Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

New-wave Suncreens

Active ingredient makers are frustrated by the long list of sunscreens and UV-A testing protocols that are still awaiting FDA decisions

by Marc S. Reisch

April 11, 2005

| A version of this story appeared in

Volume 83, Issue 15

The rest of the world benefits from a variety of sunscreen active ingredients and effectiveness rating systems that aren't available in the U.S. The Food & Drug Administration has promised to give U.S. consumers more options, but sunscreen ingredient suppliers contend that the agency is dragging its feet.

For example, almost three years ago, chemical companies applied to FDA for permission to sell three new sunscreen active ingredients under expedited review procedures. They are still waiting.

Six years ago, FDA promised manufacturers and formulators that it would advise them on an acceptable measuring system to let consumers know how effectively a sunscreen formulation blocks UV-A rays. The industry is still waiting.

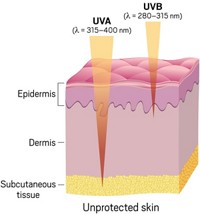

Today, consumers buying sun protection lotions and creams can get some sense of how these products protect them from sunburn-causing UV-B rays by reading the Sun Protection Factor (SPF) rating, which has long been in place to indicate the ability of sunscreens to block UV-B. However, scientists believe that radiation from the UV-A spectrum is responsible for skin wrinkling and, more important, may contribute to skin cancer. UV-B light wavelengths range from 290 to 320 nm; UV-A wavelengths, from 320 to 400 nm.

Until FDA provides UV-A testing guidelines, manufacturers can only indicate that their lotions and creams offer UV-A protection. Consumers have no idea of how effective a sunscreen product is in protecting them against the cancer-causing rays of the sun. That would be useful information because most of the more than 1 million nonmelanoma cases of skin cancer diagnosed in the U.S. annually are considered to be sun-related, according to the American Cancer Society.

FDA says its reviews have taken longer than expected to ensure "that they reflect the current understanding of medicine and science in the field." But the frustration among sunscreen makers and formulators over the agency's lack of action is palpable. In 1999, FDA issued a "final" sunscreen monograph--the dos and don'ts of sunscreen labeling and formulation. The agency has not "finalized"; the document. Proposed UV-A testing and labeling rules are due later this year, the agency promises.

Personal care industry consultant David Steinberg accuses FDA of "foot-dragging." He attributes the delays in the UV-A testing protocols and the slow approval of new sunscreen ingredients to a highly politicized atmosphere at the agency. "It's politics, not science, that has gone wrong," Steinberg says.

Many professionals in FDA are as frustrated as those in the industry over the slow pace of approvals, Steinberg says. Wrangling between Democrats and Republicans over who is to head FDA, pressure on FDA to speed approval of new drugs, and the controversy over approved drugs with serious problems--such as Vioxx and the COX-2 inhibitor class--have all made the agency especially cautious.

Steinberg, who worked with one of the three companies to submit a new sunscreen application to FDA, says it "should only take a half-day to get approval." But it has been almost three years since Symrise, Germany's Merck, and BASF submitted requests to allow use of three ingredients in sunscreen formulations in the U.S.

Symrise, formed in 2002 through the merger of Haarmann & Reimer and Dragoco, asked for approval of isoamyl methoxycinnamate. Merck sought approval for 4-methylbenzylidene camphor. And BASF requested approval for octyl triazone. All would add to the arsenal of UV-B sunscreens available to product formulators.

Each of the companies submitted applications in August 2002 under FDA's TEA process for time and extent applications. FDA put the TEA process in place early in 2002 to expedite listing new sunscreens and other types of over-the-counter (OTC) ingredients in FDA's monographs. Active ingredients with a five-year history of extensive and safe OTC use in another country are eligible for the fast-track FDA review.

COMPARED WITH many other countries, the U.S. has few useful UV-B filters and even fewer UV-A filters. Of the 16 filters now listed for use in U.S. sunscreen formulations, nine are basic UV-B filters, says Nadim A. Shaath, president of personal care consulting firm Alpha Research & Development. Of those nine, only five are extensively used. The others have one issue or another associated with them. Aminobenzoic acid, for instance, stains clothing and may cause adverse reactions in sensitive individuals.

Seven UV filters listed in the U.S. monograph block UV-A rays, Shaath says. But oxybenzone, for instance, is primarily a UV-B filter that also blocks some UV-A rays. Menthyl anthranilate is not a broad-spectrum UV-A filter. Avobenzone provides broad-spectrum UV-A blockage but quickly loses potency on the skin if not formulated properly. Sulisobenzone and dioxybenzone are difficult to solubilize and are rarely used. Two physical blockers, titanium dioxide and zinc oxide, are difficult to incorporate into formulations.

In Europe, by contrast, the list of approved useful UV-A and UV-B sunscreens "goes on and on," Shaath says. That list, in fact, contains 28 approved sunscreens. Sun-kissed Australia has 26 on its approved list, and Canada has 21. Since 1978, FDA has only allowed the addition of avobenzone and zinc oxide to the list.

FDA treats sunscreen active ingredients like drugs for regulatory purposes, Shaath explains, while regulators in Europe and elsewhere treat sunscreens as cosmetics, for which the regulatory approval procedure is less onerous.

Until FDA initiated the TEA process, the only way to get a sunscreen approved was to file a New Drug Application. That meant spending many millions of dollars to do the testing and studies necessary for drug approval in the U.S. Such a route might be cost-effective for a new cancer drug or antibiotic, where annual sales can be in the hundreds of millions of dollars. But a blockbuster sunscreen ingredient would only have sales of about $10 million, Shaath says, far too little to justify the kind of testing expenditures that would satisfy FDA.

In fact, the total U.S. market for sunscreen lotions and potions at the producer level comes in at just about $640 million a year, reports Carrie Bonner, a market manager at consulting firm Kline & Co. By comparison, annual pharmaceutical industry sales in the U.S. exceed $150 billion.

IN EUROPE, the approval process is swifter and less costly. Manufacturers of a new sunscreen ingredient submit standard irritation and sensitivity tests to the European Cosmetic, Toiletry & Perfumery Association, which may then recommend it for regulatory approval. The tests are not as costly as what is required in the U.S. After several years of provisional testing, a new ingredient can move onto a final list of approved ingredients. The list expands and contracts at a faster pace than in the U.S., depending on experience in use, Shaath says.

"We started with a new drug application seven years ago" to get FDA approval of isoamyl methoxycinnamate, says Karl Harris, director of regional business management at Symrise. "We switched to the TEA process when it became available. We're still waiting for approval." Harris adds that he expects approval "any day now."

Ratan K. Chaudhuri, director of cosmetics research and applications at EMD Chemicals, the U.S. affiliate of Germany's Merck, says his firm has yet to hear from FDA about its application seeking U.S. approval for the use of 4-methylbenzylidene camphor (4-MBC). He says he is frustrated that a product with a 25-year history of use in Europe still cannot be used in the U.S.

Chaudhuri acknowledges that scientists have recently looked into the possibility that 4-MBC might be an endocrine disrupter. But he points out that his own company's investigation found no estrogenic effects. Furthermore, the Scientific Committee for Cosmetic Products & Non-Food Products Intended for Consumers, a European Commission advisory body, has for now cleared 4-MBC and one other sunscreen ingredient, octyl methoxycinnimate, while it continues to look into the matter.

"The U.S. is one of the most highly regulated markets," says Folker Ruchatz, cosmetic solutions marketing manager for BASF, which is awaiting approval of its TEA to list octyl triazone in the sunscreen monograph. Octyl triazone is "an extremely photostable filter with strong UV-B absorbence characteristics," according to BASF Technical Service Manager Lee Mores. In other words, Mores says, a little bit goes a long way.

In the meantime, BASF must bide its time before it can submit other new sunscreens for approval. In February, European authorities approved the firm's new UV-A absorber, diethylamino hydroxybenzoyl hexyl benzoate, but it will likely be at least five years before BASF can bring the ingredient to the U.S. "We're committed to introducing it in the U.S. as soon as regulators allow us," Ruchatz says.

Aside from pushing through new active ingredients, it is important that FDA publish acceptable testing methods and label requirements for UV-A protection, says Julian P. Hewitt, sun care team leader for Uniqema. "We currently have no rules for determining or labeling products for UV-A protection," he points out.

Europeans, however, do have such a guideline. Many formulators have adapted the Boots PLC star rating system, which provides a measure of the ratio of UV-A to UV-B radiation absorbed from a simulated light source. For a five-star rating, a sunscreen's UV-A performance must be at least 90% as good as its UV-B efficiency.

Hewitt also points out that current FDA rules do not allow formulators to combine the organic UV-A sunscreen avobenzone with the inorganic sunscreen titanium dioxide. Such a combination, he says, might allow formulators to achieve desirable UV-A and UV-B benefits at lower cost. Uniqema sells a range of nanoparticle-size titanium dioxide products for sunscreens under the Solaveil trade name.

In a letter to FDA in 2000, Ciba Specialty Chemicals argued that the agency should include two of its new sunscreens in a final sunscreen monograph. The firm had developed two broad-spectrum, organic microfine UV-A and UV-B sunscreens now used in Europe and elsewhere: bis-ethylhexyloxyphenol methoxyphenol triazine and methylene bis-benzotriazolyl tetramethylbutylphenol. Ciba trade named the two Tinosorb S and Tinosorb M, respectively.

Tinosorb M is the first of a new class of sunscreens that combine the benefits of an organic and an inorganic filter. "The idea came to us seven or eight years ago," explains Uli Osterwalder, global marketing manager for UV protection and actives. Ciba scientists developed an organic filter that absorbed radiation like an organic compound and scattered and reflected radiation like an inorganic material.

Ciba developed Tinosorb M as a large, photostable, organic molecule with performance characteristics typical of titanium dioxide and zinc oxide, Osterwalder says, but it is easier to formulate with and has higher transparency. Company scientists used similar criteria to develop Tinosorb S, relying instead on chemistry from light stabilizers used in plastics, he adds. Tinosorb M is intended for use in aqueous dispersions, whereas Tinosorb S is for oil-phase sun-care formulations.

Because the sunscreen particles are relatively large, scientists reasoned there would be little chance that Tinosorb M and S could be absorbed through the skin and pose a threat to human health. "We checked both Tinosorb M and S for estrogenic activity, and they were both negative," Osterwalder says. The earliest that Ciba expects to see these two new sunscreens allowed for use in the U.S. is in 2006, when the company will be eligible to submit data to FDA for approval under the TEA process.

Another company with products sitting on the sidelines is DSM, which acquired a stable of sunscreen ingredients as part of its 2003 acquisition of Roche's vitamins and fine chemicals business. "The U.S. has effectively closed the door on newer and better technologies," says Fintan Sit, global marketing manager for DSM Nutritional Products.

Even before the acquisition, Roche had launched a new UV-B filter, dimethicodiethylbenzal malonate, for use everywhere in the world--except the U.S. Sit says the cost of filing a New Drug Application in the U.S. for the filter, known as Parsol SLX, is too high. And without five years of data, it is still too early to qualify Parasol SLX using the TEA route, he says.

"Parsol SLX addresses safety issues we think will come up in the future," Sit says. Octyl methoxycinnimate and 4-MBC came under suspicion a few years ago because people thought these materials might penetrate the skin. Parsol SLX, like the new Ciba filters, is larger than conventional sunscreens. It is made of organic chromophores attached to a polysiloxane chain, Sit says. While the silicone chain has an affinity for skin, it does not penetrate the skin's surface and keeps the sunscreen active ingredients on top, he explains.

Advertisement

While new sunscreen actives are unlikely to find their way into the U.S. market soon, sunscreen ingredient suppliers are doing all they can to tweak approved sunscreens or improve the usefulness of existing sunscreen actives.

For instance, Oxonica, spun out of England's University of Oxford, recently introduced an ultrafine titanium dioxide sunscreen doped with 0.7% manganese. According to Gareth Wakefield, vice president of R&D, the manganese changes the rutile pigment's electronic structure, eliminating its potential to generate free radicals. The manganese also makes the pigment a better UV-A filter than undoped titanium dioxide, he says.

According to David Browning, Oxonica's health care business director, because titanium dioxide is already listed in FDA's monograph, Oxonica expects to introduce its Optisol sunblocker in the U.S. soon.

BASF has also supplemented its existing line of titanium dioxide with two coated microfine pigments manufactured by Sakai Chemical Industry of Japan. "It is a better grade of titanium dioxide because it is more transparent than existing grades," technical services manager Mores says.

And EMD Chemicals' Chaudhuri says his firm expects to introduce a stabilizer that will boost the effectiveness of the UV-A sunscreen avobenzone. The stabilizer, diethyl hexyl syringylidene malonate, is a singlet oxygen quencher that will effectively boost the sunscreen's photostability.

Many involved in the sunscreen ingredients business contend that FDA is ignoring their industry's needs. And as long as the agency remains preoccupied with other matters, U.S. consumers will be among the last to benefit from the latest sun care products.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter