hard-to-treat Acinetobacter.

Another small firm, Melinta Therapeutics, expects to soon file for approval of Baxdela (delafloxacin). It licensed the drug from Japan’s Wakunaga Pharmaceutical in 2006 after Abbott returned it in a portfolio reshuffle. Eugene Sun, Melinta’s chief executive officer, led the development efforts at Abbott. Oral and intravenous forms are expected to treat hospital-acquired pneumonia and skin infections, often caused by methicillin-resistant Staphylococcus aureus (MRSA).

Baxdela is a fluoroquinolone, but it differs from others in the class in its size and charge, explains Melinta’s chief scientific officer, Erin Duffy. Although the anionic molecule remains subject to the same resistance mechanisms as other fluoroquinolones, its high potency means that clinically meaningful resistance is harder to develop, she says.

Melinta has early-stage programs arising from its expertise in the structure and function of the bacterial ribosome. To avoid resistance, it decided to hit a new site on the ribosome in gram-negative bacteria. Using structure-based drug design, it then generated three new classes of antibiotic. Melinta expects to start clinical trials of one of these, a pyrrolocytosine, in 2017.

“Having a new class is a real benefit because you are not shackled by the properties of a known class and then trying to either modify those or overcome the liability,” Duffy says. “So that is a blessing. The curse is that you don’t know what you don’t know in terms of druggability and safety.”

Combining old and new, Entasis Therapeutics is a 2015 spin-off of AstraZeneca’s antibiotics R&D group. Its gram-negative-pathogen-directed approach combines various drug discovery tools with medicinal chemistry to rationally design molecules while also trying to understand bacterial uptake of drugs, CEO Manos Perros explains.

Entasis’s most advanced agent has completed Phase II trials with support from NIAID. ETX0914, or zoliflodacin, is an oral spiropyrimidinetrione for treating uncomplicated gonorrhea. It binds at a new site on the DNA gyrase enzyme targeted by older drugs, such as the fluoroquinolones.

Entasis is also working to restore the usefulness of once-widely-used β-lactam antibiotics. Bacteria defeat these drugs by making β-lactamase enzymes against them. A long-standing solution has been to deliver a β-lactamase inhibitor along with the drug. But resistance can develop to the inhibitors as well, often because they themselves are β-lactams.

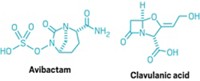

As a new work-around, researchers are developing non-β-lactam β-lactamase inhibitors. In 2015, FDA approved AstraZeneca and Allergan’s Avycaz, which contains such an inhibitor, avibactam, and a third-generation cephalosporin, ceftazidime. Merck has the new inhibitor relebactam in Phase III testing, and Medicines Co. is working with a novel boron-based inhibitor that it gained when acquiring Rempex Pharmaceuticals in 2013.

Entasis’s candidate is ETX2514, a diazabicyclooctenone β-lactamase inhibitor. Because it is potent against multiple classes of β-lactamase enzymes, ETX2514 expands the spectrum of gram-negative, drug-resistant bacteria that are treatable with β-lactams, Perros explains. The company is looking at ETX2514 in combination with the antibiotic sulbactam, which has intrinsic activity against Acinetobacter.

Another strategy for killing gram-negative bacteria is to harness drugs designed for gram-positive bacteria. “Gram-negative pathogens don’t typically see gram-positive agents, so there is no evolutionary reason for them to build in that resistance yet,” says Ankit Mahadevia, CEO of Spero Therapeutics, which is pursuing this approach.

The trick is to overcome the imposing outer wall of gram-negative bacteria. To do so, Spero has developed chemical potentiators that disrupt the wall by interacting with its lipopolysaccharides to increase permeability. The firm has been testing the potentiators in combination with antibiotics. Spero also acquired a series of bacterial gyrase and topoisomerase inhibitors from Vertex Pharmaceuticals.

“We treat multi-drug-resistant pathogens quite well because we don’t overcome resistance mechanisms. They are irrelevant to us,” Mahadevia says. “Even for drugs that have shown gram-negative selection, the data demonstrate that we add more punch to them because they get into the cell at a much higher concentration.” Spero expects to start clinical trials of its first potentiator, the polymyxin B derivative SPR741, this year.

Monoclonal antibodies also can potentiate the effect of antibiotics, albeit by a different mechanism. “You can get a boost in the antibiotic effect or, in other words, a decrease in the minimum inhibitory concentration needed to eradicate the organism,” explains Rene Russo, CEO of six-year-old Arsanis.

But Arsanis wants to alleviate the need to rely on antibiotics. The goal of the company’s lead antibody, ASN100, which should enter Phase II trials this year, is to neutralize bacterial toxins that cause human disease. For example, patients who are on ventilators may be colonized with S. aureus. A dose of ASN100, which contains two different antibodies, is designed to prevent colonized bugs from turning virulent and causing pneumonia. Once the toxins are neutralized, the body can clear the bacteria and keep them at bay.

Because the antibodies target bacterial toxins, and not the organisms themselves, Arsanis hasn’t been able to induce any type of resistance. “Preventing disease is the ultimate in antibiotic stewardship and the ultimate in preventing the emergence of antibiotic resistance because we avoid the need for antibiotics,” Arsanis Chief Development Officer David Mantus says.

However, going after some bacteria will likely require antibodies that are directly bactericidal. With ASN-4, Arsanis is targeting a new receptor it has identified in certain drug-resistant E. coli.

Monoclonal antibody approaches now make sense in the fight against infection, Russo says. “Antibodies are incredibly specific, and the field has moved from broad-spectrum, low-cost antibiotics to a desire for more precision therapies to be used more conservatively and targeted in patients who are at very high risk.”

Advertisement

Another small firm, Achaogen, is tackling gram-negative bacteria with both antibodies and small molecules. The company’s lead program is the aminoglycoside plazomicin, designed to overcome resistance mechanisms affecting this 40-year-old class, says CEO Kenneth Hillan. The program is funded in part by the Biomedical Advanced Research & Development Authority (BARDA) for up to $104 million.

Two Phase III trials are under way. One, looking at plazomicin’s use against cUTIs, is to support a regulatory filing in the second half of 2017. Another is studying the drug in patients with serious bacterial infections due to carbapenem-resistant Enterobacteriaceae, one of the urgent bacterial threats.

Regulatory hurdles

That one of Achaogen’s studies is focused on a bacterial disease and the other on a bacterial pathogen itself has made for an “interesting journey,” Hillan says. “Both trials are going to be extremely important from a clinical perspective and a regulatory perspective.”

Five or six years ago, the regulatory pathway was extremely uncertain for any type of antibacterial agent. Political and public pressure to speed up antibiotics development brought changes at FDA. Today, developers say they are enjoying clearer guidance and greater cooperation from the agency.

However, most clinical trials for antibiotics still involve testing in a disease-related study, such as for cIAI or cUTI, and comparing it for “noninferiority” to the best available therapies, Silver explains. That’s a problem in itself, she says, because “now you have a new drug that’s not inferior to an old drug, but how are you going to sell it?”

“It is very hard to show that your drug is better than another unless it specifically can cover resistant bugs,” Silver says. But then the problem becomes how to conduct a clinical trial targeting bacteria that can’t be treated with anything, because using a placebo in critically ill patients isn’t an ethical option.

As the science turns toward defeating specific drug-resistant bacteria, many developers see a need for pathogen-specific trials, rather than ones in diseases where they hope to come across the bacteria. “Today we face pathogens that are essentially resistant to all of the major classes of antibiotics, and it is important for us to study in that setting,” Hillan says.

When it comes to clinical testing, however, the pathogen-specific approach is relatively untried and difficult to conduct, as Achaogen discovered. Without rapid diagnostic tests, it is hard to identify and enroll patients in time to treat them appropriately. What’s more, countries afflicted by high rates of drug-resistant pathogens often don’t have the resources for running clinical trials.

In July, FDA held a much-talked-about public workshop on antibacterial development against infections resulting from highly resistant pathogens. The event featured a discussion about how to develop antibiotics targeting a single species.

“Policy matters,” Spero’s Mahadevia says. “You can draw a direct line from the regulatory reforms that we have seen in the industry, as well as from tangible discussions around incentives, to a resurgence of activity in the field.” Small companies like Spero, he says, have been “able to get off the ground and raise meaningful capital.”

Funding the war

Positive shifts appear to be encouraging a modest return by big pharma as well. Roche, for example, has partnerships with the antibiotic developers Spero, Discuva, Meiji Seika Pharma, and Fedora Pharmaceuticals.

Although AstraZeneca recently decided to sell its non-U.S. small-molecule antibiotics business to Pfizer for up to $1.6 billion, it is retaining a stake in Entasis and working on biologic approaches through its MedImmune unit. And Allergan acquired Durata Therapeutics in 2014. In the same year, Merck acquired Cubist Pharmaceuticals.

However, small antibiotics companies point out that there just aren’t enough big pharma players in the field. And their interactions with the smaller firms are often acquisitions that occur late in product development or even after launch, as was the case with Cubist and its drug Cubicin, Durata with Dalvance, and Rempex with Carbavance.

As a result, small antibiotics firms find themselves having to support their drug development programs alone through expensive late-stage trials and preparation for commercial launch. “The ability to be extremely successful with an antibiotic can be harder than in other therapeutic areas, and yet the development costs and timeline is pretty similar,” Tetraphase’s CEO, Guy MacDonald, says.

Despite growing concern in the public health community about antibiotic resistance, the sector isn’t considered financially attractive. Potential investors see both scientific challenges and lackluster sales potential and come away unimpressed.

“We compete for the same health care investors as all of the other small companies,” Achaogen’s Hillan says. “Those investors have to decide, ‘Will I put my dollar in an oncology company, or will I put it in an antibacterials company?’ ”

Investing in an antibiotic firm can be a tough sell: To keep resistance levels down and maintain effectiveness, doctors often hold new drugs in reserve and use them only when needed and with limited patient populations. Companies support such good antibiotic stewardship, but they lament its business impact. “Uniquely among therapeutic categories, the better your drug is, the less it is going to be used,” Melinta’s Sun says. “And that is not a good investment thesis.”

Financial challenges for antibiotic developers extend to health care providers. Facing their own economic pressures, hospitals are constrained in how they reimburse for drugs, so it’s often difficult to convince doctors to spend money on a new therapy, especially if cheaper generics are available, Arsanis’s Russo explains. “Even if you can provide benefit to the patient, you really have to have a very strong health economic argument.”

“Many people say the market is broken,” Russo says. “I would say that it is evolving, but the market and the reimbursement models are evolving much more slowly than the medical need.”

In the antibiotics field, it’s common to hear about a desire for “value-based pricing,” in which the cost of the drug is aligned with the impact it can have on patients and the health care market. “We are not asking for special treatment,” Spero’s Mahadevia says. “If we believe as a society that anti-infectives are important, then we should put them at least on a level playing field with other therapeutic areas.”

A sign that attitudes may be changing is Allergan’s success with Avycaz. The firm prices the drug at up to a lofty $12,000 for a course of treatment but has been enjoying good sales.

Mahadevia argues that it is possible to create a viable antibiotics business model. But doing so may require external financial incentives. Indeed, as many as four dozen different “pull” incentives have been proposed to reward companies when they are successful in getting products to the market (J. Antibiot. 2016, DOI: 10.1038/ja.2015.98).

Economic incentives include cash payouts for antibiotic developers, advance purchase programs, and vouchers that developers can use to speed approval of other products. Such programs would ensure that antibiotics are produced and available, but not promoted or used unnecessarily.

Although such ideas are attractive, some company executives aren’t convinced that the necessary coordination and funding will ever come together. Rather than market entry rewards, many would be happy to see improvements in the marketplace itself, such as the changes in reimbursement policies proposed in the Developing an Innovative Strategy for Antimicrobial Resistant Microorganisms (DISARM) Act in the U.S.

Two other acts—the Promise for Antibiotics & Therapeutics for Health (PATH) Act in the Senate and the companion Antibiotic Development to Advance Patient Treatment (ADAPT) Act in the House of Representatives—seek to streamline approval by allowing for smaller clinical trials in areas of unmet need.

“As a small company, we are pragmatic—anything that levels the playing field is better than nothing, and any one of them could help us,” Mahadevia says. “We just have to convince everybody to get behind a solution and go for it.”

At the same time, many “push” incentives designed to support and encourage antibiotics R&D are emerging. Already in place is government funding, such as that from BARDA, NIAID, and the European Union’s Innovative Medicines Initiative.

In July, groups including BARDA, NIAID, and the U.K.’s Wellcome Trust created the Combating Antibiotic Resistant Bacteria Biopharmaceutical Accelerator, or CARB-X (Nat. Rev. Drug Discovery 2016, DOI: 10.1038/nrd.2016.155). Initial funding is $350 million over five years. The public-private partnership intends to take new antibiotics, diagnostics, and vaccines through preclinical development and then hand them off to public or private groups.

“There are number of initiatives to restart the discovery engine in antibacterials, and all of these are crucial,” Entasis’s Perros says. Success is critical, he adds, because it will “drive a change of the discovery, development, and ultimately commercial landscape.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter