Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

The University Of Oxford’s Start-up Machine

How one of the oldest institutions is becoming one of the most entrepreneurial

by Alex Scott

February 22, 2016

| A version of this story appeared in

Volume 94, Issue 8

When the deadly Ebola virus was ripping through communities across West Africa last April, epidemiologists turned to MinION, an instrument capable of sequencing the DNA of a virus in less than 60 minutes.

The size of a cell phone, MinION could be brought easily to remote locations in Guinea where Ebola cases were rife. Suspected virus samples were sequenced in the field, and the data were immediately transmitted from laptops to a team of microbiologists in the U.K. Within 24 hours they were able to inform epidemiologists whether the virus—or a substrain of it—was present so that appropriate public health measures could be deployed.

MinION was developed by Oxford Nanopore Technologies from science that originated in the research group of Hagan Bayley, a chemist and professor of chemical biology at the University of Oxford. It measures the ionic current of genetic material that passes through nanopores and uses the changes to determine the sequence.

Building an ability to translate knowledge from academic groups such as Bayley’s into businesses that can impact people’s lives is now a key aspiration for the university. “Alongside excellence in research and teaching, we see innovation and knowledge exchange as a key strength of the university,” says Ian Walmsely, an Oxford professor and pro-vice-chancellor for research and innovation.

The university wants to crank up the rate at which it creates start-ups, especially those from its science and engineering departments. It is arguably better placed than any other university in Europe to create chemistry-based start-ups: Alongside a stellar reputation for science research, Oxford has possibly the largest chemistry department in the Western world with 80 research groups.

Within the past year the university has established Oxford Sciences Innovation (OSI), a venture capital fund for start-ups created by its staff and students. With a value of $460 million, the fund is the largest of its kind held by a single academic institute, the university claims.

OSI joins Isis Innovation, an in-house research and technology commercialization firm that the university has been strengthening. Between the two, the university is confident it can more effectively convert an entrepreneurial “buzz” present at the school these days into start-up companies.

“The current time is the most exciting for translation of Oxford science in many years,” says Adam Stoten, head of life sciences technology transfer for Isis. “There is a large and growing proportion of academics at the university who are embracing entrepreneurship, and now we’ve got the infrastructure to support it.”

Isis currently has 40 potential spin-offs in its pipeline—more than ever—as well as 2,900 patents or technologies that it offers for license. Isis was involved in creating 10 new companies in the fiscal year that ended in March 2015, up from eight in the previous fiscal year.

At this level, the university ranks as one of the most entrepreneurial in the U.K. The University of Cambridge runs slightly ahead with 11 new companies in 2015, and Imperial College London generated six.

Yet this activity is Lilliputian when compared with leading U.S. universities: A study based on data from the CrunchBase technology finance website put Stanford University way out in front with 172 start-ups receiving their first venture capital funding in 2013, followed by Harvard University with 103, Massachusetts Institute of Technology with 92, and the University of California, Berkeley, with 79. Tel Aviv University was the most entrepreneurial outside the U.S., with 20 start-ups.

Oxford’s start-up productivity may be modest in comparison, but it has come a long way: In the 40 years leading up to 2000, it created a total of 20 start-ups. Buoyed by OSI and a bigger Isis, Oxford will continue to increase the number of spin-offs it generates, predicts Jamie Ferguson, Isis’s deputy head of technology transfer for chemistry and biophysics. Most of the start-ups are in the life sciences, materials science, and software.

Recent successes include iOX Therapeutics, an immuno-oncology company that raised about $2.6 million, and Bodle Technologies, a developer of thin-film window glazing technologies, which raised an undisclosed sum from OSI.

Isis executives argue that the formation of OSI marks a watershed event in the university’s strategy to commercialize scientific knowledge. “OSI validates the tremendous volume and quality of raw innovation coming out of the university,” Stoten says. “Having a $460 million fund focused solely on Oxford says to other investors, ‘You should be taking notice of what’s going on in this institution.’ ”

OSI was created with money from investors including Invesco Asset Management Ltd., IP Group, Oxford’s endowment fund, and the Wellcome Trust.

Isis has created five start-ups with money from OSI since the fund was created in March 2015. “And we have a large number of opportunities in the pipeline where OSI is likely to commit capital,” Stoten says. OSI’s introduction has also attracted more venture capitalists and angel investors to the university, he says.

The university retains ownership of intellectual property developed within its facilities and licenses IP exclusively to academics wishing to set up businesses. Researchers may have a share of both royalties and companies. The university also gets a stake in the companies, meaning the money it invests can come back, either via a share of profits or from the equity value of a company.

Isis returned more than $20 million to the university and its researchers in the fiscal year ending in March 2015, up from $11 million a year earlier. In the same year Isis also played a role in helping secure $37 million in translational funding for the university’s researchers.

To further improve its ability to create spin-offs, Isis has been hiring staffers able to give advice and support in areas such as IP management and social media strategy. The number of staff has risen from 35 a decade ago to almost 100 today.

“Most people here are expert in something,” Ferguson says. “They come from a variety of backgrounds. Most have a Ph.D. and then worked in industry,” says Ferguson, who himself started out as an engineer with BP and went on to work for start-ups.

To accommodate more experts, Isis recently relocated to a modern brick office building on the outskirts of the city. It is a stark contrast to the medieval quads and dining halls of the university’s old colleges. But the move brings more space and with it the option to add more staff and office space for start-ups.

In addition to the OSI fund, Isis has a list of angel investors and venture capital firms from which it can raise funding. More than 200 companies pay an annual fee of almost $10,000 to gain access to patent information and meet with academics at dinners and other gatherings as part of the Oxford Innovation Society.

Because of its size and financial strength, Oxford has been less active than some other U.K. universities when it comes to joining consortia. An almost $60 million investment fund for drug development created recently by Imperial College London, University of Cambridge, University College London, and three drug companies is “interesting” but not an essential model for Oxford to follow, Stoten says. But the university is considering new approaches that can increase translational support for specific scientific areas, he adds.

When a start-up succeeds in gaining funding, it tends to set up operations in one of the science parks dotted around the city of Oxford. An example is Bodle Technologies, which launched in Begbroke Science Park in late 2015.

Bodle’s technology, which the firm plans to license out, is based on university research that was published in Nature

The firm sandwiches a 7-nm-thick layer of a phase-change material made from germanium, antimony, and tellurium between two layers of transparent electrode. It then runs a tiny current through to create colors within the stack. The stacks, which are less than 100 nm wide, are effectively nanoscale pixels that can be switched on or off to create high-resolution displays, the firm says.

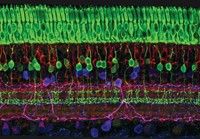

The technology has a raft of potential applications, including displays for phones, “smart” glass for windows, windshield displays, and even synthetic retinas that mimic the abilities of photoreceptor cells in the human eye.

Unlike most liquid-crystal displays, the Bodle pixels don’t need to be constantly refreshed. This means that any display based on the technology would have extremely low energy consumption, the firm says.

Bodle’s three founders are Peiman Hosseini, a postdoctoral researcher; Harish Bhaskaran, associate professor of materials; and David Fyfe, who took Cambridge Display Technology from the lab to a commercial company and sold it to Sumitomo Chemical for $285 million. Bodle was funded by OSI after being awarded research grants by the U.K. government.

One of the first applications the firm is targeting is smart windows. “We can selectively filter infrared radiation passing through a window without affecting the visible component of the light,” Hosseini tells C&EN. “We want to create truly revolutionary smart windows, not next-generation smart curtains.”

Bodle is currently scaling up its technology from lab-scale samples to centimeter- and meter-scale products. Isis was a major contributor to the start-up by helping with patent filing, building a business plan, securing funding, and more, Hosseini says.

Another recent spin-off is iOX. Created last summer, the immuno-oncology firm is developing synthetic lipids that activate an immune cell known as an iNK T cell. There is evidence that stimulation of this type of cell is an effective way to attack tumors and treat cancer.

The lipids were discovered at Oxford in collaboration with the University of Birmingham and Austria’s University of Konstanz. iOX plans to take its lead molecule into Phase I clinical trials in 2016 for the treatment of melanoma.

The university is betting that, with more venture capital money and expertise in place, it can create more spin-offs such as iOX, Bodle, and Oxford Nanopore. “Oxford is really pushing us to explore the commercial spaces of our ideas,” Bodle’s Hosseini says. “This is probably the best time for an academic to be in Oxford.”

CORRECTION:

This story was modified on Feb. 23, 2016, to remove mention of Oxbridge White. The company is a prospective spin-off from the University of Oxford and has not yet raised funding.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter