Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Business Concentrates

February 28, 2005

| A version of this story appeared in

Volume 83, Issue 9

Sankyo Co. and Daiichi Pharmaceutical, the second and sixth largest pharmaceutical companies in Japan, are going to merge, according to Japan's leading business newspaper, the Nihon Keizai Shimbun (Nikkei). The companies won't confirm the report, but the Nikkei is a well-connected and usually accurate source of business information in Japan. According to the Nikkei, the merger will be announced shortly and should be complete in October. Sankyo would be the majority shareholder of the holding company that would be used to unite the two firms. The merged company would have sales of $8.7 billion and be the second largest drug company in Japan after Takeda Pharmaceutical. Yamanouchi Pharmaceutical and Fujisawa Pharmaceutical are in the process of combining to create a $7.8 billion behemoth. Japan's largest pharmaceutical companies remain relatively small by international standards and are facing pressure to combine operations to support their expensive R&D activities. Sankyo is strong in circulatory diseases and Daiichi, in infectious diseases. In a statement to the Tokyo Stock Exchange, Sankyo said that it has been exploring a variety of strategies to cope with rapid changes in the pharmaceutical sector but that nothing has been decided yet.

Speyside Equity, a Delaware-based private equity company, has acquired Degussa's fruit systems business for an undisclosed sum. The unit has sites in Philadelphia and Gardena, Calif., and roughly 200 employees. Its sales in 2004 were just under $80 million. The business sells fruit and nonfruit sweet preparations to the food industry; it will take the new name Sweet Ovations and be headquartered in Philadelphia. With the sale, Degussa has cleared the way to divesting the larger remaining part of its food ingredients business.

Symyx, a supplier of high-throughput screening software and technology, has agreed to purchase privately held Synthematix, a developer of organic-synthesis planning software, for $13 million. Symyx CEO Steven D. Goldby says the acquisition will allow his company to add pharmaceutical discovery and biotech functionality to its Renaissance and IntelliChem software, "enabling customers to utilize one integrated solution spanning both their discovery and development research activities." Symyx may pay up to $4 million more to Synthematix shareholders if revenue targets are reached over a one-year period.

Oil and gas producer Kerr-McGee may sell its chemical business--the third largest U.S. maker of titanium dioxide--and has hired an investment bank to help it look into the possibility. DuPont and the Millennium Chemicals subsidiary of Lyondell Chemical are the number one and number two TiO2 producers. Rick Buterbaugh, Kerr-McGee's vice president for investor relations, revealed the information during a conference call last week but did not identify the bank. The firm's chemical sales in 2004 were $1.3 billion, up 5% from the year earlier. Interest in Kerr-McGee has been on the rise since financier Carl C. Icahn filed a notice earlier this month with regulators indicating that he might acquire up to $1 billion in its stock. The company's stock closed at a 52-week high of $74.20 after Icahn's move became public.

Bayer MaterialScience and the Swiss automotive design firm Rinspeed will jointly present a driver-sensing concept car at the Geneva Motor Show next month. According to Bayer, the car, called the Senso, senses the driver by measuring his or her biometric data and then exerts a positive influence with the help of patterns, colors, music, and fragrances. Color panels in the car make use of an electroluminescent film technology developed by Bayer MaterialScience and the Swiss electronics firm Lumitec.

Borden Chemical is building a 125,000-metric-ton-per-year formaldehyde plant and a 170,000-metric-ton resins plant in the southern Brazilian state of Rio Grande do Sul. The resins plant will make both phenol-formaldehyde and urea-formaldehyde resins for fiberboard and plywood used in furniture and construction applications, which are promising markets in the region. Additionally, Borden says it is planning a resin blending facility in nearby northern Uruguay. Borden already has three facilities in Brazil.

MedImmune is putting an additional $100 million into its venture capital fund, MedImmune Ventures, which invests in early- to late-stage companies. The fund, founded in 2002 with $100 million, has invested about $85 million to date in a dozen companies such as Iomai, Inotek Pharmaceuticals, and Receptor BioLogix. On average, individual investments run about $7 million but can be as high as $20 million. Attention focused on MedImmune last fall when it launched FluMist, a nasal spray alternative to flu vaccinations. The firm has had difficulty selling the 3 million doses it produced at the request of U.S. health officials.

Pfizer has agreed to acquire Idun Pharmaceuticals, a 50-employee biopharmaceutical company focused on controlling apoptosis, a process of cell death that occurs in several diseases. Idun's lead compound, IDN-6556, is in Phase II clinical trials for liver transplantation. Pfizer says the purchase furthers a strategy of augmenting its internal R&D efforts. In January, Pfizer announced plans to buy Angiosyn, which is developing a compound to address uncontrolled blood vessel growth.

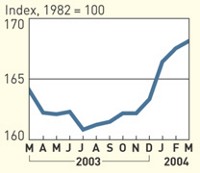

U.S. prices for all chemicals continued to rise in January, but prices for industrial chemicals fell slightly from the previous month, according to data from the Labor Department. The Producer Price Index for all chemicals increased 0.9% from December to 185.3 (1982 = 100) and was 11.2% ahead of January 2004. The index for industrial chemicals, however, took a breather, slipping a slight 0.1% from the previous month to 177.1. The January index for industrial chemicals was up 18.0% from the same month last year.

Biotage is buying Argonaut Technologies' consumables division for $19.9 million in cash. The sale includes Argonaut's synthesis and purification consumables, bioanalytical sample preparation consumables, and flash chromatography systems. Biotage says the acquisition will "strengthen its position" in medicinal chemistry, enabling it to offer a portfolio for drug discovery of microwave synthesis, cleanup and purification systems, and consumables. Argonaut says it is looking to sell its remaining business in process development products and services.

Dynea Chemicals has formed a strategic alliance with the Dutch firm GreenChem to make and market AdBlue, a urea-based additive for selected catalytic reduction technology. The technology is employed by truck makers to reduce the emission of nitrogen oxides and particulate matter to levels below new European standards. This year, most new heavy-duty trucks will incorporate selected catalytic reduction. Under the alliance, GreenChem will handle marketing and sales of the additive, while Dynea, a urea chemistry specialist, will handle sourcing and production.

A multimember partnership has been launched, under the auspices of the European Union's new sixth R&D framework program, to establish design methods for the manufacture of novel dispersed nanoparticulate products. The goal is to encourage processes for making predictable products that meet rigorous quality standards. The partnership brings together the academic institutions Karlsruhe University, Loughborough University, Birmingham University, Warsaw University of Technology, and Poznan University of Technology; technology specialists Rockfield Software, C3M, and BHR Group; and the international companies Unilever and Bayer. The group will develop and refine methods to characterize such factors as particle wettability, porosity, morphology, size distribution, liquid and dispersion rheology, and product stability.

Degussa will spend more than $13 million to build an oil additives plant in Singapore. The plant, to be run by the company's specialty acrylics business, will make RohMax brand additives for the lubricant market. Degussa says the specialty acrylics business will shortly be opening a technical service lab in Shanghai as well. Separately, according to a local report, Japan's Kureha Chemical is studying the construction of a new polyphenylene sulfide plant in Singapore. Kureha is already expanding its U.S. PPS capacity through its Fortron Industries joint venture with Celanese.

Oxiteno, a Brazilian ethylene oxide and derivatives maker, will spend $94 million over the next two years to build a plant in Camaçari, Bahia, Brazil, that produces 100,000 metric tons per year of fatty alcohols, fatty acids, and glycerin. The company says it will use some 30% of the plant's fatty alcohol output to make surfactants.

BASF is expanding its ability to compound Ultramid nylon and Ultradur polybutylene terephthalate in Asia. A new compounding plant will open in Shanghai by the end of 2006, the firm says, and an existing plant in Pasir Gudang, Malaysia, will be expanded by the middle of this year.

Prolexys Pharmaceuticals has licensed antitumor compounds from the Whitehead Institute for Biomedical Research and Columbia University. The small-molecule compounds were discovered by Brent R. Stockwell, formerly of Whitehead Institute and now assistant professor of biology and of chemistry at Columbia.

Lonza and Biotest have entered an agreement covering production of Biotest's BT-061 monoclonal antibody for studies in treating rheumatoid arthritis and psoriasis. Lonza will produce clinical quantities in Slough, England, with an option for large-scale production in the future.

InnoCentive has signed partnerships with four Chinese universities. The agreements, which add to six existing university pacts in China, provide students and researchers the opportunity to solve problems posted by big companies on the InnoCentive website.

Serono has taken a license from Inpharmatica for the latter's Admensa Interactive technology. Admensa is part of Inpharmatica's PharmaCarta platform, which integrates biology- and chemistry-based drug discovery activities.

The European Commission has delayed its ruling, originally due out last week, on Blackstone Group's purchase of acetyl chemicals maker Acetex, until March. Blackstone intends to merge the firm with Celanese, a global player in acetic acid and vinyl acetate.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter