Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Ginkgo Bioworks and Zymergen scale up synthetic biology with robots

Two hot start-ups are giving the biobased chemicals industry new life

by Melody M. Bomgardner

November 14, 2016

| A version of this story appeared in

Volume 94, Issue 45

Companies have been using biotechnology ever since Robert A. Swanson and Herbert Boyer founded Genentech in 1976. From its start as a way to get microorganisms to spit out drugs, the technology is now used industrially to make enzymes, biopolymers, and fuels.

The technology works, but it can be cumbersome and slow. Now a new group of companies wants to take its latest iteration—synthetic biology, in which organisms are changed with DNA sequences completely designed and synthesized by humans—and breathe new life into industrial biotech. The impact on biobased chemicals and materials could be enormous if an emerging ecosystem of specialized start-ups can successfully work together.

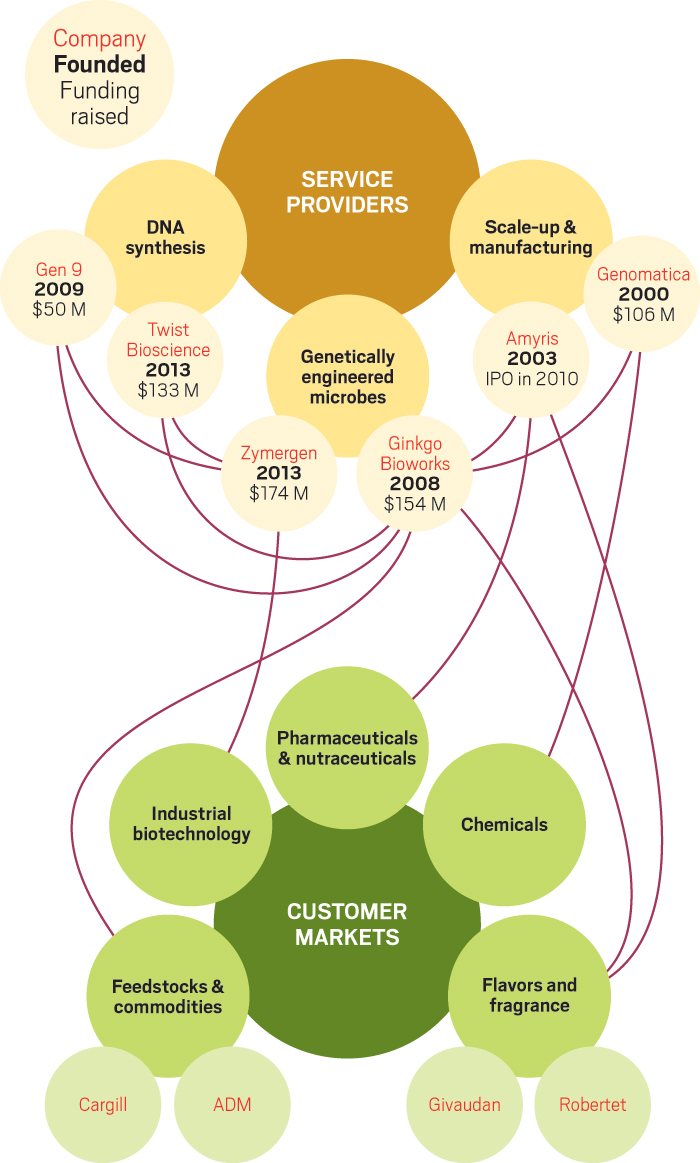

Ginkgo Bioworks and Zymergen have placed themselves in the center of this new ecosystem, by pursuing fast, large-scale, and highly automated approaches to make thousands of genetically engineered organisms in parallel. And that’s pretty much all they do. They don’t build factories or make products based on their innovations.

The custom microbes developed by Ginkgo and Zymergen contain DNA that has been precisely designed by the companies’ scientists and their computer models. Both firms heavily depend on other companies, Twist Bioscience and Gen9 in particular, to cheaply produce large amounts of the synthetic DNA that turns a microbe into a manufacturing tool for industry.

This divide-and-conquer approach has attracted the attention of venture capital investors. Ginkgo, Zymergen, Twist, and Gen9 have raised a combined $486 million since 2014—a huge amount for the biobased materials industry. But to prove their mettle—and repay investors—the start-ups need their new and better microbes to be put to work churning out products that people will buy.

Investors in the new synthetic biology firms are likely making a good bet, suggests Victor Oh, a reseach associate at Lux Research, which tracks the advanced materials sector. “There has been a lot of hype and use of the phrase ‘synthetic biology’ as if it’s a new thing, but it is not. What is new is that a firm like Ginkgo is really automating it,” Oh points out.

“That is the revolution—a roomful of robots and how much that can do versus what a roomful of microbiologists can do. It has really changed the game.”

To increase their odds of market success, Ginkgo and Zymergen are agnostic about what microbes and corresponding end-products they develop. They work closely with customers or downstream collaborators to identify desired targets—say, a flavor compound or specialty chemical. They get paid for the microbe and are not on the hook for bringing products to market.

That contrasts with their predecessors in the biobased world. Many of those firms did it all—engineer a microbe, develop a product, and build a plant. Even as inexpensive and fast genetic sequencing became common, using that information to build better organisms required a lot of time-consuming manual effort at the bench.

As Oh says, it’s difficult for one company to maintain expertise in microbiology, product development, and manufacturing all at the same time. Just getting the microbe in shape to produce a chemical at the desired yield can take many years and sap the patience of investors.

Oh points to the French biotech firm Deinove. For a decade it has worked on a platform based on Deinococcus bacteria to produce fuels and chemicals. The firm’s scientists are experts at working on that one organism and have automated their strain improvement and pathway development, Oh says. But in September, Deinove said it would shift focus to antibiotics and carotenoids.

“After 10 years, they just need to get something to market,” Oh says.

Jason Kelly, Ginkgo’s chief executive officer, agrees that the go-it-alone approach—vertical integration, he calls it—doesn’t work. “If you have to be good at all those things to bring a product to market, that’s a very high hurdle. The industry spent $5 billion trying it.”

Kelly says Ginkgo is staying in its own lane: putting engineered DNA into microbes, growing them, and testing their performance in environments that mimic the precise manufacturing conditions at its customers’ facilities.

Ginkgo was formed in 2008 and existed on government grants for years. “But we have been emblematic of a shift that has happened in the past two years,” Kelly says. That’s when investors—many from the tech world—discovered synthetic biology. The firm raised $125 million in 14 months. “First we had to prove the core technology works, now we are scaling up.”

So far, the scale-up has been lightning fast. Ginkgo built its first organism “foundry”—called Bioworks1—in early 2015 and followed this September with Bioworks2, a 1,700-m2 facility in Boston. Already, the company is planning a third, even larger, foundry to open next year.

Sources: SynBioBeta, Ginkgo Bioworks

Sources: SynBioBeta, Ginkgo Bioworks

The new facility houses scientists, engineers, fermenters, and 31 different robots. Ginkgo’s workforce of more than 100 includes synthetic biologists, systems biologists, protein engineers, computational biologists, genome engineers, organism engineers, sequencing experts, analytical chemists, fermentation engineers, automation engineers, process engineers, and software developers.

All of that is to make it possible for Ginkgo to produce and test thousands of microbe variants at once. That’s key, explains Christina Agapakis, the firm’s creative director, because developing an optimized organism is still a trial-and-error proposition.

“When we’re designing a new pathway for a new project or product, we can’t predict which sequence is going to do the job or do it well,” Agapakis says. With the ability to buy hundreds of thousands of synthetic base pairs to test different sequences, “we can get a really broad picture of an important enzyme and see what versions will be more successful,” she says.

Ginkgo stitches genes together from short synthetic DNA sequences provided by Twist Bioscience and Gen9. The company is so large that its bulk orders have made those two firms much bigger. In 2015, Ginkgo ordered 10 million base pairs from Twist. Next year, Ginkgo will buy 300 million pairs from Twist and another 300 million from Gen9, which could represent as much as 60% of the market for synthetic DNA.

“Those relationships are vital for us,” Apagakis says. “It’s not possible to do what we do without them.”

Twist cofounder Emily Leproust is thrilled with how Ginkgo is expanding the market for DNA synthesis. “They were able to take advantage of this massive amount of DNA and alter the machines that we use in the industry to move in fast and take market share, to the point where now they are the trailblazer,” Leproust observes.

Their mutual success so far proves that DNA synthesis and strain engineering are scalable, Kelly asserts. “As you do more, it gets cheaper to do.” Twist is selling sequences for 9 cents per base pair, or even less on large orders, compared to 30 cents three years ago and about $1.00 in 2006. “With cheaper DNA, the budget buys more, and then you can get a bigger budget and buy even more,” Leproust says. “It’s a very good feedback loop.”

Kelly says he’d be happy to outsource even more of Ginkgo’s synthetic gene-making to his partner firms because the market for productive microbes is bigger than his firm’s capacity. “No one makes sequences larger than 10,000 base pairs—I have to do that myself and I’m not happy about it.” It doesn’t bother Kelly to be so reliant on his suppliers. “Mutual dependence across the industry is fine,” he says.

Still, there are limits to how much information Ginkgo is sharing. When it places orders for DNA it sends only the sequence that it wants and does not disclose the organism or the specific product it is working on, according to Twist.

Agapakis explains that Ginkgo’s main business is making microbes that express so-called cultured ingredients: fine chemicals for fragrances, flavors, cosmetics, and nutrition. For example, it is working on lactone molecules and rose scent for flavor and fragrance customer Robertet and an unnamed ingredient for agribusiness giant Archer Daniels Midland. In addition, Ginkgo provides enzyme discovery services and strain improvement for Cargill and other industrial biotechnology firms that are already using microbes.

But it has deeper relationships with two downstream collaborators, the biobased products manufacturer Amyris and Genomatica, a biotech firm that develops microbial production processes for large-volume intermediate chemicals. Both are survivors of the earlier era of the biobased industry, and both have strong microbial engineering chops themselves.

“At one point they would have been considered competitors, as they do a lot of synthetic biology in-house,” Lux’s Oh says. “But at Amyris and Genomatica, their core business ability is in fermentation and the actual manufacturing of chemicals and products.”

Kelly gives Amyris credit for making a market in microbe-derived fine chemicals, pointing to the firm’s 2014 breakthrough: commercializing a cost-effective microbial pathway for the patchouli fragrance molecule. He says Ginkgo and its other customers benefit from collaborating with a firm that reached commercial scale because fermentation and actual manufacturing “are a known nightmare.”

Industrial-scale fermenters are usually 3,000 L and operate at specific temperature, pressure, and pH. The microbes need to be cheaply fed and defended from competing organisms. These operating constraints mean that not all microbes optimized in the confines of the lab will work on the factory floor.

Amyris operates a commercial facility in Brazil and has a track record of delivering high-margin fragrance molecules as well as large quantities of farnesene, an intermediate chemical that it sells and uses to make chemicals such as the cosmetic ingredient squalene.

According to Joel Cherry, Amyris’s head of R&D, the partnership with Ginkgo expands his firm’s development capacity. “We have 13 corporate partners and 25-plus molecules under development. That’s way more than one company can do at once, and Ginkgo has a similar pipeline with lots of products,” Cherry says. “The real trick is finding the synergy between our two firms to get more done.”

And Ginkgo’s high profile, combined with Kelly’s ability to generate interest in the capabilities of synthetic biology, have already brought Amyris new customers, Cherry says.

The collaboration with Genomatica brings the broader chemical industry into Ginkgo’s fold. Genomatica works on large-volume intermediates and specialty chemicals that are produced in dedicated facilities run by major chemical companies.

It’s a different set of challenges than making pricey fragrance molecules, points out Genomatica CEO Christophe Schilling. The chemical industry needs microbes that are designed for high yield and low costs to compete with petroleum, he says. “And you can’t just hand a microbe to a chemical industry customer—you have to deliver the whole manufacturing process.”

Genomatica and Ginkgo do not have overlapping product areas but rather complementary capabilities, Schilling says. “You’ve got the capabilities of Genomatica to design a process and pathway to get to specific molecules, Ginkgo to drive the engineering and construction of microbes, and then our process engineering.”

Compared to the community Ginkgo is building to serve a wide swath of industries, the microbe makers at Zymergen are taking a narrower path. “We don’t feel the need to create a virtual ecosystem of players,” says Zymergen CEO Josh Hoffman. Instead, he says, the firm is focused on optimizing microbes for large companies already running scaled-up fermentation operations.

The goal is to improve the economics of a fermentation reaction by a factor of three to five by increasing yield or titer amounts. Zymergen works across a wide range of microbes including common production organisms such as filamentous fungi and Streptomyces bacteria.

Hoffman says Zymergen has differentiated itself by creating a technology infrastructure based on machine learning software and robots.

“Oftentimes we don’t even have an idea to start from—all the ‘omics’ we have make a data hairball, and the ideas we do have are almost always wrong,” he says.

Instead of starting with a hypothesis or known metabolic pathway, Zymergen’s scientist set their machines loose on whole genomes. “We find that in strain engineering, at least half of the beneficial changes we might make are off-pathway—somewhere in the dark space of the genome,” Hoffman says.

Advertisement

Zymergen says it has customers in the Fortune 500 but declines to name them or disclose its revenue streams. Lux’s Oh says both Ginkgo and Zymergen will likely earn near-term revenue from customers via R&D payments. The value-adding microbes that they create will bring royalties when customers start selling products made by their designer creations.

The first money-making products will be fine chemicals for the fragrances, flavors, and nutrition markets as well as improved strains of existing industrial microbes, Oh says. Larger-volume, industrial chemicals will be further out because their attractiveness is more dependent on petroleum prices.

Ginkgo’s Kelly and Hoffman of Zymergen both say their firms are also dedicating some of their capabilities to making new-to-the-world products. Compared to the petroleum palette, “biology has a huge range of different starting points,” Hoffman says. He lists adhesives for wet environments, clear polyamide films that don’t require heat curing, and improved fiber optic cables as potential new nature-inspired materials.

Bringing new molecules to market would certainly help this new ecosystem succeed because it is made up of companies that might otherwise be rivals. Genomatica’s Schilling, a relative old-timer in the biobased industry, marvels at the attention and investments the new players are getting compared to the struggles biobased firms like his own faced a decade ago.

“There is exuberance because of their ability to attract a lot of dollars,” he says. “But in some number of years—two or three, not more than five—after you start raising that kind of money, you’ve got to deliver.”

Inside Bioworks2, organism factory

The first steps visitors take into Bioworks2, Ginkgo Bioworks’ new facility in Boston, are sticky ones. An adhesive-coated welcome mat at the facility’s threshold cleanses soles, keeping dirt away from the facility’s immaculately clean floor as well as the sensitive microorganisms inside.

That dazzlingly white floor, along with the bright white ceiling tiles and wall of windows that look out into the surrounding office suite, can make a visitor feel like Charlie Bucket entering one of Willy Wonka’s testing rooms. But instead of creating chocolate to be sent via television, scientists working in Bioworks2 create yeast genetically engineered to churn out valuable chemicals.

Ginkgo’s grand plan is to use microorganisms engineered with synthetic DNA to create chemicals, thereby bringing biology, which the company describes as “the most advanced technology on the planet,” into new markets, such as consumer goods and industrial manufacturing.

The facility, or foundry as Ginkgo likes to call it, opened in September in a sort of fishbowl at the center of the firm’s new space across from Boston’s Dry Dock.

In a neighborhood once dominated by ship building and repair, Bioworks2 will enable the company to dramatically expand its efforts in a decidedly 21st century industry—synthetic biology. Here, Gingko scientists will build and test novel microorganisms for chemical manufacturing in a facility that has six times the capacity of the company’s first foundry.

Bioworks2 practically hums with activity. A cabinet on one wall contains Erlenmeyer flasks gently gyrating solutions of microbes, while across the lab there’s a faint fruity aroma where two dozen containers hold a strain of brewer’s yeast designed to synthesize peach flavoring. At the foundry’s core, robots lovingly described as “eight-armed graduate students” sample solutions for analysis.

Jason Kelly, Gingko’s CEO and cofounder, likes to compare the company’s work to the fast-paced world of computer programming. The difference, he explained at an event held as part of Boston’s Hubweek innovation festival in September, is that instead of editing computer code his company edits the code of DNA.

“At the end of the day, information technology just moves bits. Biotechnology moves atoms,” he said. “We see opportunity everywhere you’re moving atoms around.”—Bethany Halford

CORRECTION: This story was updated on Dec. 14, 2016, to correctly represent the relationship between Ginkgo Bioworks and the agribusiness companies Archer Daniels Midland and Cargill.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter